- All Solutions

- Audience measurement

- Media planning

- Marketing optimization

- Content metadata

- Nielsen ONE

- All Insights

- Case Studies

- Perspectives

- Data Center

- The Gauge TM – U.S.

- Top 10 – U.S.

- Top Trends – Denmark

- Top Trends – Germany

- Olympic Games

- Election Data Hub

- Big Data + Panel

- News Center

Client Login

The need for consistent measurement in a digital-first landscape

Few changes in the media industry are as defining as audiences’ relationship with television. And the latest evolution capturing audiences’ attention is streaming services, smart TVs, and the content they support. In the U.S. alone, Americans watched 19 million years worth of streaming content in 2022 .

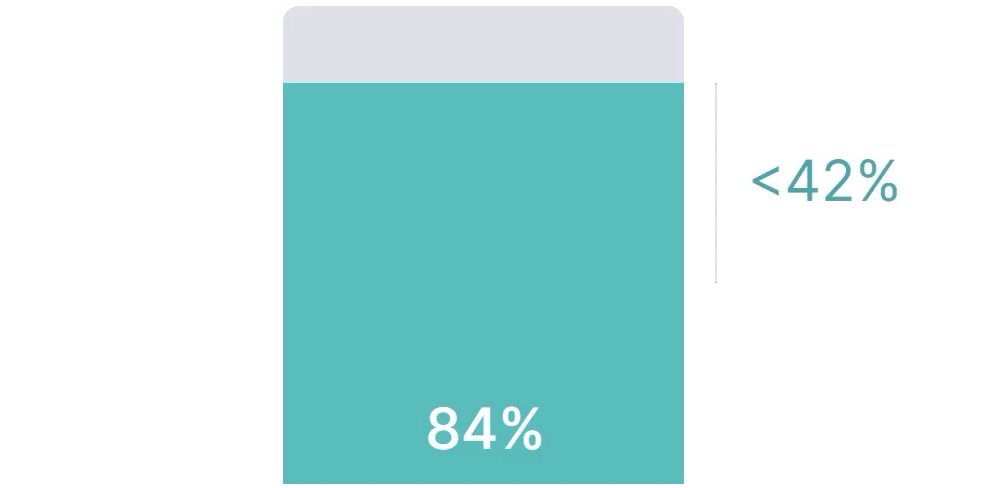

So, naturally, brands have adjusted their media strategies: 84% of global marketers say they include streaming channels in their media plans.

The catch? Less than half believe this spending is effective.

In December of 2022, we surveyed 1,524 global marketing professionals to understand how they feel about changing viewing behaviors, the rise of streaming and CTV, and solutions for tracking and proving campaign impact.

Here are four key survey insights:

Recession or not, marketers expect ad budgets to grow.

Despite 69% of global marketers saying economic conditions had a big impact on planning, 64% expect their budgets to grow.

Streaming is the future, but value remains unclear

84% of global marketers include streaming in their media planning. Less than half, however, view this spending as effective.

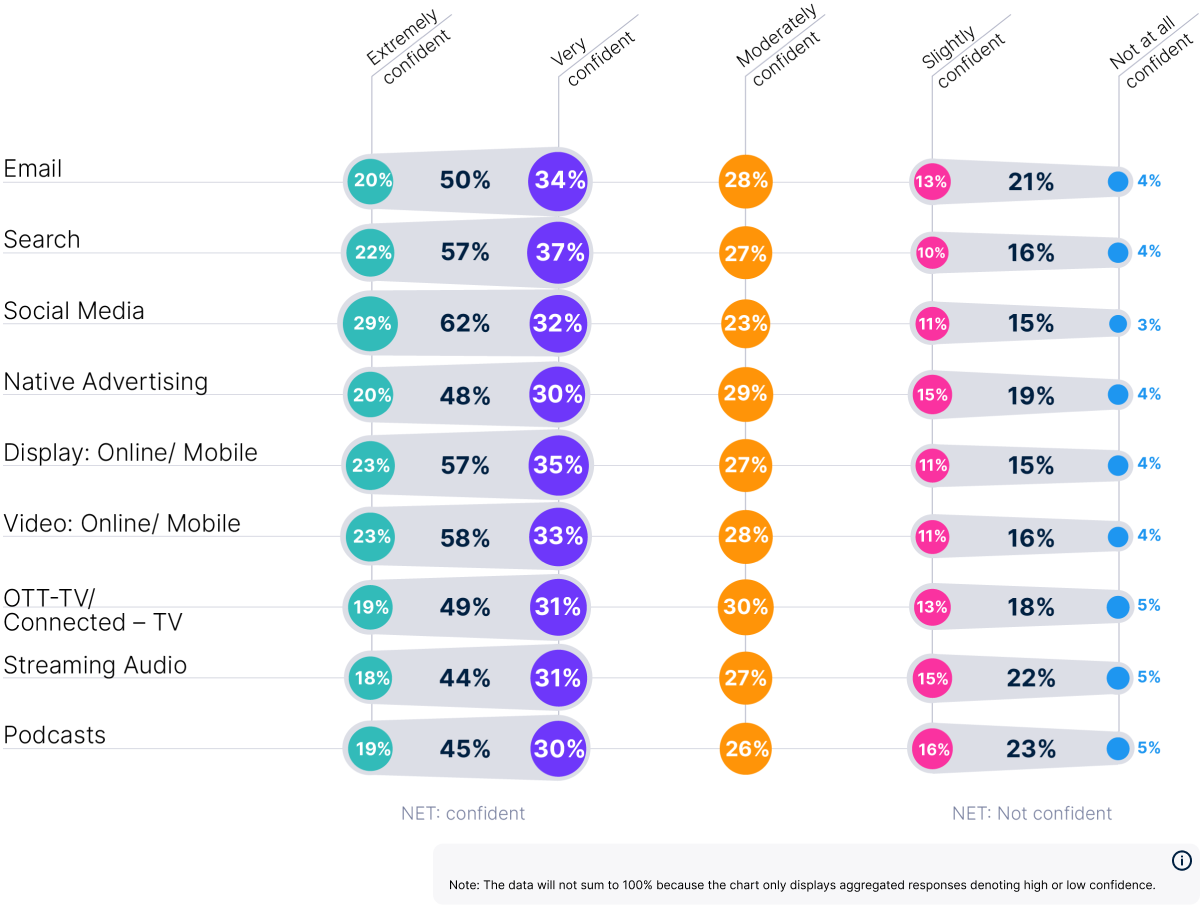

ROI confidence is lowest across digital channels

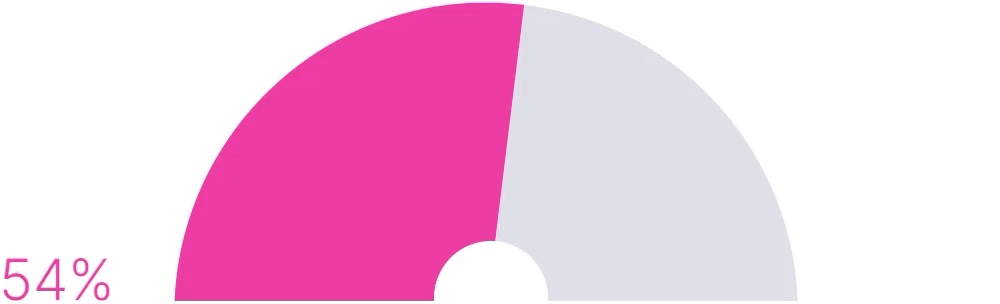

Only 54% of marketers are confident in ROI measurement across digital channels.

Multiple measurement tools could be hurting confidence

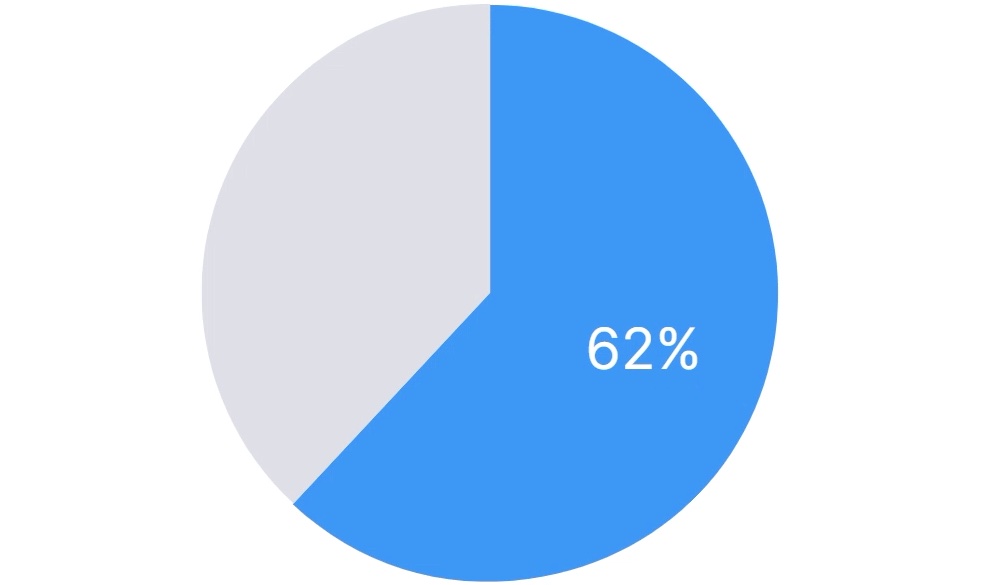

62% of marketers use multiple measurement solutions to achieve a comprehensive look at marketing performance, which may be contributing to the lack of confidence.

Keep scrolling to access Nielsen’s 2023 Annual Marketing Report.

Want to save these insights?

- Introduction

- Recommendations

Digital spend edges out other channel investments

For marketers, 2023 was assumed to be an uncertain year, with 69% surveyed for this report saying that the economic conditions had an impact on their planning.

Still, 64% expect their ad budgets to increase this year, with 13% even expecting increases of 50% or more. Much of that growth can be attributed to CTV and streaming.

Anticipated budget changes of 50% or more throughout the year

Anticipated CTV/OTT spending aligns with global trends we’ve been tracking.

