AI Presentation Maker

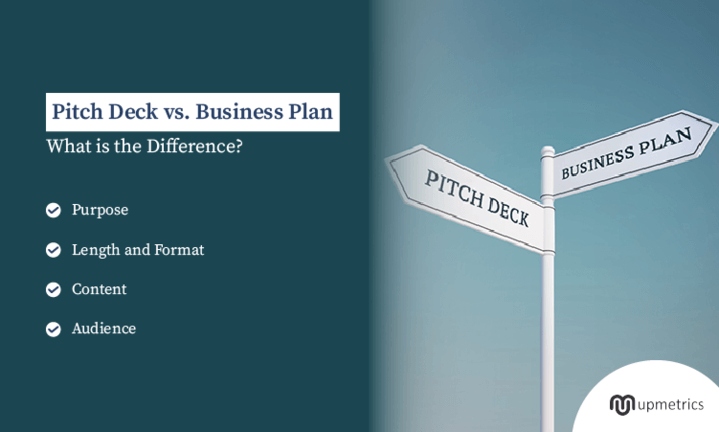

Pitch Deck vs Business Plan: Differences and Which to Use

Table of Contents

Have you ever spent time deciding between creating a pitch deck vs business plan? For startups and new business owners, where every minute counts, it’s crucial to concentrate on activities that deliver the most significant impact.

This blog article demystifies the pitch deck vs business plan, whether you aim to attract investors, secure a loan, or win over partners and clients. We’ll start with pitch decks, followed by business plans, with the goal of helping you choose wisely – so you can spend less time on paperwork and more time building your business.

1. What is a pitch deck?

A pitch deck is a slideshow that concisely conveys your business idea, market opportunity, and value proposition in a presentation format. Also known as a business or investor deck, they are used to quickly present business ideas, products, or services in 10 to 20 slides.

Purpose of a pitch deck

The purpose of a pitch deck is similar to that of an elevator pitch: tell a compelling story to grab the attention of potential investors, partners, or clients.

The goal isn’t to seal a deal on the spot but to spark sufficient interest to secure follow-up meetings and negotiate potential funding.

How long should a pitch deck be?

Your pitch deck should pack a punch, not bore your investors. Aim for 10-20 impactful slides . For complex ideas or specific industries, slightly more might be okay.

The 10/20/30 rule is your friend: make a 10-slide deck that grabs attention. Investors see hundreds of pitch decks a year. Choose quality over quantity – make each slide count!

💡 Related article: How many slides do you need for a 10-minute presentation?

What should be in a pitch deck

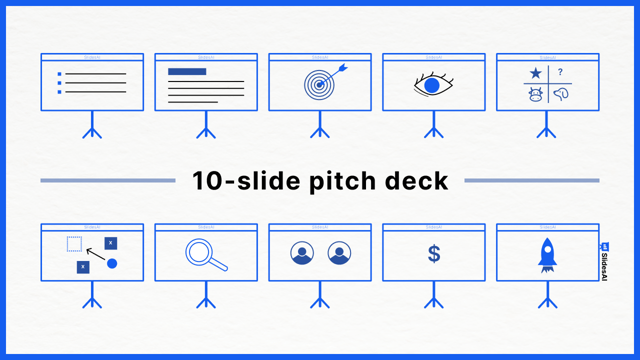

Most successful pitch decks follow a similar flow to keep investors hooked. The tried-and-tested 10-slide pitch deck format is a great starting point but be prepared to adjust or add slides for emphasis.

These are the 10 core slides for a pitch deck based on Guy Kawasaki’s 10/20/30 rule:

- Problem slide

- Solution slide

- Market size and opportunity

- Product/service

- Business model

- Competition

- Financials and key metrics

- Ask (funding needs)

Here are additional slides you may include based on specific business and investor preferences:

- Introduction

- Go-to-market (GTM) slide

- Sales and marketing strategy

- Use of funds

- Exit strategy

💡 Learn more about the 10/20/30 rule: How to create a pitch deck (and the 10 slides you need)

Pitch deck examples

Curious how some tech unicorns have pitched their ideas in the early stages? Here are two examples that have proven successful.

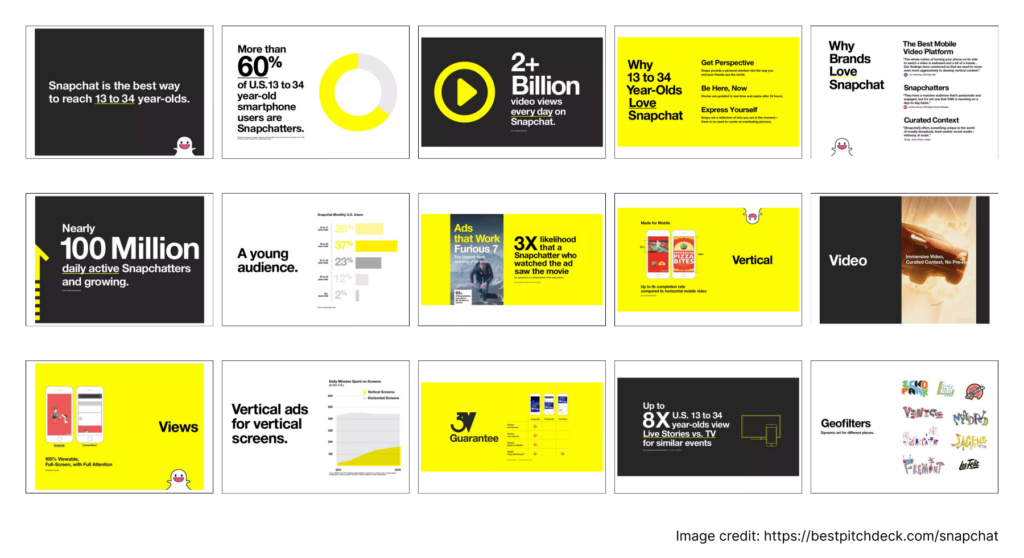

✅ Snapchat pitch deck (2013, Pre-seed)

✅ Tinder pitch deck (2016, Seed)

Examples from Best Pitch Decks

2. What is a business plan?

A business plan is a written document with detailed information that acts as a roadmap for your business. A traditional business plan is a formal document that outlines all aspects of your business, including its goals, strategies, market analysis, operational structure, and financial forecasts for the next 3 to 5 years. Most business plans are created in a Word document or report format, ranging from 10 to hundreds of pages long.

There are other types of less formal business plans used by startups or for internal alignment:

- Lean startup plan/Lean canvas: Summarizes the value proposition and business model into a single page, with a focus on the problem-solution fit.

- One-page business plan: Fits the essential information of a business into one page. Great for quickly testing an idea’s viability or getting immediate feedback.

- Internal business plan: Less formal, designed for use within an organization — for example, a feasibility business plan, operations plan, strategic, or expansion plan.

Purpose of a business plan

Business plans aren’t just for paperwork – they drive action and results. Think of your business plan as a multi-purpose tool that serves several vital functions:

- Attract investors

- Fundraising or securing loans

- Map your strategy

- Provide a strategic roadmap

- Track business progress or provide a performance benchmark

- Win over partners, talents, and potential hires

Components of a business plan

Business plans don’t have a right or wrong format; only different situations call for other formats. You can mix different plan types to prioritize components that directly support your objectives.

What to include in a traditional business plan:

- Executive summary: A concise overview of your entire business plan, highlighting the most critical points.

- Company description: What your business does, the problem it solves, your target market, and competitive advantages.

- Market analysis: Research data like market size, trends, competitors, and customer demographics.

- Organization and management: The business structure, roles, and experience of key team members.

- Products or services: Details on your offer, including features, benefits, pricing, and any intellectual property considerations.

- Sales and marketing strategy: How you plan to reach your target customers (market) and tactics to promote and drive sales.

- Financial projections: Forecasts of your income, expenses, cash flow, and profitability for the next 1 to 5 years.

- Funding request: If you are fundraising, state the amount, how it will be used, and the terms you offer investors.

- Appendix: Include any supplemental information and documents.

💡 Pro tip: Customize your plan! Add, remove, or rearrange sections to achieve your goals.

How long should a business plan be?

Think about your reader and your goal. Need a detailed plan for a bank loan? That might be 15-25 pages. Want a quick internal roadmap? A one-page Lean Canvas could work. Consider your industry, who’s reading it, and what you need the plan to do.

💡 Pro tip: Choose quality over quantity. Focus on clarity, regardless of length.

How long does it take to write a business plan?

It can take anything from 20 minutes to 20 weeks. The whole process of creating a business plan can be time-consuming (if opting for a long format), and it can also be quick (for example, the Lean Canvas).

The general advice is: Don’t overthink your first business plan. Start simple, move fast, and build as you grow. Business plans aren’t static, so be prepared to refine and expand your plan as the business evolves.

💡 Pro tip: It’s not uncommon to uncover some challenging sections while writing the plan – the key is to show awareness of these issues and ways to overcome them.

Business plan templates

Not sure where to start? Use these example plans and templates from these reputable sources to get you started:

- SBA.gov: Write your business plan – Has the traditional business plan and lean startup business plan templates

- SCORE.org – Has business plan templates for a startup , an established business , and the Business Model Canvas

- Bplans has over 550 business plan examples across multiple industries, which you can use for inspiration.

Create presentation slides with AI in Seconds in Google Slides

10M+ Installs

Works with Google Slides

3. Pitch deck vs business plan: the differences

Now that you understand pitch decks and business plans, let’s dive into their key differences.

- Pitch decks are short and punchy, designed to grab investors’ attention and get you that crucial meeting.

- Business plans are thorough and detailed documents, perfect for in-depth analysis or large funding requests.

💡 Think of it this way: Pitch decks are the attention-grabbing movie trailers that sell the whole project. Business plans are your complete blueprint.

Both documents can serve you, but understanding their differences helps you select the best tool for attracting investment or charting your company’s path.

4. Do you need a pitch deck or a business plan?

In the past, business plans were the standard document to present a business idea to investors. However, simple business plans and pitch decks are increasingly popular, especially in startups.

Here’s how to choose the right tool for the job:

🎯 Pitches and investor meetings

Pitch decks provide a snapshot of your business or idea’s potential to spark interest and secure future investor meetings.

🎯 Early stages or for idea validation

Use a simple business plan or Lean Canvas, as the format forces you to focus on the core problem you’re solving and the solution.

🎯 Internal roadmap and planning

Formal business plans will aid in longer-term strategic planning, or they can be shorter since they are for internal use.