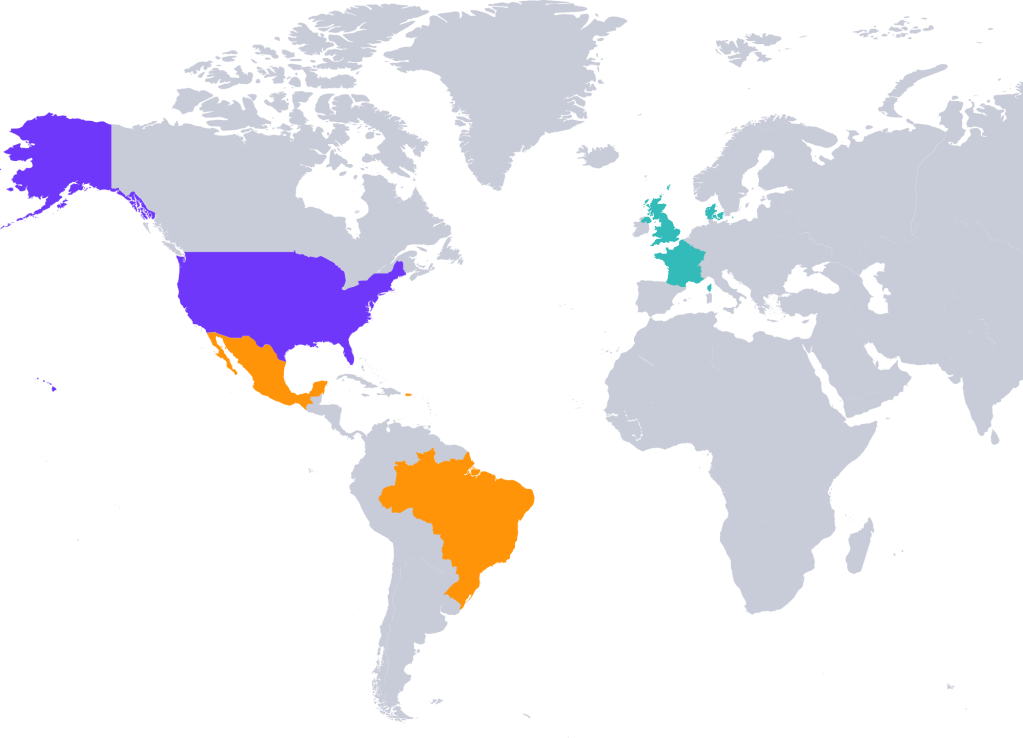

In the U.S., 2022 digital video ad spend was up 171% from 2020.

Across Puerto Rico, Mexico and Brazil, digital ad spend increased 228% * between 2021 and 2022 for a total of US$24.5 billion, with 58% (US$14.2 billion) allocated to digital video.

In France, Denmark and the U.K., internet-based video spend increased from US$2.3 billion in the first three quarters of 2020 to US$4.2 billion USD in 2022.

*The data reported is derived from the increased coverage of our Ad Intel measurement, which shows greater visibility of actual spending on digital vehicles. (1) Digital activity reporting in Brazil starts in January 2022. (2) PPP and social activity reporting in Puerto Rico starts in May 2022.

Global ad budgets lean into CTV

The increased spend across online video reflects audiences’ shift to streaming in particular.

In the U.S., Americans watched more than 19 million years’ worth of streaming content in 2022.

In Mexico, streaming grew to account for 15.2% of total TV usage as of December 2022.

In Thailand, streaming content reaches more than 50% of the TV audience .

In Australia, 70% of people 14 and older say they use the internet to stream video.

1 Nielsen Streaming Content Ratings and Nielsen National TV panel 2 The Gauge Mexico 3 Thailand Cross-Platform Ratings 4 Australia Consumer and Media View, Q4 2022

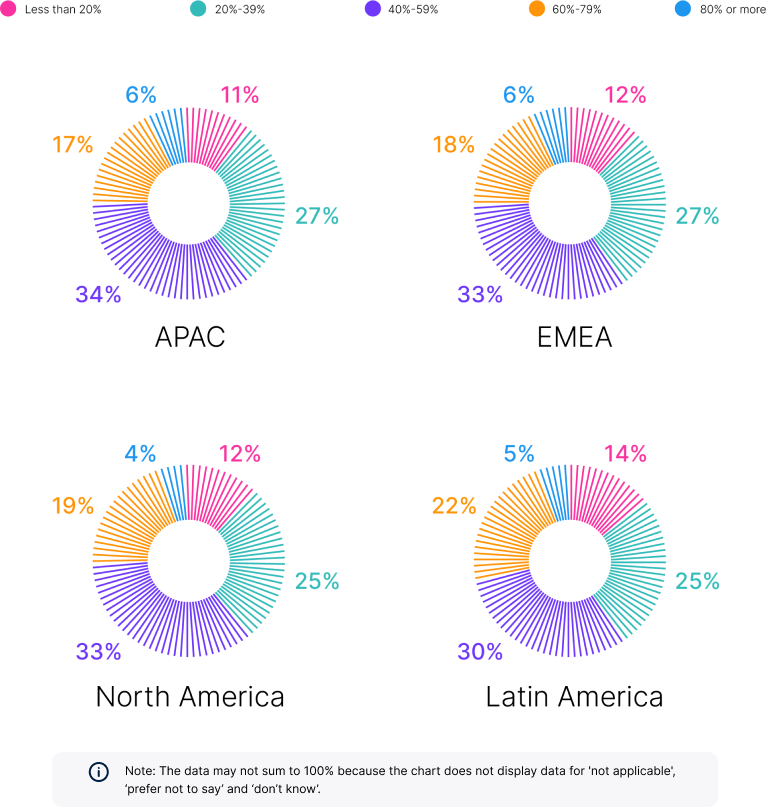

Naturally, global marketers are refining their media spend: On average, 32% report allocating 40%-59% of their budgets to CTV, and nearly one-fifth (19%) report shifting 60%-79%.

Global ad budgets are shifting to CTV

Zenith Media forecasts that global online video ad spending will grow at a compound annual growth rate (CAGR) of 4.8% through 2025 to account for 30% of the overall ad market. The company expects advertising on subscription video on demand (SVOD) services to grow at a CAGR of 27.9% to reach US$13.1 billion by 2025.

This is massive momentum. And yet, according to global marketers, the perceived effectiveness of their CTV/streaming investments is just 49%.