🎯 Complex business model

Create a thorough business plan with intricate details; short plans and pitch decks wouldn’t cut it for specific industries or complicated business models.

🎯 Fundraising, loans, or traditional financing

Banks, investors, and government-funded grant applications often require a detailed business plan. Whether you seek debt or equity funding, angel investors, VCs, and banks need compelling reasons to support your venture.

💡 Pro tip: You’ll still need a traditional business plan for detailed strategy or significant funding!

- No design skills required

- 3 presentations/month free

- Don’t need to learn a new software

5. Conclusion

Pitch decks and business plans aren’t simply documents – they’re essential tools for driving your business forward. Now that you know the difference, consider your current needs. Ready to capture investor attention? Start crafting a compelling pitch deck. Need a detailed roadmap? Begin writing a winning business plan. Use the resources in this guide to get started and put your business on the right track toward success!

When should you write a business plan?

According to research by Harvard Business Review , between six and 12 months after deciding to start a business. For various reasons, crafting a comprehensive business plan either earlier or later doesn’t necessarily impact business success:

- Most startups pivot from their original ideas and plans.

- The time needed to create a thorough plan is better spent on other business activities (at least initially).

- Creating an elaborate plan may distract entrepreneurs from seeing opportunities in real time and responding to real customers’ needs.

Planning is valuable, and entrepreneurs who plan are more likely to start a successful business. However, you don’t need a complex business plan to begin working on your business. It’s okay to create a plan early on but remember; it’s more about being strategic with your time than trying to forecast the future from the start.

What’s the difference between a business plan and a canvas?

They differ in complexity and length. Business plans are longer and more detailed and are typically used to secure funding from investors or financial institutes.

A canvas, Lean Canvas , or business plan canvas, is a 1-page business plan. The Lean Canvas template helps you deconstruct your idea and focus on finding customer problems worth solving without a significant time investment.

It is popular as a direct replacement for traditional business plans within startups. The canvas can be used for quick and efficient brainstorming of multiple business models in a few hours or less.

How do I turn a business plan into a pitch deck?

Once you’ve done the groundwork of creating a business plan, you can reuse some of the insights, data, and information for a pitch deck.

- First, extract the core details from the business plan, such as the problem you solve, the solution, the size of the market, team strengths, and financials.

- Translate that information into your chosen pitch deck template (for example, the 10-slide pitch deck ) or use an AI presentation generator tool such as SlidesAI to structure your slides.

- Add and emphasize visuals. Replace some text with charts, diagrams, and graphs whenever applicable.

- Edit and keep the pitch deck focused and clear. Quality over quantity!

- Get feedback, practice your pitch, and then iterate on the deck until you are ready to show it to investors.

💡 Related article: 5 best free AI pitch deck generators 2024

Is a pitch deck only for investors?

No, while the primary purpose of a pitch deck is to attract funding, it can be adapted for various audiences and goals, such as partnerships, customers (especially enterprise customers), grant applications, startup or pitch competitions, or even for internal alignment within your team.

Related Posts

How to Create a Pitch Deck (and the 10 Slides You Need)

This article shows you how to create a pitch deck and the ten essential slides you need. We’ll also explain what makes a good pitch deck (including examples), the 10/20/30 rule, and how to avoid common mistakes.

Best Free AI Pitch Deck Generators 2024

Are you struggling to create a professional pitch deck without much time or design skills? These days, you don’t have to start from scratch – artificial intelligence is here to help you create effective decks to convince investors (or clients) about your business idea. This guide will explore the best free AI pitch deck generators […]

PowerPoint vs Google Slides: Which is Right for Your Presentations?

Microsoft PowerPoint and Google Slides are two names that frequently come up while discussing slide presentation software. Even though both programs offer a viable alternative for producing presentations with a polished appearance, several distinctions between them may make one more appropriate for a given project than the other. Both Google Slides and PowerPoint offer features […]

Save Time and Effortlessly Create Presentations with SlidesAI

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Popular Templates

- Accessibility

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Beginner Guides

Blog Business Pitch Deck vs Business Plan: Key Differences Explained

Pitch Deck vs Business Plan: Key Differences Explained

Written by: Hansika Oct 29, 2024

For startups, securing funding is the lifeblood of getting your brilliant idea off the ground. In a competitive landscape, with fewer and smaller VC deals, especially with the 2023 funding crunch , communicating your vision in a compelling way is key.

Two essential documents help you do this: a pitch deck and business plan. Both have their unique advantages and disadvantages and the best choice for you depends on specific needs and goals of your business.

A business plan is a comprehensive document that outlines your company’s objectives, strategies and financial projections. A pitch deck is concise, visually engaging and is designed to capture investors’ attention quickly. Studies show that investors spend an average of 3 minutes and 44 seconds reviewing a pitch deck, highlighting the need for brevity and impact.

Understanding the key differences between these two business tools is crucial for effectively communicating your ideas and securing the support you need. Don’t worry, you don’t have to start from scratch. Try Venngage’s business plan templates and pitch deck creator and pick from a wide range of customizable options to help you create visually stunning and persuasive materials.

Click to jump ahead:

What is a pitch deck?

What is a business plan, key differences between a pitch deck and a business plan, what is included in each one, use cases for business plans and pitch decks, when to use a pitch deck vs a business plan.