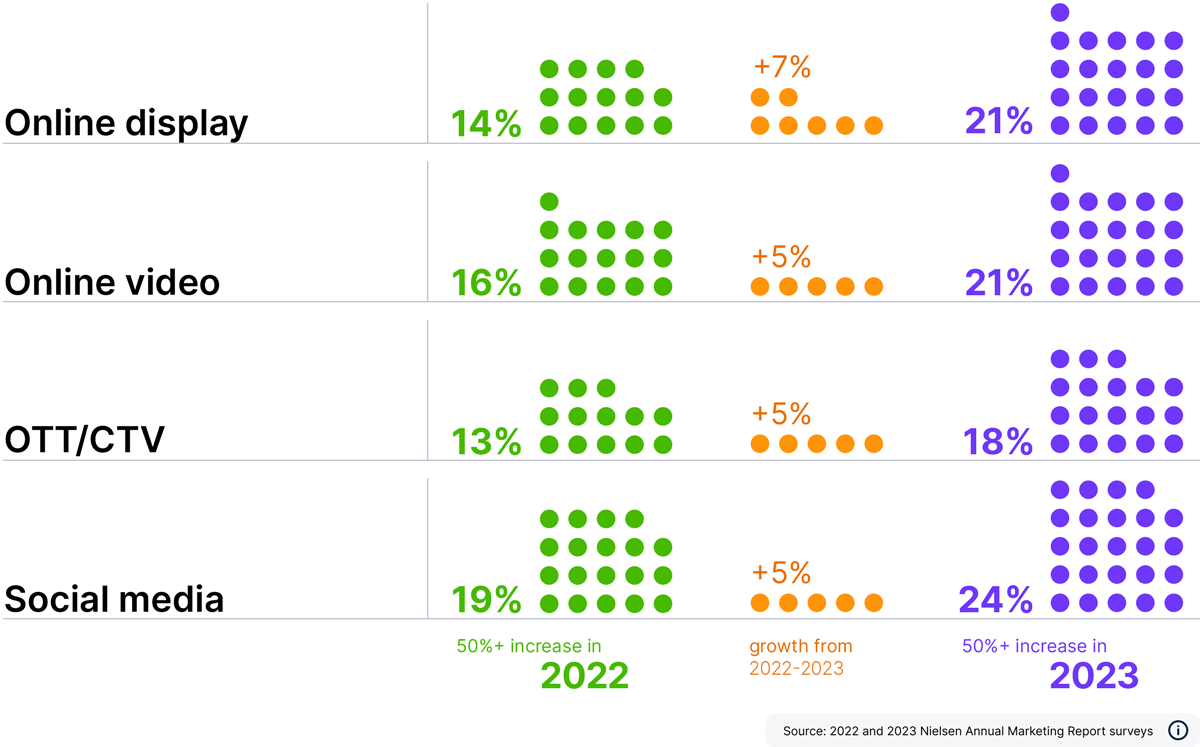

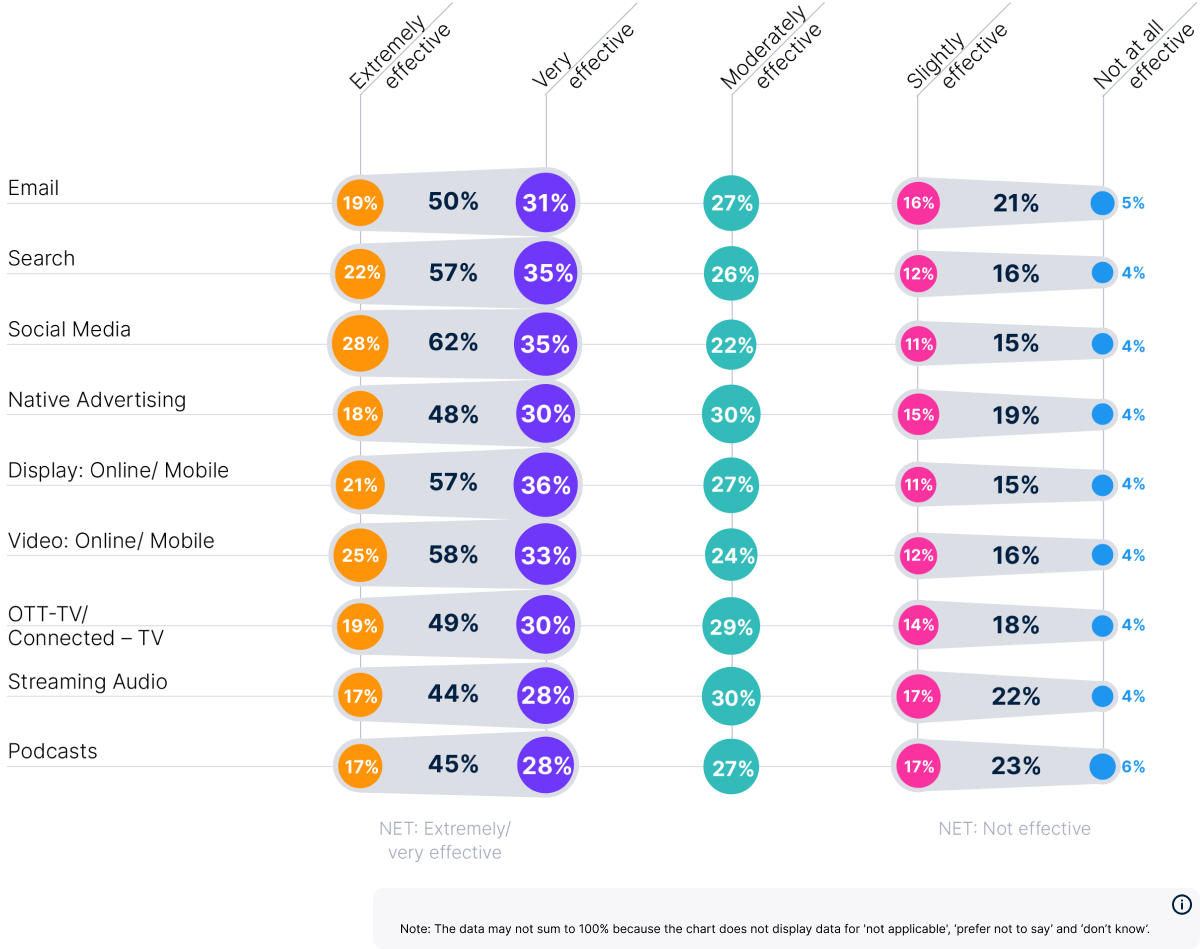

Perceived effectiveness of digital spending by channel

Confidence is low for holistic ROI measurement

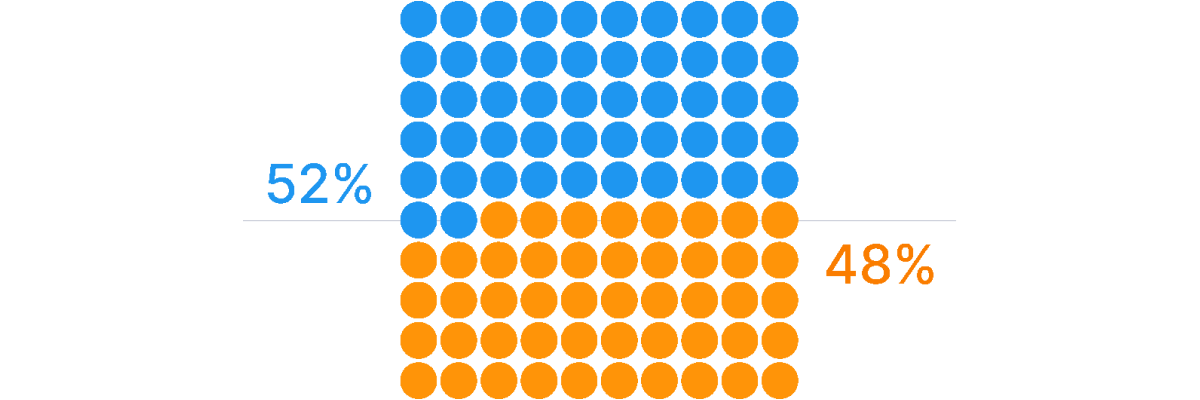

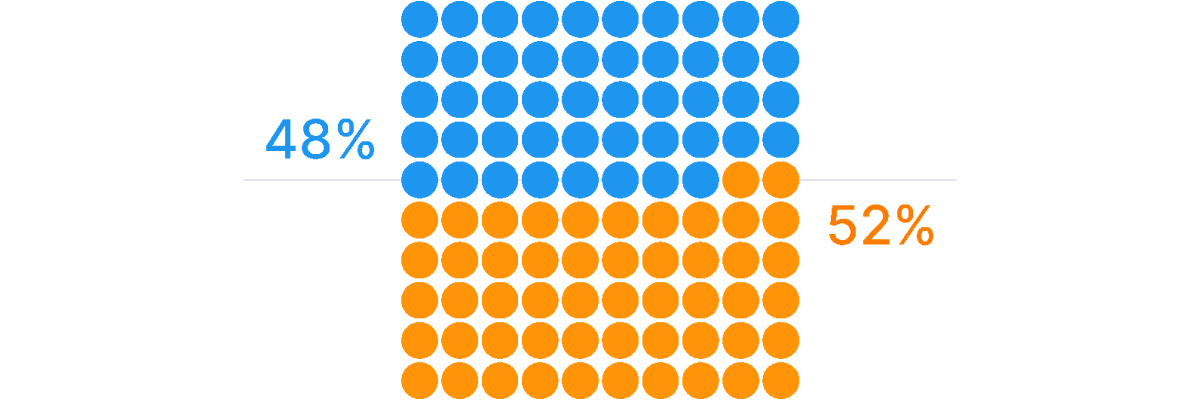

Measurable returns will always help marketers make tactical investment decisions, but cross-media ROI measurement challenges have more than half of global marketers (52% on average) focused only on reach and frequency metrics.

Marketers’ approach to cross-media measurement

We are solely focused on reach/frequency.

We are focused on both reach/frequency and ROI

One potential cause for the simplified focus is under-utilized marketing technology (martech). Gartner’s 2022 Marketing Technology Survey Insights found that marketers aren’t using their tools as well as they could be: Only 42% of survey respondents said they use the full breadth of their martech capabilities, down from 58% in 2020.

Untapped martech could also explain the gap between marketers’ stated belief in their martech’s ability to measure aggregate ROI (69%) and their reported ROI confidence at the individual channel level, which is much lower.

Confidence in ROI measurement by channel

Channel-specific tools don’t paint the full performance picture

Shaky ROI confidence isn’t all untapped martech’s fault. Several other factors are at play in a crowded media landscape, including:

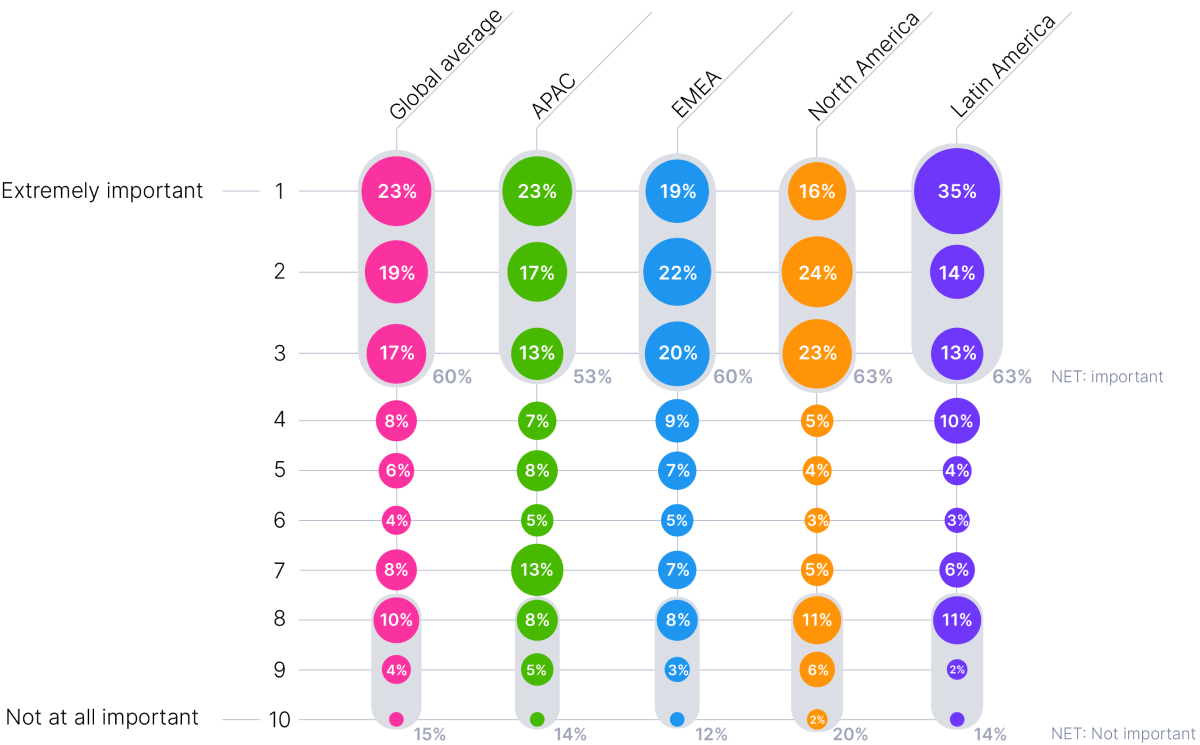

Many don’t equate campaign success with on-target reach

On average, 40% of global marketers don’t believe understanding cross-platform reach is important when assessing whether campaigns reach their intended audience. In Asia-Pacific, that rises to 47%. Given how fragmented the modern media landscape is, this number is surprising and notable.

Importance of understanding cross-platform reach when measuring success of reaching target audience

Effective reach depends on quality audience data

Quality audience data is at a premium–especially as third-party cookies and mobile advertising IDs (MAIDs) become obsolete. It makes sense then that only 23% of marketers strongly agree that they have the quality audience data they need to get the most out of their media budgets. In Latin America, the percentage is higher, at 26%.

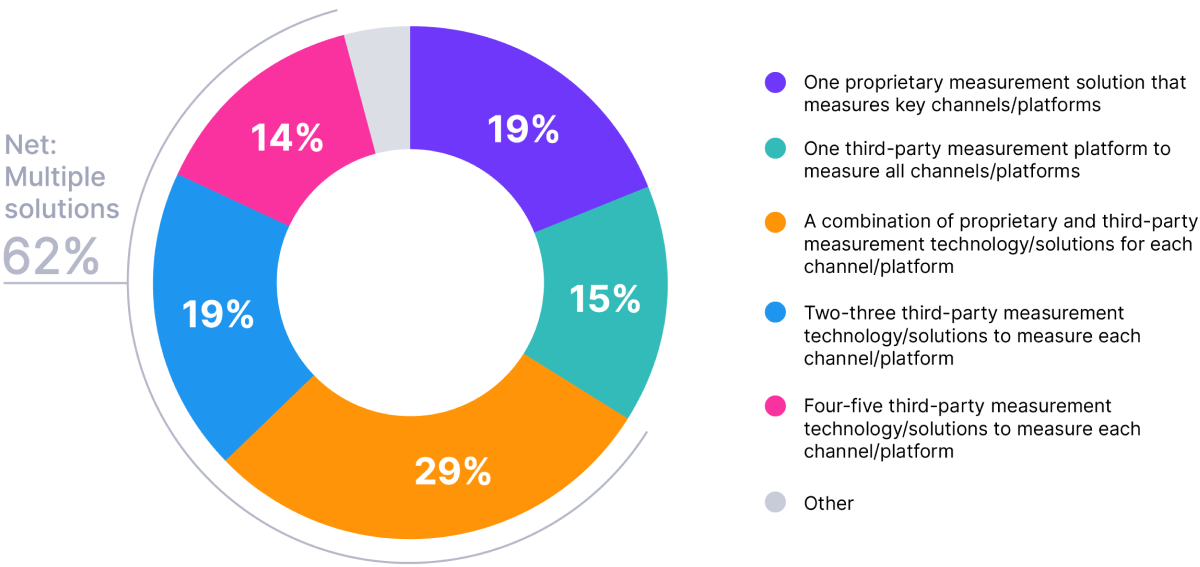

Channel-specific tools deliver isolated insights

Historically, linear and digital measurement have relied on different methodologies. So, understandably, marketers have turned to multiple, channel-specific tools. On average, 62% of marketers globally use multiple measurement solutions to arrive at cross-media measurement, with 14% leveraging four to five. Just 34% report using one platform for cross-measurement needs: 19% have their own proprietary solution, and 15% use a third-party tool.

Approaches used to achieve cross-media measurement

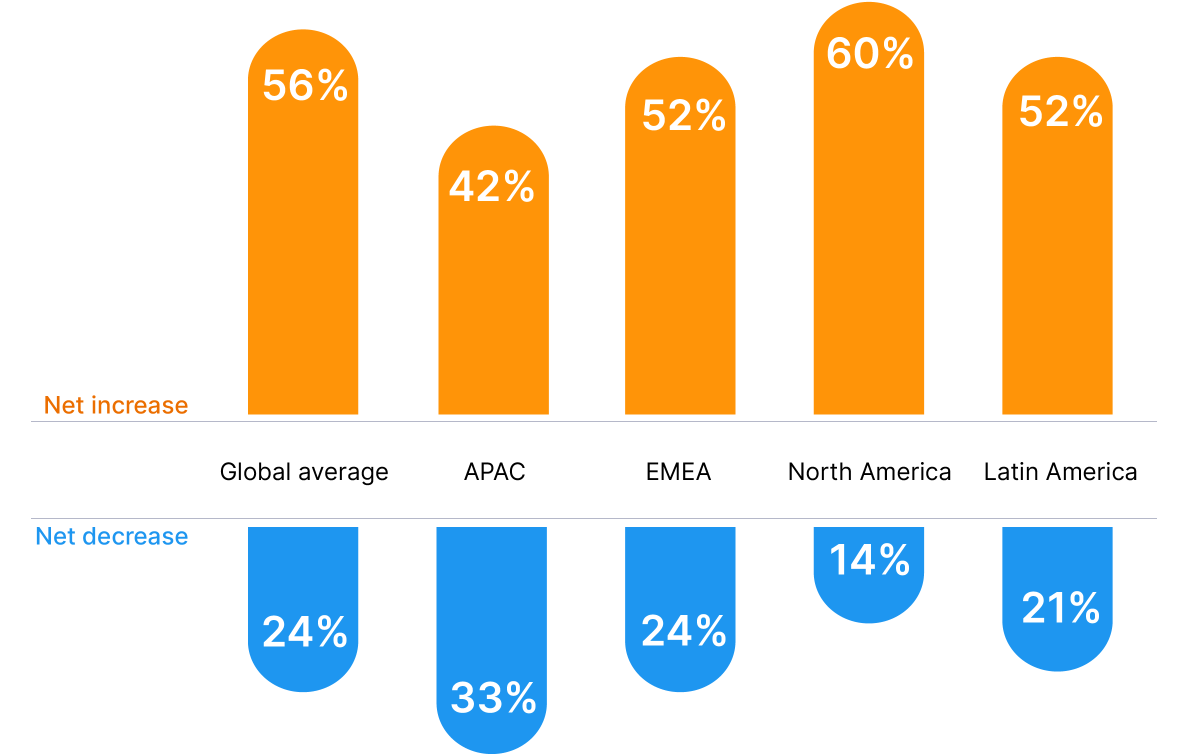

Martech investment is declining

In addition to using less of their martech, marketers now plan to pull back on additional investment in 2023. On average, 24% of global marketers cite reducing martech investments to some degree, with 12% planning cuts of 150% or more.

Planned investment in marketing technology over the next 12 months

As audiences increase their time with digital devices, emerging channels and streaming content, advertisers and agencies will need measurement that provides comparable data across devices and platforms. What’s more, they need accurate data that doesn’t duplicate viewership while audiences constantly toggle between screens. This comprehensive view across linear and digital platforms will deliver a precise look at audience and impact, which should improve their confidence in marketing investments.

The importance of comparable, person-level measurement isn’t lost on global marketers—71% say comparability is extremely or very important in their cross-media measurement. Arriving at comparable, deduplicated measurement, however, remains a challenge.

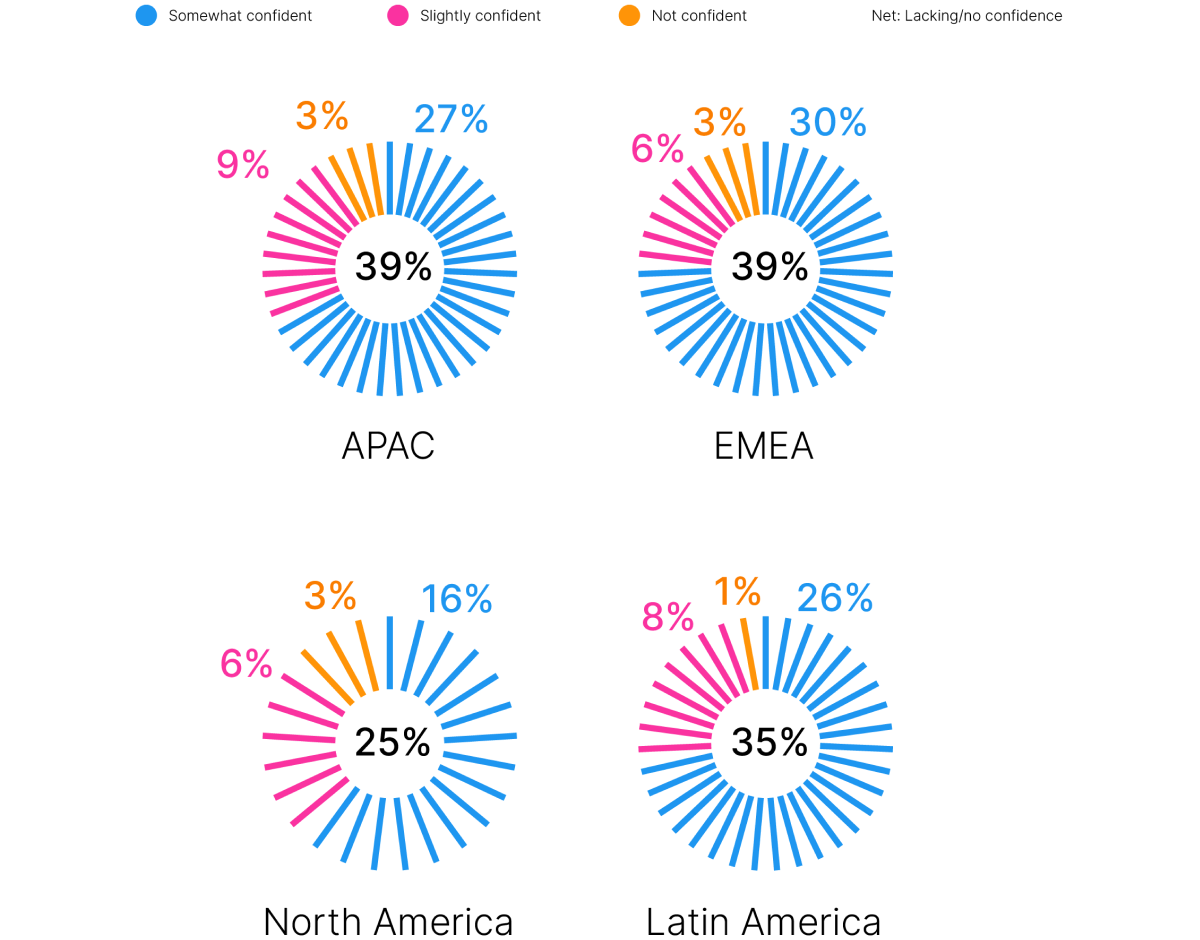

Confidence in current solutions delivering comparable, deduplicated cross-media measurement

Plenty is vying for marketers’ attention and budgets. The key is knowing what to prioritize, and how.

Our recommendations

Beware of underinvesting on brand equity.

Marketers are always asked to do more with less, even without threats of a recession. The economic uncertainty, however, adds pressure to protecting brand equity and sharpens the need for efficient, targeted and measured ad spending. Marketers may just have less budget to do it all.

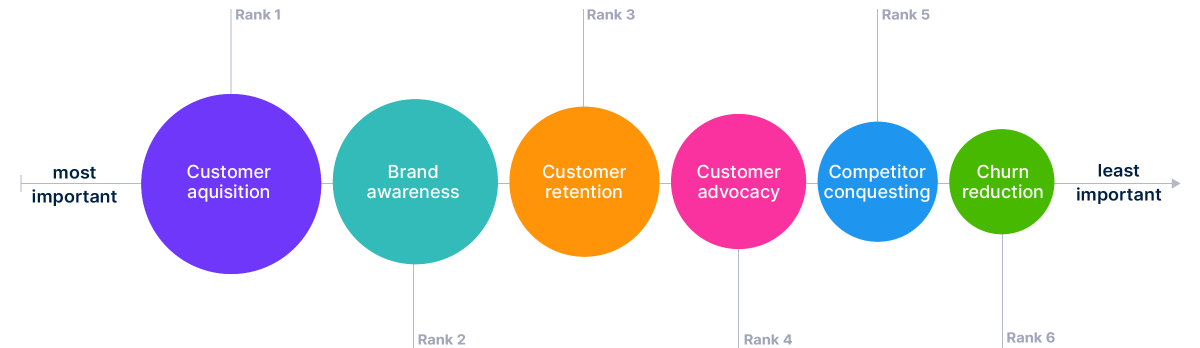

If that wasn’t hard enough, there’s another big consideration: Most brands were already under-spending—by a median of 50%— and losing opportunities to achieve their maximum ROI in 2022. Reducing spending more could hurt ROI even further. It may also have a negative impact on marketers’ top objectives for 2023: customer acquisition and brand awareness.

Top marketing objectives for the 2023

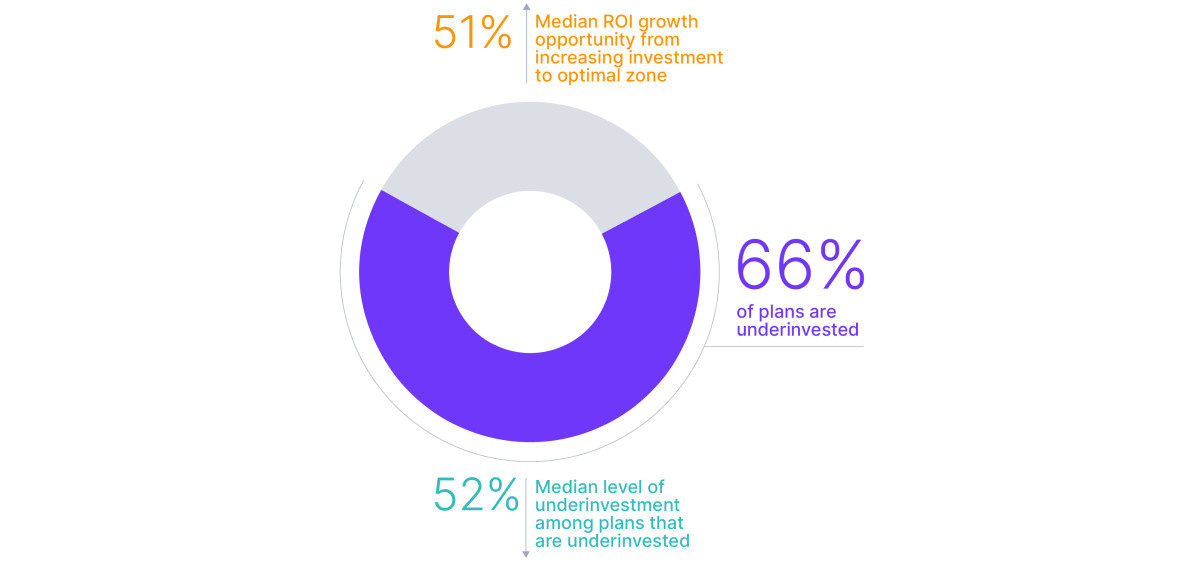

In digital channels where engagement is rising, under-spending is even higher. For example, May 2022 data from Nielsen’s Predictive ROI Database showed that 66% of global media plans were under-invested for digital video. But marketers that close the spending gap and optimize their digital video investments can improve ROI by a median of 51%.