- What level of detail needed for each business tool

Choose the right communication tool for your business

A pitch deck is a streamlined visual presentation, typically 10 to 20 slides, designed to effectively communicate your startup’s core business idea, market potential and unique value. Think of each slide as a powerful snapshot of your startup’s story. Often referred to as a “business deck” or “investor deck,” this presentation serves as a critical tool for engaging potential investors by succinctly conveying your vision and strategic plan.

Instead of diving into an exhaustive business plan, a pitch deck is your startup’s highlight reel, allowing you to capture investor interest with the unique opportunity your business presents.

A well-structured pitch deck often follows Guy Kawasaki’s 10/20/30 rule . This approach emphasizes clarity and brevity—10 slides, delivered in 20 minutes, with no text smaller than 30-point font. Follow this framework to ensure that your presentation is concise, engaging and easy to understand. The goal is to convey your startup’s potential through impactful visual storytelling, making your message both compelling and memorable.

Key sections of a pitch deck typically include your problem statement, solution, market opportunity, business model, competitive analysis, financial projections and the team behind the venture.

Remember, in the fast-paced startup ecosystem, your pitch deck might be your only shot at turning skeptical investors into enthusiastic backers. So, make every slide count!

A business plan is an in-depth, comprehensive document that outlines your company’s goals, strategies, market analysis, operational framework and financial projections. It’s where vision meets strategy and dreams are translated into actionable steps.

A business plan is a comprehensive written document that details:

- Your business objectives

- Strategies to achieve these objectives

- In-depth market analysis

- Operational structure

- Detailed financial forecasts

A business plan serves as a detailed roadmap for how you plan to build, grow and sustain your business over time. Think of it as the GPS for your business journey, guiding you through every twist and turn.

Unlike a pitch deck, which is brief and high-level, a business plan dives into the granular details necessary for long-term strategic decision-making.

It typically covers several core components, such as business objectives, market opportunities, target audience analysis, competitive landscape, operational structure and detailed financial forecasts.

Types of Business Plans

Not all business plans are created equal. Depending on your needs, you might opt for:

- Traditional Business Plan: The full monty – detailed and comprehensive. These are often lengthy, structured and suitable for securing loans or investor funding.

- Lean Startup Plan: A quick, high-level overview focusing on key elements.

- One-Page Business Plan: Your entire business strategy condensed into a single, impactful page.

- Internal Business Plan: A roadmap for your team, focusing on operational and strategic details.

A well-crafted business plan is a versatile tool that can serve multiple purposes. It can secure loans by providing lenders with a detailed overview of your business, including your market analysis, financial projections and management team. This helps lenders evaluate the risk and potential return of your venture.

A business plan is crucial to attracting top talent by showcasing your company’s potential. It demonstrates your passion, vision and commitment to growth, making it more appealing to talented individuals. By highlighting your company’s mission, values and long-term goals, you can attract employees who are aligned with your vision.

Finally, a business plan can serve as a reality check by helping you identify potential challenges before they arise. By conducting a thorough analysis of your market, competition and financial projections, you can identify potential risks and develop strategies to mitigate them. This can help you avoid costly mistakes and make informed decisions.

Pitch decks are like headlines; business plans are the articles. A headline grabs attention and provides a brief summary, while the article delves into the details.

Here are some more points of difference between these two business tools:

As you can see, a pitch deck provides a concise overview of your business, while a business plan provides a comprehensive analysis.

Now that you know the differences between a pitch deck and business plan, let’s look at all the components included in each of them.

There are different scenarios where you would pick between a pitch deck and a business plan. Use the right business communication tool and you’re more likely to get your desired result.

Pitch deck use cases

- Investor meetings:

The goal in investor meetings, to quickly capture interest. Pitch decks help you to provide a succinct overview of your business, focusing on high-impact visuals and concise messaging to outline your value proposition, market opportunity and financial potential. Ensure your deck makes a strong impression in the first 30 seconds to hook those Investors in for a follow-up meeting. See how Facebook raised its initial seed money of $500,000 with its pitch deck.

Source: Cirrus Insight

- Startup competitions:

During startup competitions, a pitch deck gives you a powerful way to convey your business idea and unique position. The audience may include judges, potential investors, or industry experts who will appreciate a clear, compelling presentation that highlights your startup’s vision, business model and market fit, within a limited time frame.

- Partnership discussions:

When discussing potential partnerships, a pitch deck helps you present your business’s potential in a clear and concise manner. By showcasing synergy, market positioning and growth potential, a pitch deck provides partners with a snapshot of how collaboration could be mutually beneficial and sets the vital foundation for further negotiations.

Business plan use cases

- Securing bank loans:

A well-prepared business plan with solid financials and market analysis demonstrates your preparedness and reduces the perceived risk for lenders. When approaching banks or financial institutions for a loan, a business plan is crucial in giving lenders and financial authorities a clear picture of your organization’s financial health, your business model and any anticipated risks so they’re aware of your ability to repay the loan.

- Internal strategic planning:

A business plan also serves as a guiding document for internal strategy. It outlines long-term business objectives, operational plans and growth strategies, so that your team can align your team with the company’s vision and goals. When everyone is working towards the same goals, chances of success increase.