Rampant underspending is preventing maximum ROI

Embrace a comparable measurement mindset

Audiences have spoken: Digital video—in all of its forms—is the future of how audiences will engage with content. This shift calls for transformative change in measurement. Marketers know how important comparable metrics are to understand the effectiveness of their ad spending, but they’re still too reliant on tools that give only a limited view of performance. To keep pace with the industry’s future, marketers need tools, solutions and metrics that are media-agnostic.

Impressions, for example, are universally applicable across ads, content and platforms. And subminute measurement, which produces individual commercial metrics , brings linear TV and digital video measurement closer to how digital campaign performance is measured.

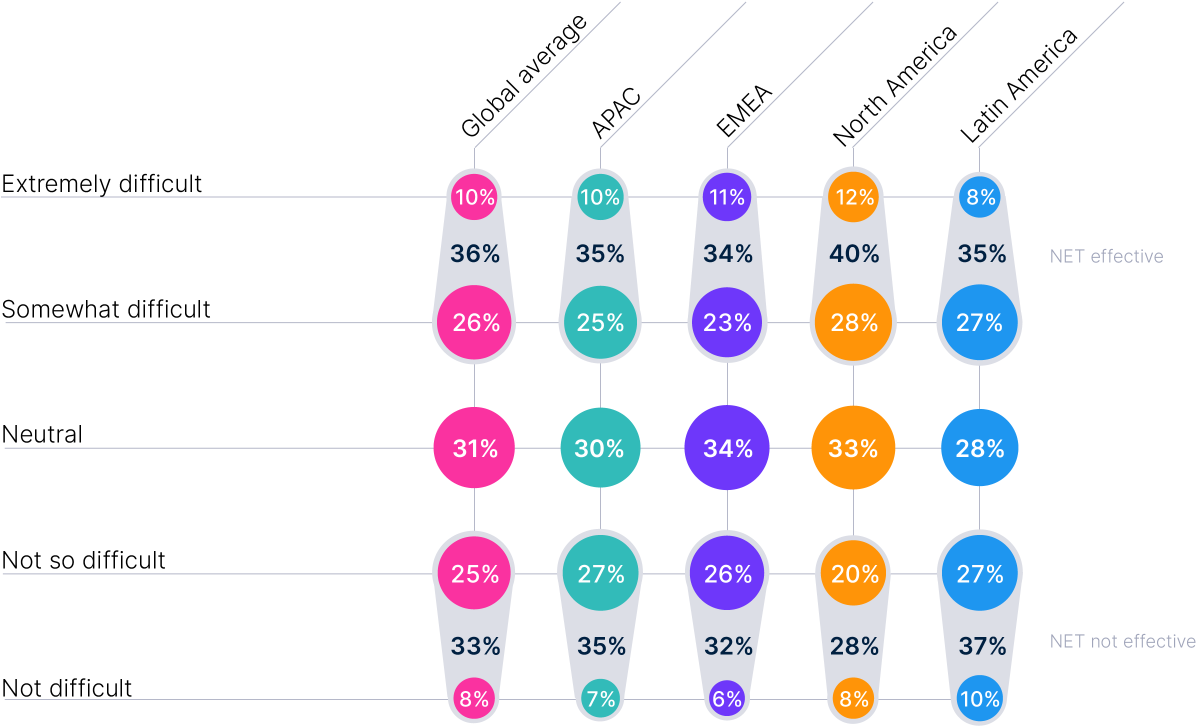

On average, 62% of marketers find it hard to know where to use their ad budgets to reach specific audiences. Even more (69%) agree that digital media and audience fragmentation poses significant challenges to reach their target audiences.

Difficulty with OTT/CTV advertising measurement

To be the transformation that marketers want and finally achieve comparable cross-media measurement at the individual level, marketers should prioritize solutions that are focused on delivering measurement that is media agnostic.

Increase ROI by reaching more of your target audience

Understanding how campaigns are performing in near real time should be the way forward on the quest for maximum ROI. We hear this a lot: Reach more of the right audience and your ROI will increase. There’s more truth to this statement than many people might realize.

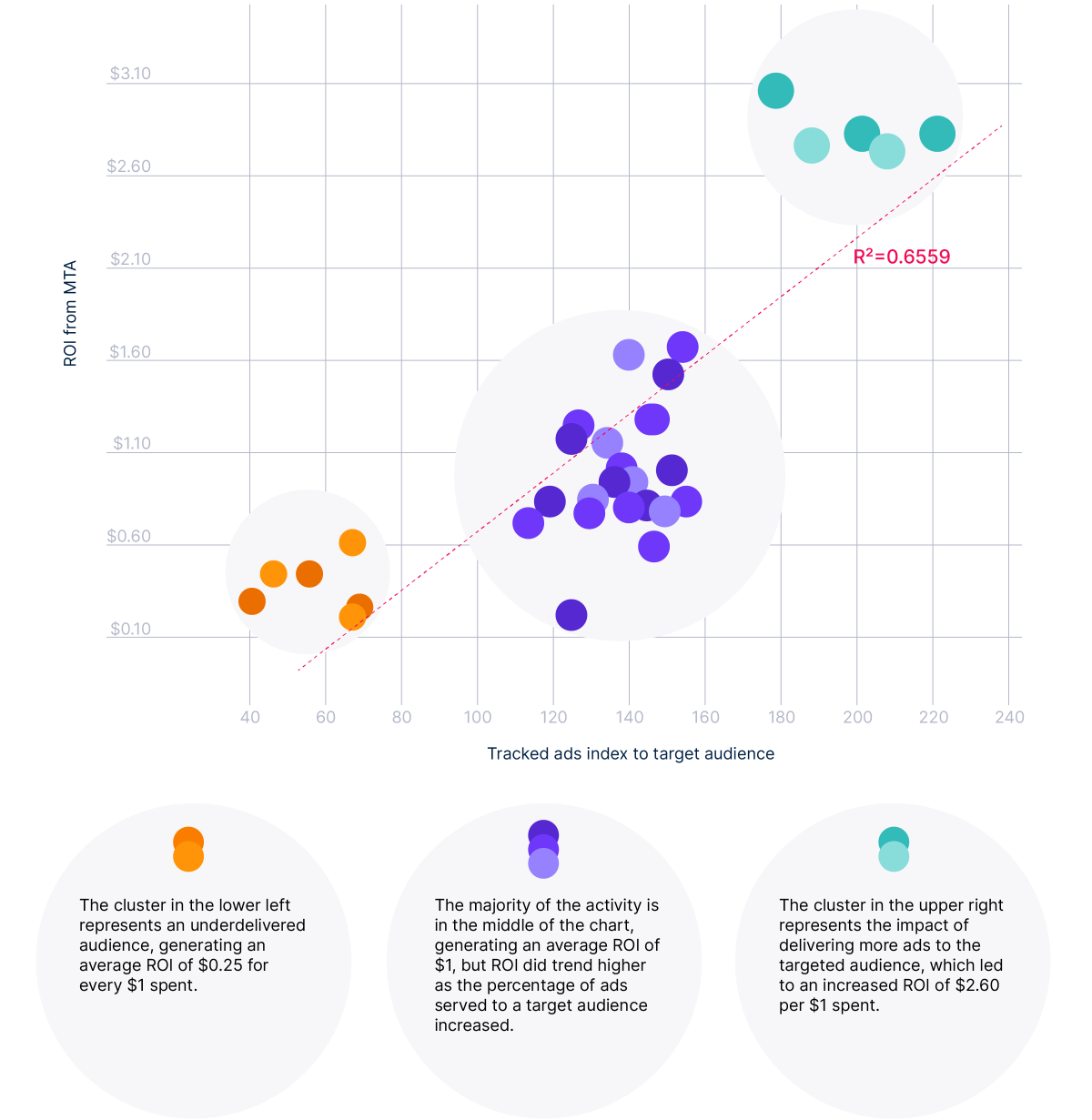

In 2022, Nielsen conducted a study involving 15 brands and 82 digital campaigns in the U.S. to verify the correlation between target reach and campaign ROI. When we combined in-flight target measurements from Nielsen Digital Ad Ratings and outcome metrics from Nielsen Attribution , we found one clear truth: Ads that best reached their intended audience generated significantly higher ROI than those that didn’t.

Tracking the relationship between targeted ads and ROI

The graph above shows three distinct performance clusters with each bubble representing data for one vendor, for one month, on one campaign.

This study revealed key learnings about targeted reach:

Increased campaign reach raises costs and does not guarantee higher campaign ROI

Increased targeted reach will improve campaign ROI

Advertisers can use reach analysis to better understand which audiences to target

Focusing on the most valuable audiences improves efficiency and drives higher ROI

Honing campaign reach is a critical ROI lever. To stave off the complications of fragmented channels and viewerships, marketers need to prioritize measurement solutions that cover all platforms and devices, with near real time insights, so they can capitalize on opportunity and drive impact from the beginning.

Thank you for reading the Nielsen’s 2023 Annual Marketing Report!

About this report

This is the fifth annual marketing report Nielsen has produced. It’s also the second to be global. The report leverages survey responses of marketers across a variety of industries whose focus pertains to media, technology and measurement strategies. For this report, we engaged 1,524 global marketing professionals who completed an online survey between Dec. 7, 2022, and Dec. 21, 2022.

In terms of seniority level, we engaged global brand marketers at or above the manager level. These managers work with annual marketing budgets of US$1 million or more across the auto, financial services, FMCG, technology, health care, pharmaceuticals, travel, tourism and retail industries.

Here are the corresponding sample distributions by region. Please keep these sample sizes in mind when reading and interpreting the charts in this report.

Respondents by Region

- APAC: 386 respondents

- EMEA: 374 respondents

- North America: 402 respondents

- Latin America: 362 respondents

Total: 1,524

How can we help?

Complete the form below to access the report.

Not ready to complete the form? <- Go back to the introduction.

Find the right solution for your business

In an ever-changing world, we’re here to help you stay ahead of what’s to come with the tools to measure, connect with, and engage your audiences.