- Attracting key hires and partners:

A comprehensive business plan is a great tool to attract top talent or potential partners. High-level candidates and partners are often keen to understand the company’s vision, strategy and long-term potential. A business plan shows them your business is viable, well-organized and future-focused, so they’re reassured of their decision to invest their time or resources.

Choosing between a pitch deck and a business plan depends on your business goals, the stage of your company and the audience you’re addressing.

Pitch decks

A pitch deck is designed to make a strong first impression in a limited time. It’s visually engaging and provides an overview of your business without going into the deep operational details. If your goal is to secure initial interest or kickstart a relationship, a pitch deck is your go-to tool.

If your primary objective is raising early-stage capital, opt for a pitch deck. Investors want a quick, visually engaging presentation that covers the essentials and sparks interest. Use a pitch deck when presenting to new investors, partners, or during competitions where brevity and clarity are key. If you’re not sure about where to start, check out the pitch deck templates by Venggage for a professional, minimal pitch deck to crack your next investor meeting.

Business plans

Business plans on the other hand, are important tools when it comes to long-term planning and objectives. If you’re securing long-term funding, formal partnerships, or aligning internal teams, this comprehensive document is essential for ensuring all stakeholders are on the same page with your business goals. Business plans allow these stakeholders to understand the potential and long-term viability of your business.

Opt for a business plan when the audience needs to understand the intricate details of your business, such as during long-term financial planning, strategic hires, or scaling discussions.

By choosing the right tool for the right scenario, you ensure that your message resonates with the intended audience and helps you achieve your specific business goals.

What level of detail is needed for each business tool

Pitch decks are high level documents. Clarity and length of your messaging is vital to keeping investors engaged and interested. Use visual elements like images, graphs and charts to convey complex ideas quickly. Stick to the main ideas and guide investors through your story with a clear, compelling arc.

Your goal here is to highlight the benefits of your product or service quickly in an impactful way.

An ideal pitch deck will have 10-20 slides that capture the essence of your startup, with simple and powerful statements.

Business Plan

Business plans are comprehensive and in-depth. All the sections need thorough explanation, backed by data. Various aspects like financial projections, operational plans and market analysis should be robust and well-researched.

A 20-40+ page document that provides detailed insights into every aspect of your business.

Both pitch decks and business plans are essential tools in your business journey, but they serve different purposes. The pitch deck is a quick, visual way to spark interest, while the business plan offers a full roadmap for long-term success.To determine which tool is right for you, assess your current goals—whether it’s securing quick investor interest with a pitch deck or presenting an in-depth financial strategy with a business plan.

Frequently Asked Questions (FAQs)

1. is a pitch deck only for investors.

No, pitch decks are also used in startup competitions, partner meetings and internal presentations.

2. Can a business plan be turned into a pitch deck?

Yes, you can distill key elements from your business plan into a concise, visual pitch deck format.

3. What are the essential slides in a pitch deck?

Key slides include the problem statement, solution, market opportunity, business model, financials and the team.

4. Do I need both a pitch deck and a business plan?

Yes, it’s beneficial to have both. The pitch deck helps in initial presentations, while the business plan supports deeper discussions and planning.

5. How do I turn a business plan into a pitch deck?

Pick the most important sections from your business plan—such as your market opportunity, solution and financials—and distill them into a 10-20 slide format.

6. When should you write a business plan?

Write a business plan when you need detailed financials for a loan, want to guide internal strategy or seek to partner with other organizations.

7. What’s the difference between a business plan and a canvas?

A business plan is detailed and long, while a business model canvas is a one-page visual tool that outlines key aspects of your business model.

Discover popular designs

Infographic maker

Brochure maker

White paper online

Newsletter creator

Flyer maker

Timeline maker

Letterhead maker

Mind map maker

Ebook maker

- PITCH DECK DESIGN

- PITCH REVIEW & COACHING

- PITCH DECK PORTFOLIO

- CLIENT TESTIMONIALS

- STARTUP PITCH DECK

- FUND PITCH DECK

- TV / MOVIE PITCH DECK

- LOGO & BRANDING

- SALES & MARKETING COLLATERAL

- PRESENTATION DESIGN

- STRATEGIC ADVISORY

- LOGO PORTFOLIO

- VIDEO PORTFOLIO

- PRESENTATION PORTFOLIO

- CLIENT PITCH DECK

- STARTUP FUNDING GUIDE

- IS YOUR BUSINESS FUNDABLE?

- TOP FOUNDER MISTAKES

- PITCH DECK QUICK START GUIDE

- PITCH DECK TEMPLATE

- DESIGN RESOURCE TOOLKIT

- WORKSHOPS & COURSES

- VENTURE CAPITALIST NEAR ME

- STARTUP EVENTS NEAR ME

- ACCELERATORS NEAR ME

- THE IGNITE BLOG

- by Stacie Sterren

- What is a Pitch Deck

Whether you’re a first time founder, a hopeful entrepreneur or a serial startup guru, you’ve likely pondered “What is the difference between a pitch deck and a business plan?” Which one came first? Why would you use a pitch deck over a business plan? Or, why would you use a business plan over a pitch deck? Are business plans archaic? Is a pitch deck just a pretty business plan? What works best for your startup? And at what time? Do you even need either one? These are important questions. Especially when your time is limited as you are building and growing your company.