- Services ›

- Business Services

Nielsen Holdings - statistics & facts

Nielsen is a household name in the u.s. market, decreasing cost of revenue, key insights.

Detailed statistics

Research revenue of Nielsen Holdings worldwide 2006-2021

Market research revenue of Nielsen in the U.S. 2013-2021

Operating income of Nielsen Holdings 2013-2021

Editor’s Picks Editor’s Picks Current statistics on this topic

Market Research

Revenue of Kantar worldwide 2006-2023

Research revenue of GfK worldwide 2007-2021

Recommended statistics

Regional and industry rankings.

- Premium Statistic Revenue of the market research industry worldwide 2008-2023

- Premium Statistic Leading market research companies worldwide by global research revenue 2016-2022

- Premium Statistic Leading market research companies by U.S. research revenue in 2021

- Premium Statistic Market research: research services contributing the most to revenues 2022, by type

- Premium Statistic Market share of the market research industry worldwide by country 2022

- Premium Statistic Distribution of global market research revenue by region 2022

Revenue of the market research industry worldwide 2008-2023

Revenue of the market research industry worldwide from 2008 to 2023 with a forecast for 2024 (in billion U.S. dollars)

Leading market research companies worldwide by global research revenue 2016-2022

Leading market research companies worldwide from 2016 to 2022, by global research revenue (in billion U.S. dollars)

Leading market research companies by U.S. research revenue in 2021

Leading market research companies in 2021, by U.S. research revenue (in million U.S. dollars)

Market research: research services contributing the most to revenues 2022, by type

Services contributing the most to the global revenue of market research companies in 2022, by type of service

Market share of the market research industry worldwide by country 2022

Market share of the market research industry worldwide in 2022, by country

Distribution of global market research revenue by region 2022

Distribution of global market research revenue in 2022, by region

Company overview

- Premium Statistic Research revenue of Nielsen Holdings worldwide 2006-2021

- Premium Statistic Cost of revenue of Nielsen Holdings 2015-2021

- Premium Statistic Market research revenue of Nielsen in the U.S. 2013-2021

- Premium Statistic Operating income of Nielsen Holdings 2013-2021

- Premium Statistic Total assets of Nielsen Holdings 2013-2021

- Premium Statistic Number of full-time Nielsen Holdings employees in the U.S. 2007-2021

Research revenue of Nielsen Holdings worldwide from 2006 to 2021 (in billion U.S. dollars)

Cost of revenue of Nielsen Holdings 2015-2021

Cost of revenue of Nielsen Holdings worldwide from 2015 to 2021 (in billion U.S. dollars)

Market research revenue of Nielsen Holdings in the United States from 2013 to 2021 (in billion U.S. dollars)

Operating income of Nielsen Holdings worldwide from 2013 to 2021 (in million U.S. dollars)

Total assets of Nielsen Holdings 2013-2021

Total assets of Nielsen Holdings worldwide from 2013 to 2021 (in billion U.S. dollars)

Number of full-time Nielsen Holdings employees in the U.S. 2007-2021

Number of full-time Nielsen Holdings employees in the United States from 2007 to 2021

Competitors

- Basic Statistic Market research revenue of Kantar in the U.S. 2013-2021

- Premium Statistic Number of full-time employees at Kantar in North America 2007-2023

- Premium Statistic Research revenue of IQVIA worldwide 2013-2023

- Premium Statistic IQVIA revenue 2016-2023, by operation

- Premium Statistic Number of IQVIA employees worldwide 2014-2023

- Premium Statistic Revenue of Ipsos worldwide 2000-2023

- Basic Statistic Number of Ipsos employees worldwide 2000-2023

- Premium Statistic Research revenue of GfK worldwide 2007-2021

- Premium Statistic Revenue of Gartner worldwide 2010-2023

- Premium Statistic Number of employees in Gartner worldwide 2010-2023

- Premium Statistic Salesforce revenue 2010-2024

Market research revenue of Kantar in the U.S. 2013-2021

Market research revenue of Kantar in the United States from 2013 to 2021 (in million U.S. dollars)

Number of full-time employees at Kantar in North America 2007-2023

Number of full-time employees at Kantar in North America from 2007 to 2023

Research revenue of IQVIA worldwide 2013-2023

Research revenue of IQVIA worldwide from 2013 to 2023 (in billion U.S. dollars)

IQVIA revenue 2016-2023, by operation

Revenue of IQVIA from 2016 to 2023, by operation segment (in million U.S. dollars)

Number of IQVIA employees worldwide 2014-2023

Number of IQVIA employees worldwide from 2014 to 2023

Revenue of Ipsos worldwide 2000-2023

Revenue of Ipsos worldwide from 2000 to 2023 (in billion euros)

Number of Ipsos employees worldwide 2000-2023

Number of Ipsos employees worldwide from 2000 to 2023

Research revenue of GfK worldwide from 2007 to 2021 (in billion U.S. dollars)

Revenue of Gartner worldwide 2010-2023

Revenue of Gartner worldwide from 2010 to 2023 (in million U.S. dollars)

Number of employees in Gartner worldwide 2010-2023

Number of Gartner employees worldwide 2010 to 2023

Salesforce revenue 2010-2024

Salesforce.com's revenue from 2010 to 2024 (in billion U.S. dollars)

Further reports

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Make your Smartphone usage count!

Your participation matters

By participating in Nielsen research, you can improve products and services you use online today. More Panel combines your unique Smartphone usage with people like you to build a picture of Smartphone usage behavior. By using the Smartphone as you do every day, we invite you to make a difference and earn redeemable reward points!

How It Works

Just be you to join the nielsen family.

Answer our registration questions to tell us more about you and your household.

Install the App

Download our safe and secure Nielsen More App. It is noninvasive and won't impact device performance.

Earn Rewards

After you've installed the app, get rewarded just for using the Smartphone as you do today!

Your privacy and security is Nielsen's top priority. The app is easy to install, won't slow down your device, and sends us anonymous data about how you use the Smartphone. Our App never collects the content of visited websites, and we do NOT collect user IDs, passwords, or other private information. More about privacy

Start earning as soon as you download

Not only will you be contributing to our research on Smartphone trends, but you will also be rewarded for it!

Earn Points

For installing the Nielsen More App on your smartphone or tablet, you can earn monthly points which can be redeemed for gift cards and prizes.

More Rewards

There are opportunities to earn even more rewards by taking surveys and staying with us longer.

*1100 points = INR 100

Caring about consumer insights for over 90 years

Nielsen is a professional research company and the world's leading provider of media and marketing information. Our mission is to learn about what people watch, listen to, and buy, as well as what they do online. Filling out our survey and registering your device is an opportunity to become a part of important research insights. We'd love to have you!

- Market Measurement Consumer Behavior & Insights Innovation Brand & Media Analytics & Activation

- Consumer Packaged Goods Beauty Beverage Alcohol Packaging Pet

- Become an NIQ partner Find a partner

- Featured Insights CMO Outlook Consumer Life Consumer Outlook State of Tech & Durables

- Key Topics Artificial Intelligence Brand Strategy Consumer Behavior Data Technology Health & Wellness

- Programs Early Careers NIQ University

- Life at NIQ Our Principles Corporate Citizenship Our Stories

- Company News Events Diversity, Equity & Inclusion Leadership Corporate Citizenship

- Partner Network

Select your preferred language

How can we help you?

Beverage alcohol.

Empowering the growth of Beverage Alcohol brands with the Full View™

Industries / Consumer Packaged Goods / Beverage Alcohol

For alcoholic beverages, understanding the drivers of consumer behavior and choice at every point of purchase , alongside the ability to track sales and market share across all channels, is crucial for building brand equity and sustainable long-term growth.

Combining unrivalled omnichannel coverage with best-in-class consumer intelligence, NielsenIQ (NIQ) enables alcoholic beverage brands to adapt to changing consumer trends, target the most profitable consumer occasions, and create activations that influence decision-making at each point along the consumer path to purchase.

NIQ’s Full View™ integrates on-premise (bar/restaurant), off-premise (in-store), online, and direct-to-consumer sales data to provide seamless analytical capabilities delivered in an intuitive, self-serve platform that empowers clients to identify threats and opportunities, growth-driving market trends, and headroom opportunities.

With our industry-leading alcoholic beverage research and analytics, you can:

- Measure the market and track your sales and share performance against your competitors

- Grow and optimize distribution by identifying the channels with the greatest sales and consumer opportunities for your brands.

- Win with consumers , manage brand health, and target key consumption moments across all channels.

- Activate with confidence by making data-driven decisions with assortment, price, marketing mix, and basket and check-level analytics.

- Maximize e-commerce , measure the digital shopper journey, and track competitive performance and opportunity online.

Bacardi Australia

“OPUS has given us a level of On Premise understanding that we didn’t think would be possible. We now know exactly what motivates consumers and drives purchase behavior, instead of relying on assumptions as we did before. The team have been very proactive in making sure we get the most of the platform and that we are always up-to-date with the latest insights and trends.”

Fever Tree Australia

“CGA by NIQ have supported us throughout our partnership, using Outlet Index they’ve helped our venue segmentation targeting and allowed us to identify opportunities for premium mixers in the Australian On Premise. They’ve continually provided us with valuable On Premise insights using their best-in-class products and services. Not only do they deliver exceptional outputs, their consultative and proactive approach has aided Fever-Tree in excelling within the Australian On Premise.”

2024 BevAl trends to watch

NIQ’s experts look back at the consumer behaviors that defined the Beverage Alcohol space in 2024 and forward to this year’s BevAl trends that will shape the landscape.

How to win in the On- Premise in 2024

In this complex, dynamic and constantly changing sector, how are you driving awareness, demand and sales for your brands?

Uncovering On-Premise opportunities

Featured product, nielseniq on-premise.

Discover opportunities in the On-Premise consumption market with reliable, robust and representative data and insights.

NIQ BASES Pack & Design

Develop powerful packaging and predict the potential of the pack in market.

Meet the team

James Restivo SVP, Account Leadership, Beverage Alcohol Vertical Lead

James Restivo

SVP, Account Leadership, Beverage Alcohol Vertical Lead

James Restivo is an SVP and BevAl vertical lead for NielsenIQ. Over the past 20 years, James has specialized in consumer understanding and using those insights to help drive decision making. James leads a team in the Alcohol vertical that explores emerging trends and industry challenges.

Jon Berg VP Alcohol Industry Thought Leader

VP Alcohol Industry Thought Leader

Jon has been in the BevAl industry for about 20 years with previous roles at Coors Brewing, Bacardi, and LVMH prior to NIQ. Jon is our leading thought leader and regularly speaks industry events and clients on behalf of NIQ.

Bilal Habib Global Group Client Lead

Bilal Habib

Global Group Client Lead

Bilal has 15+ years at NIQ working across several different geographies and roles. He is currently leading a group of our global clients including some of the largest beverage and alcohol clients

Kaleigh Theriault Director, Beverage Alcohol Thought Leadership (US)

Kaleigh Theriault

Director, Beverage Alcohol Thought Leadership (US)

Kaleigh brings a unique skillset of analytic capabilities, commercial selling story creation, and brings consumer insights to the forefront in support of sales trends. Through her thought leadership Kaleigh informs strategy and tactics for Beverage Alcohol as the industry changes and develops

Jonathan Jones Managing Director Beverage Alcohol Vertical – On Premise (International Markets)

Jonathan Jones

Managing Director Beverage Alcohol Vertical – On Premise (International Markets)

With 15 years’ experience working with suppliers and operators in the On Premise, Jonny combines his passion for the sector with data-driven strategy, to deliver actionable insights and consultancy at c-suite level that shape the way our clients approach the channel and support them to grow sales and share

J.J. Tellez Client Director, Convenience & Liquor Retailers

J.J. Tellez

Client Director, Convenience & Liquor Retailers

With +15 years’ experience selling to national & regional retailers, JJ is passionate about tracking consumer behavior and the intricacies of retail operations. JJ is an expert at balancing long term needs with immediate results which has resulted in record retail partnership expansions.

Sahle Forbes SVP, Customer Success Beverage Alcohol Vertical

Sahle Forbes

SVP, Customer Success Beverage Alcohol Vertical

With over 20 years of Consumer Package Goods (CPG) experience Sahlé leads NielsenIQ’s ongoing engagement across its Alcoholic Beverage customers. Sahlé consults with leading manufacturers and distributors to help them address key business questions and achieve their strategic objectives in the marketplace

Rachel Weller

Commercial Leader Beverage Alcohol Vertical (UK)

Rachel leads NIQ’s commercial strategy, planning and execution for On Premise clients in the UK & Ireland. With 16+ years experience working in the Beverage Alcohol industry, Rachel helps clients achieve growth by elevating brand, marketing and sales strategies with data, insight and consumer research

Related Insights

Italy Wine Report

Transform consumer insights into strategic opportunities in the South Korea beverage market

Transform consumer insights into strategic opportunities in Italy beverage market

Discover On Premise Insights in South Africa

Stay in the know with niq’s beverage brief newsletter.

Get our latest thought leadership, events information, and more delivered straight to your inbox

NIQ’s Product Finder

Explore our Innovative product offerings to unlock the Full View™

This page does not exist in [x], feel free to read the page you are currently on or go to the [x] homepage.

NielsenIQ Is Said to Explore IPO at a Valuation Near $10 Billion

By Ryan Gould and Dinesh Nair

NielsenIQ is exploring an initial public offering that could value the consumer intelligence firm at about $10 billion, according to people familiar with the matter, as the market for first-time share sales continues a comeback.

NielsenIQ, which is backed by Advent International and KKR & Co. , has begun talking to potential advisers about a listing in 2025, the people said, asking not to be identified discussing confidential information. No final decision has been made and the Chicago-based company could opt to stay private, the people said.

Representatives for NielsenIQ, Advent and KKR declined to comment.

NielsenIQ, or NIQ, helps ...

Learn more about Bloomberg Law or Log In to keep reading:

Learn about bloomberg law.

AI-powered legal analytics, workflow tools and premium legal & business news.

37 Facts About Novosibirsk

Written by Adelice Lindemann

Modified & Updated: 10 Oct 2024

Reviewed by Sherman Smith

- Cities Facts

Novosibirsk, often referred to as the “Capital of Siberia,” is a vibrant and dynamic city located in southwestern Russia. With a population exceeding 1.5 million residents, it is the third most populous city in Russia and serves as the administrative center of the Novosibirsk Oblast.

Nestled along the banks of the Ob River, Novosibirsk is renowned for its rich cultural heritage, scientific advancements, and picturesque landscapes. As the largest city in Siberia, it offers a perfect blend of modern and traditional attractions, making it a fascinating destination for both locals and tourists .

In this article, we will delve into 37 interesting facts about Novosibirsk, shedding light on its history, architecture, natural wonders, and cultural significance. Whether you are planning a visit or simply curious about this intriguing city, these facts will give you a deeper understanding of what Novosibirsk has to offer.

Key Takeaways:

- Novosibirsk, the “Capital of Siberia,” is a vibrant city with a rich cultural scene, stunning natural landscapes, and a strong sense of community, offering a high quality of life for its residents.

- From being a major industrial and transportation hub to hosting world-class cultural institutions and scientific research centers, Novosibirsk is a dynamic city with a diverse culinary scene and a thriving IT and tech industry.

Novosibirsk is the third-largest city in Russia.

Situated in southwestern Siberia, Novosibirsk has a population of over 1.6 million people, making it one of the largest and most vibrant cities in the country.

The city was founded in 1893.

Novosibirsk was established as a railway junction on the Trans-Siberian Railway, playing a significant role in the development of Siberia.

It is known as the “Capital of Siberia”.

Due to its economic and cultural significance, Novosibirsk is often referred to as the capital of Siberia.

Novosibirsk is a major industrial center.

The city is home to a wide range of industries, including machinery manufacturing, chemical production, energy, and metallurgy .

It is famous for its scientific and research institutions.

Novosibirsk hosts several renowned scientific and research institutions, contributing to advancements in various fields including nuclear physics, chemistry, and biotechnology.

The Novosibirsk Opera and Ballet Theatre is one of the largest in Russia.

This iconic cultural institution showcases world-class ballet and opera performances and is a must-visit for art enthusiasts visiting the city .

The city has a vibrant theater scene.

Novosibirsk boasts numerous theaters, showcasing a wide variety of performances from traditional plays to experimental productions.

Novosibirsk is a major transportation hub.

Thanks to its strategic location on the Trans-Siberian Railway, the city serves as a crucial transportation hub connecting Siberia with other regions of Russia .

The Ob River flows through Novosibirsk.

The majestic Ob River adds to the city’s natural beauty and provides opportunities for recreational activities such as boating and fishing.

Novosibirsk is known for its harsh winter climate.

With temperatures dropping well below freezing in winter, the city experiences a true Siberian winter with snowy landscapes.

The Novosibirsk Zoo is one of the largest and oldest in Russia.

Home to a wide variety of animal species, including rare and endangered ones, the Novosibirsk Zoo attracts visitors from near and far.

Novosibirsk is a center for academic excellence.

The city is home to Novosibirsk State University, one of the top universities in Russia, renowned for its research and education programs .

The Novosibirsk Metro is the newest metro system in Russia.

Opened in 1985, the Novosibirsk Metro provides efficient transportation for residents and visitors alike.

Novosibirsk is surrounded by picturesque nature.

Surrounded by stunning landscapes, including the Altai Mountains and the Novosibirsk Reservoir, the city offers numerous opportunities for outdoor activities.

The Novosibirsk State Circus is famous for its performances.

Showcasing talented acrobats , clowns, and animal acts, the Novosibirsk State Circus offers entertaining shows for all ages.

Novosibirsk is home to a thriving art scene.

The city is dotted with art galleries, showcasing the works of local and international artists .

Novosibirsk has a diverse culinary scene.

From traditional Russian cuisine to international flavors, the city offers a wide range of dining options to satisfy all taste buds.

The Novosibirsk State Museum of Local History is a treasure trove of historical artifacts.

Exploring the museum gives visitors an insight into the rich history and culture of the region.

Novosibirsk is known for its vibrant nightlife.

The city is home to numerous bars, clubs, and entertainment venues, ensuring a lively atmosphere after dark.

Novosibirsk has a strong ice hockey tradition.

Ice hockey is a popular sport in the city, with local teams competing in national and international tournaments.

The Novosibirsk State Philharmonic Hall hosts world-class musical performances.

Music lovers can enjoy classical concerts and symphony orchestra performances in this renowned venue.

Novosibirsk is home to the Akademgorodok, a scientific research town.

Akademgorodok is a unique scientific community located near Novosibirsk, housing numerous research institutes and academic organizations.

Novosibirsk has a unique blend of architectural styles.

The city features a mix of Soviet-era buildings, modern skyscrapers, and historic structures , creating an eclectic cityscape.

Novosibirsk is an important center for ballet training and education.

The city’s ballet schools and academies attract aspiring dancers from across Russia and abroad.

Novosibirsk is a gateway to the stunning Altai Mountains.

Located nearby, the Altai Mountains offer breathtaking landscapes, hiking trails, and opportunities for outdoor adventures.

Novosibirsk hosts various cultural festivals throughout the year.

From music and theater festivals to art exhibitions, the city’s cultural calendar is always packed with exciting events.

Novosibirsk is a green city with numerous parks and gardens.

Residents and visitors can enjoy the beauty of nature in the city’s well-maintained parks and botanical gardens.

Novosibirsk is a center for technology and innovation.

The city is home to several technology parks and innovation centers, fostering the development of cutting-edge technologies.

Novosibirsk has a strong sense of community.

The residents of Novosibirsk are known for their hospitality and friendly nature, making visitors feel welcome.

Novosibirsk is a paradise for shopping enthusiasts.

The city is dotted with shopping malls, boutiques, and markets, offering a wide range of shopping options.

Novosibirsk has a rich literary heritage.

The city has been home to many famous Russian writers and poets, and their works are celebrated in literary circles.

Novosibirsk is a popular destination for medical tourism.

The city is known for its advanced medical facilities and expertise, attracting patients from around the world.

Novosibirsk has a well-developed public transportation system.

With buses, trams, trolleybuses, and the metro, getting around the city is convenient and efficient.

Novosibirsk is a city of sport.

The city has a strong sports culture, with numerous sports facilities and opportunities for athletic activities.

Novosibirsk has a thriving IT and tech industry.

The city is home to numerous IT companies and startups, contributing to the development of the digital economy.

Novosibirsk celebrates its anniversary every year on July 12th.

The city comes alive with festivities, including concerts, fireworks, and cultural events, to commemorate its foundation.

Novosibirsk offers a high quality of life.

With its excellent educational and healthcare systems, cultural amenities, and vibrant community, Novosibirsk provides a great living environment for its residents.

Novosibirsk is a fascinating city filled with rich history, stunning architecture, and a vibrant cultural scene . From its origins as a small village to becoming the third-largest city in Russia, Novosibirsk has emerged as a major economic and cultural hub in Siberia. With its world-class universities, theaters, museums, and natural attractions, Novosibirsk offers a myriad of experiences for visitors.

Whether you’re exploring the impressive Novosibirsk Opera and Ballet Theater, strolling along the picturesque banks of the Ob River , or immersing yourself in the city’s scientific and technological achievements at the Akademgorodok, Novosibirsk has something for everyone.

From its iconic landmarks such as the Alexander Nevsky Cathedral to its vibrant festivals like the International Jazz Festival , Novosibirsk has a unique charm that will captivate any traveler. So, make sure to include Novosibirsk in your travel itinerary and discover the hidden gems of this remarkable city.

Q: What is the population of Novosibirsk?

A: As of 2021, the estimated population of Novosibirsk is around 1.6 million people.

Q: Is Novosibirsk a safe city to visit?

A: Novosibirsk is generally considered a safe city for tourists. However, it is always recommended to take standard precautions such as avoiding unfamiliar areas at night and keeping your belongings secure.

Q: What is the best time to visit Novosibirsk?