Before we can answer these questions, let’s talk about what a pitch deck and a business plan are.

THE BUSINESS PITCH DECK

A pitch deck is a presentation that contains 10-20 slides. The pitch deck presentation is either sent to investors as a pdf to get them interested in taking a meeting with the entrepreneur, or used as a visual aid during a live presentation to either investors or other audiences like pitch competitions. Sometimes pitch decks are used for both.

A pitch deck is meant to share information about your business. Who does it serve and why, the size of the market, your special sauce and how you will win in that space. It lays out clear go to market strategies, and delves into some detail on future opportunities. It relies on your research of your industry and understanding of your business’ plan for launch and growth. The pitch deck helps an investor see where you are, where you are going and enables them to decide if they want to help you get there. The goal of a pitch deck is to score an in-person meeting or to kick off the conversation with an investor about joining your funding round.

- 10-20 slides

- Highly Visual

- Used to Get Investors Attention

THE BUSINESS PLAN

A business plan is a fully researched 10-100 page document. The document is used to store and convey in detail your business’ plans for the next 1,3, 5 years. The business plan lays out the research you’ve done in your industry and competitors. It discusses your sales, marketing, and operational plans. It takes into account your financial analysis, assumptions on growth and success, and lays out a map of where your company will be and how it will get there.

The business plan goes into detail on the management team and what unique skills they bring to the table. The document usually includes a significant number of charts, depictions and pictures. But it relies heavily on text to convey the information. The business plan is used as a document that is shared with potential investors for them to use as a reference point when deciding whether or not to invest in your company. It is often used in a due diligence step in the funding process. The goal of a business plan is to lead you and your team members down the path of success over the next few years, and to show an investor how you plan to be successful with their investment.

- 10-100 Pages

- Highly Text-Based

- Used to Get Investor Buy-in

Which Came First, the Pitch Deck or the Business Plan?

The business plan is a longstanding document that has been been used in the building and planning and funding of businesses for quite some time. Possibly as long as businesses have been a thing. If you can believe that. It is a basic document really, it is the plan for the enterprise which you are setting out on.

To ensure that you are successful, you should carefully plan how you will be successful, and make those decisions based on thorough research. You need to understand your customers and their problems as well as your competitors and their weaknesses. Before the existence of Venture Capital firms and other now widely available forms of equity funding, banks gave out loans to businesses to help them get started. But in order to choose who to give the loans to, they needed to make sure that they would be able to pay those loans back. A business plan was required to convey to the banker the viability of the venture. It has been a staple ever since. Banks still require business plans for loan applications today. Some request or accept pitch decks too, but not usually instead of the business plan.

It is not clear who put together the very first pitch deck, or since exactly when investors have been looking for the pitch deck, but we can deduce a few things from history. Venture Capital firms really started to gain traction as a viable source of funding during or right before the tech boom of the 90’s. They played a big role in bank-rolling the launch and growth of many 90’s startup companies. Back then, it took a lot of capital to set up the infrastructure needed to start a large tech company. Websites needed to be built and coded, infrastructure (like servers, mainframes & networking components). They needed to be purchased and set up and run and maintained.

But, online companies looked nothing like traditional businesses. Like a restaurant or a manufacturer–it was all a little too uncertain and risky for banks to give out loans. So, venture capitalists and angel investors filled the void. They offered funding in exchange for equity.

The Beginning of the Business Pitch Deck

I imagine in the beginning these groups read the full business plans of potential deals. But as the venture capitalists got more busy, received more applications, and more and more founders looked to equity instead of debt financing, they likely couldn’t read a whole business plan for every applicant. One pagers and executive summaries helped, but even these were tiresome text-heavy documents to read through all day long. There was a need for a shorty, easier to digest document.

In comes graphic design tools for the masses. Microsoft PowerPoint was invented in 1987, and grew in it’s popularity through the 90’s. The appeal of PowerPoint was that you could use it to project a visual aid as you spoke to your audience. This meant they could see additional information, charts and pictures that provided more context to your speech. So founders started using these technologies when pitching to investor during those initial meetings.

Somewhere along the line, the ease and visual nature of the Slide Deck merged with the long-form business plan. And founders started sending visual documents created in PowerPoint and other slide deck design tools to investors before they met them.

So which came first the pitch deck or the business plan? The pitch deck is a child of the business plan. The business plan came first, then the pitch deck.

Why You May Not Need Both a Pitch Deck and a Business Plan

All of that said, today you may not need both a pitch deck and a business plan. It depends on your business stage and what your goals are. A business plan is a thorough document that contains “the plan” itself. If you have “the plan” itself written down in a variety of documents or sources of information than you may not need an official business plan document in the traditional sense. And at least not a 100 page one.

If you are looking to work with a pitch deck designer, it may be advantageous to have a full or partial business plan. Your pitch deck designer will most likely not assist you with business decisions and strategies. Rather, they will work with you–the expert–to tell your plan, ensure it is compelling to the investor audience, and well designed and visually appealing. You need to have a concept. And likely need to have done some level of research into your industry and competitors to work with a designer on your deck. But, you needed that anyway just to be an effective founder.

When You Need a Business Plan and Not a Pitch Deck

- If Seeking Debt Financing: Banks still review business plans, so you will need a business plan if you’re looking to get any kind of loan from a bank.

- When Raising Over $500K: If you’re raising a lot of money, you better have a plan for what you’re going to do with it. Investors will be doing due diligence, be prepared.

- When You Have Co-founders / Co-owners: When you have several cooks in the kitchen, it is helpful to have a written and agreed upon plan to make sure everyone stays on track and executes the way you intended. This should be a living document that is updated over time and as things change.

When You Need a Pitch Deck and Not a Business Plan

- When You are Seeking Equity Funding: If you’re looking for funding from venture capitalists, angel investors or saavy friends and family, you need a clear pitch deck.

- If You’re Networking with Investors: Not ready to get investment now, but have the opportunity to network with investors? You should have a pitch deck ready. First impressions are important, especially when building influential relationships.

- When Your Pitch in a Competition: In the startup community there are a lot of pitch events and competitions designed to give founders a chance to get exposure and practice pitching their company. You definitely need a pitch deck.

- When You Are Seeking CoFounders: If you’re looking for cofounders, there is no better way to convey to them your concept, and the value you can bring to the table than through a pitch deck.

- When You Apply to an Accelerator: Many accelerators require a pitch deck in order to apply. They use the deck to evaluate your company and decide whether or not you should join the next cohort.

Which is More Important, the Pitch Deck or the Business Plan?

In can be argued that the pitch deck is more important than the business plan, because it is likely to actually be seen by others. If you don’t have a good business pitch deck, you won’t get the opportunity to talk in more detail with potential investors. You won’t excite and evangelize the startup community and your early team around the company’s growth. And, it may ruin your ability to connect with key mentors and partners that could catapult your startup business.

That said, with no plan, the pitch deck will not work. Investors see pitches day-in and day-out. They can sense a snake-oil salesman, an impossible tech product, and an unprepared founder from a mile away. If you don’t know your stuff, then the best pitch may help you get the meeting, but it won’t help you get funding. But today, the plan doesn’t have to be in the form of a traditional text-based business plan.

I hope this has helped you to better evaluate the differences between pitch decks and business plans. And help why you might choose to develop one or each of them for your startup. If you’re building your pitch deck, I strongly encourage you to work with pitch deck experts. We evaluated different options for getting your pitch deck designed here (including DIY, all the pros and cons).

Stacie Sterren

Related posts.

What is a Startup Accelerator?

What is traction?

Why You Need More Than One Pitch Deck

Can You Get Funding with a Bad Pitch Deck if your Startup is Good Enough?

Is it time? Does your startup need a pitch deck?

Business Plan vs Pitch Deck: The Differences and When You Need Them

Starting a new venture involves navigating numerous challenges, one of which is effectively communicating your business vision. Two essential tools in this process are the business plan and the pitch deck. While both are crucial, they serve different purposes and are used at different stages of your startup journey. In this article, we'll explore the key differences between business plans and pitch decks, what each includes, the level of detail required, the creation process, and specific use cases. Understanding these distinctions will help you use each tool to your advantage, ensuring you’re well-prepared to impress investors and guide your business to success.

Business Plans vs Pitch Decks - An Overview

When raising capital for your startup, both business plans and pitch decks are essential tools, each serving distinct purposes.

A business plan is a detailed document outlining your business’s objectives, strategies, market analysis, and financial projections. It provides a comprehensive roadmap for your business, guiding long-term strategic decisions and demonstrating viability to stakeholders such as banks and grant providers.

In contrast, a pitch deck is a concise, visually-driven presentation designed to quickly capture the interest of potential investors. It typically includes key highlights of your business, such as the problem you’re solving, your solution, market opportunity, business model, and team. The goal is to secure meetings and generate interest from venture capitalists, angel investors, and during startup competitions.

Both tools are crucial in fundraising, but they are used at different stages and for different audiences.

Business Plan

A business plan is a comprehensive document that outlines your business's objectives, strategies, market analysis, organizational structure, and financial projections. Its primary purpose is to serve as a detailed roadmap for your business, guiding strategic decisions and demonstrating the viability and potential of your venture to various stakeholders.

The business plan is essential for several key reasons:

- Securing Funding : It provides potential investors, banks, and grant providers with an in-depth understanding of your business model, financial forecasts, and strategic plans, helping to secure necessary funding.

- Strategic Planning: It acts as a guide for internal decision-making, helping founders and management teams align on goals and strategies.

- Attracting Talent: A well-articulated business plan can attract co-founders, key hires, and partner s by clearly outlining the business's vision and potential.

Use cases for a business plan include applying for loans, pitching to investors, and guiding internal strategy development. Each of these scenarios relies on the detailed and structured information that a business plan provides, making it an indispensable tool for startup founders.

Related resource: Startup Business Plan

A pitch deck is a concise, visually-driven presentation designed to quickly capture the interest of potential investors. It typically consists of around 10-20 slides that highlight the key aspects of your business, such as the problem you’re solving, your solution, market opportunity, business model, and team.

The primary purpose of a pitch deck is to provide a snapshot of your business that is engaging and easy to understand, aiming to secure meetings and generate interest from potential investors. Unlike the comprehensive nature of a business plan, a pitch deck is meant to be high-level and visually appealing, making it an effective tool for initial presentations.

Use cases for a pitch deck include:

- Investor Meetings: Pitching to venture capitalists and angel investors to secure funding.