A: The best time to visit Novosibirsk is during the summer months of June to September when the weather is pleasant and suitable for outdoor activities. However, if you enjoy the winter chill and snow, visiting during the winter season can also be a unique experience.

Q: Are there any interesting cultural events in Novosibirsk?

A: Yes, Novosibirsk is known for its vibrant cultural scene. The city hosts various festivals throughout the year, including the International Jazz Festival , Novosibirsk International Film Festival, and the Siberian Ice March Festival.

Q: Can I visit Novosibirsk without knowing Russian?

A: While knowing some basic Russian phrases can be helpful, many establishments in Novosibirsk, especially tourist areas, have English signage and staff who can communicate in English. However, learning a few essential Russian phrases can enhance your travel experience.

Novosibirsk's captivating history and vibrant culture make it a must-visit destination for any traveler. From its humble beginnings as a small settlement to its current status as Russia's third-largest city, Novosibirsk has a story worth exploring. If you're a sports enthusiast, don't miss the opportunity to learn more about the city's beloved football club , FC Sibir Novosibirsk. With its rich heritage and passionate fan base, the club has become an integral part of Novosibirsk's identity.

Was this page helpful?

Our commitment to delivering trustworthy and engaging content is at the heart of what we do. Each fact on our site is contributed by real users like you, bringing a wealth of diverse insights and information. To ensure the highest standards of accuracy and reliability, our dedicated editors meticulously review each submission. This process guarantees that the facts we share are not only fascinating but also credible. Trust in our commitment to quality and authenticity as you explore and learn with us.

Share this Fact:

- All Solutions

- Audience measurement

- Media planning

- Marketing optimization

- Content metadata

- Nielsen ONE

- All Insights

- Case Studies

- Perspectives

- Data Center

- The Gauge TM – U.S.

- Top 10 – U.S.

- Top Trends – Denmark

- Top Trends – Germany

- Olympic Games

- Election Data Hub

- Big Data + Panel

- News Center

Client Login

Insights > Media

The Record: Q3 U.S. audio listening trends

4 minute read | October 2024

The American media day starts early, ends late and involves a lot of choice in what to watch, listen to and read. Audio accounts for nearly 20% of daily time; in Q3 2024 that translated to 3 hours and 57 minutes of daily 1 listening across both ad-supported and ad-free platforms like radio, podcasts, streaming music services and satellite radio. The Record is a quarterly report card on how U.S. consumers spend their listening time, fueled by Nielsen and Edison Research.

While advertisers are constantly tracking changes in consumer behavior to improve the impact of their cross-channel marketing, The Record helps cut through with a unique representation of the time spent with ad-supported audio channels.

From July to September 2024, listeners spent 67% of their daily time with ad-supported audio with radio, 18% with podcasts, 11% with streaming audio services and 3% with satellite radio. Among 18-to-34 year-olds, radio now accounts for the majority of daily time spent with ad-supported audio; growing to 51% in the past quarter from 48% in the second quarter. Listening share for podcasts (31%) among the same audience decreased for the second quarter in a row, down from 35% in Q2 and 37% in Q1.

A quarterly snapshot: Edison Research Share of Ear®

This chart shows how Americans spent their time with ad-supported audio in Q3 2024.

Explore even more audio insights with the additional data tables here .

It’s not just younger listeners who are tuning into radio, the original ad-supported audio platform. At every age, consumers spend more than half of their daily ad-supported audio time with radio, and listeners 35 and older give nearly 75% of their audio time to radio.

The following tables report how the share of audience varies by format, age, demographic and platform for the top 15 largest-reaching AM/FM radio formats. These differentiate between the share of all radio listening and the share of streaming listening specifically, which are those listening to the digital streams of AM/FM radio stations.

Tracking radio listening by format

This chart compares which radio formats have the highest share of listening and how that differs between total radio (over-the-air and streaming combined) and the radio streaming universe.

With U.S. election news heating up and key sporting events in the third quarter, we saw the share of streaming listening for News and Sports programming increase. Streaming ‘shares’ were also noticeably higher this quarter for both Adult Contemporary and Urban Adult Contemporary / R&B, while Classic Rock shares remained elevated—a common trend seen during summer months when listening often peaks compared to the rest of the year.

As the data demonstrates, audio remains a fixture in Americans’ daily media habits. As you dig deeper into audience trends and begin to plan for 2025, consider how audio will fit into your cross-media campaigns.

The Record provides a quarterly analysis of audio listening behaviors across the total radio universe. The charts represent average daily usage and share of listening for U.S. audiences.

For even more audio data and insights, connect with our team of experts.

1 Edison Research, “Share of Ear ® ” Q3 2024

Related tags:

Related insights

Continue browsing similar insights

Leveraging big data measurement to advance addressable advertising

Learn how big data measurement can help you navigate tailwinds in addressable advertising.

76th Primetime Emmy Awards: Most-Watched Titles and Stars

Nielsen analyzed 2024 Emmy nominees to see which titles and talent earned the most of U.S. viewers’ time.

Tackling media fragmentation with a hybrid data approach

Learn how Nielsen is helping agencies crack media fragmentation measurement challenges and spot tomorrow’s trends before…

Related Products

Our products can help you and your business

Advanced audiences.

Seamlessly integrate first- and third-party audiences into your media plans and measurement strategies with Nielsen…

Advanced Audiences – Australia

Develop deeper connections with the audiences that matter most thanks to Nielsen’s Advanced Audiences in Australia.

Contextual Video Data

Enhance contextual ad targeting on CTV using gold-standard Gracenote video content metadata and IDs.

Find the right solution for your business

In an ever-changing world, we’re here to help you stay ahead of what’s to come with the tools to measure, connect with, and engage your audiences.

How can we help?

IMAGES

VIDEO

COMMENTS

A global leader in audience insights, data and analytics, Nielsen shapes the future of media with accurate measurement of what people listen to and watch.

Nielsen provides trusted intelligence on media behavior across all channels and platforms. Learn about Nielsen's leadership, focus, locations, people, news, and more.

The Record from Nielsen provides a quarterly analysis of audio listening behaviors across the total radio universe. Media. 4mins read. 2025 On Target Report. Media is changing. Is your marketing still on target? Today's evolving media landscape is unlocking new opportunities….

Nielsen Media Research is an American firm that measures media audiences, including television, radio, theatre, films, and newspapers. It is best known for the Nielsen ratings, an audience measurement system of television viewership that has been the deciding factor in canceling or renewing television shows by television networks.

Nielsen Holdings plc (or Nielsen) is an American media audience measurement firm.Nielsen operates in over 100 countries and employs approximately 15,000 people worldwide. For most of its history, the company was known for its two subsidiaries, Nielsen Media Research, which was responsible for TV ratings, and AC Nielsen, which was responsible for consumer shopping trends and box-office data.

How are marketers adapting to the rise of streaming and CTV in a digital-first landscape? Download the report to learn about global ad budgets, ROI confidence, and measurement challenges.

Nielsen Holdings - statistics & facts. Headquartered in New York City, Nielsen Holdings is a global market research company with operations in over 100 countries. The company specializes in ...

NIQ's ecosystem of data, emerging tech, AI and experts delivers the most complete and clear understanding of consumer buying behavior that reveals new pathways to growth. See how we do it. countries measuring $7.2T of global consumer spending. categories covering FMCG, Tech & Durables, and more. transactions captured weekly, 3x more than ...

When you truly understand your consumers, you win. Leading Brands: With critical behavior insights, data-backed recommendations, and go-to market optimization, Consumer Insights is your trusted growth advisor. Proven, predictive analytics The Consumer Insights suite of products is a collection of tools that have been verified to analyze brand sentiment, track customer satisfaction, predict ...

Nielsen is a professional research company and the world's leading provider of media and marketing information. Our mission is to learn about what people watch, listen to, and buy, as well as what they do online. Filling out our survey and registering your device is an opportunity to become a part of important research insights.

For more than 50 years, Nielsen has provided businesses around the world with critical insight into consumer behavior—and our panels make this possible. A panel is a group of people that we've chosen to represent a larger group of people. Since it's not feasible to include everyone in a specific geographic area, like a country or city, we ...

With our industry-leading alcoholic beverage research and analytics, you can: Measure the market and track your sales and share performance against your competitors. Grow and optimize distribution by identifying the channels with the greatest sales and consumer opportunities for your brands. Win with consumers, manage brand health, and target ...

Welcome to the Nielsen Consumer Survey. Thank you for taking the time to complete this survey. Your participation will help local businesses understand the products and services individuals like you need and want. Survey Login. To begin the survey please enter the Access Code from the letter you received, along with your email address.

Nielsen remains dominant, but a growing number of advertisers have tried alternatives and most find them equal or better. ... Walmart and market research. He's based near Cincinnati and has ...

NIQ (also known as NielsenIQ, formerly known as ACNielsen or AC Nielsen) is a global marketing research firm, with worldwide headquarters in Chicago, United States.The company has approximately 30,000 employees and operates in more than 100 countries. [1] NIQ acquired German market research firm GfK in 2023.. Until March 2021, it was a part of Nielsen Holdings.

Dinesh Nair. Bloomberg News. Consumer data giant talking to potential advisers for 2025 IPO. Advent acquired NIQ from Nielsen for $2.7 billion in 2021. NielsenIQ is exploring an initial public offering that could value the consumer intelligence firm at about $10 billion, according to people familiar with the matter, as the market for first-time ...

Fanáticos: Nielsen's playbook on Hispanic media consumption and sports engagement. This report provides deeper insights into how Hispanic fans engage with sports media and are shaping the future of U.S…. Insights | 01-05-2024.

Наш аэродром соответствует мировым стандартам парашютного спорта и входит в десятку лучших аэродромов мира. В 2021 году Аэродром Танай провел на своей базе — Чемпионат Мира по всем ...

Novosibirsk is the third-largest city in Russia. Situated in southwestern Siberia, Novosibirsk has a population of over 1.6 million people, making it one of the largest and most vibrant cities in the country.. The city was founded in 1893. Novosibirsk was established as a railway junction on the Trans-Siberian Railway, playing a significant role in the development of Siberia.

Find 2 memorial records at the Inskoe Cemetery cemetery in Novosibirsk, Novosibirsk Oblast. Add a memorial, flowers or photo.

Define, plan and measure your advanced audiences across platforms and devices. Seamlessly integrate first- and third-party audiences into your media plans and measurement strategies with Nielsen Advanced Audiences. Access syndicated and custom consumer research that will help you shape successful brand, advertising and marketing strategies.

Answer 1 of 3: As I'm doing research, trying to decide between cruise or land to see Russia and other Baltic capitals. Thoughts? Also, if I decide on land tour, any suggestions on reputable tour companies to use while in Russia?

The American media day starts early, ends late and involves a lot of choice in what to watch, listen to and read. Audio accounts for nearly 20% of daily time; in Q3 2024 that translated to 3 hours and 57 minutes of daily 1 listening across both ad-supported and ad-free platforms like radio, podcasts, streaming music services and satellite radio. The Record is a quarterly report card on how U.S ...