- Startup Competitions: Presenting at demo days and competitions to gain exposure and interest.

- Partnership Discussions: Engaging potential partners and stakeholders by providing a clear and compelling overview of your business.

The pitch deck serves several important functions:

- Generating Interest: It is designed to grab the attention of venture capitalists, angel investors, and other stakeholders, encouraging them to seek more detailed information.

- Communicating Vision: The pitch deck helps convey your business idea succinctly, showcasing the problem you’re solving, your solution, and your unique selling points.

- Facilitating Meetings: A compelling pitch deck can lead to follow-up meetings, providing opportunities to delve deeper into your business plan and financials.

Related resource: Building Your Pitch Deck

What is Included in Each One

Understanding the structure and key components of business plans and pitch decks is crucial for effectively using each tool in your fundraising efforts.

A detailed and comprehensive business plan covers elements such as market analysis, financial projections, and strategic planning. In contrast, a pitch deck is concise and visually engaging, highlighting key aspects like the problem you’re solving, your solution, and your business model.

This section will provide an overview of what to include in each, highlighting the differences to help you tailor them to your needs.

A business plan is a detailed and comprehensive document that covers various aspects of your business. Key components typically include :

- Executive Summary: A brief overview of your business, including your mission statement, product or service offering, and basic information about your company’s leadership, employees, and location.

- Company Description: Detailed information about your business, including the problems you’re solving, your target market, and what makes your business unique.

- Market Analysis: An examination of your industry, market size, expected growth, and competitive landscape.

- Organization and Management: An outline of your business’s organizational structure, details about the ownership, and profiles of your management team.

- Products or Services Line: Detailed descriptions of your products or services, including the lifecycle of each product, and how they benefit your customers.

- Marketing and Sales Strategy: Your plan for reaching your target market, including pricing, advertising, and sales strategies.

- Funding Request: If you’re seeking funding, this section outlines your current funding requirements, future funding requirements over the next five years, and how you intend to use the funds you receive.

- Financial Projections: Detailed financial forecasts, including income statements, cash flow statements, and balance sheets for the next three to five years.

- Appendix: An optional section that includes resumes, permits, lease agreements, legal documentation, and other pertinent information.

A pitch deck is a more concise and visual presentation focusing on highlighting your business's key aspects. Key components typically include :

- Title Slide: The name of your business and a tagline or short mission statement.

- Problem Statement: A description of the problem your business aims to solve.

- Solution: An overview of your product or service and how it addresses the problem.

- Market Opportunity: Information on your target market and the potential market size.

- Business Model: An explanation of how your business will make money.

- Traction: Evidence of your business’s progress and momentum, such as sales figures, customer testimonials, or user growth metrics.

- Competition: An analysis of your competitors and your competitive advantages.

- Go-to-Market Strategy: Your plan for attracting and retaining customers.

- Financials: High-level financial projections and key metrics.

- Team: Information about your founding team and key advisors.

- Use of Funds: How you plan to use the investment you’re seeking.

- Closing Slide: A summary of your pitch and a call to action, often including your contact information.

Related resource: Key Slides In Your Pitch Deck

Each of these components plays a crucial role in communicating the essential aspects of your business to different audiences. While the business plan is thorough and detailed, the pitch deck is designed to be engaging and to the point, helping you quickly capture the interest of potential investors.

What Level of Detail is Needed for Each One?

Business plans and pitch decks differ significantly in the level of detail they require. Business plans are comprehensive and detailed, covering strategic projections and in-depth analyses. In contrast, pitch decks are high-level, focusing on engaging visuals and key highlights to quickly capture investor interest.

A business plan requires a high level of detail to comprehensively outline your business’s strategic vision, operational structure, and financial projections. Each component must be thoroughly developed to provide a clear roadmap for the business and demonstrate its potential to stakeholders. Here's a breakdown of the required level of detail for each key component:

- Executive Summary: This section should offer a concise yet comprehensive snapshot of your business, including your mission statement, the products or services you offer, and basic company information such as leadership, employees, and location. While brief, it should be compelling enough to attract further interest.

- Company Description: This part should delve deeply into your business, explaining the problems you're solving, your target market, and what makes your business unique. It should provide a clear picture of your business’s purpose and the value it offers to customers.

- Market Analysis: This section should include in-depth research on your industry, including market size, expected growth, and trends. A detailed competitive analysis is also crucial, highlighting your competitors' strengths and weaknesses and how you plan to differentiate your business.

- Organization and Management: Provide detailed profiles of your management team, including their backgrounds, expertise, and roles within the company. An organizational structure chart can be helpful here, showing how different roles and departments interrelate.

- Products or Services Line: Offer detailed descriptions of your products or services, including their lifecycle, development stages, and benefits to customers. Explain how your offerings meet the needs of your target market and any plans for future development or expansion.

- Marketing and Sales Strategy: This section should outline your strategies for reaching your target market, including pricing models, advertising plans, sales tactics, and distribution channels. Be specific about how you will attract and retain customers, including any partnerships or collaborations.

- Funding Request: If you are seeking funding, clearly outline your current and future funding needs, specifying how much you need, how you plan to use the funds, and any future funding requirements over the next five years. Provide a clear plan for how the funds will help achieve your business goals.

- Financial Projections: Provide detailed financial forecasts, including income statements, cash flow projections, and balance sheets for at least the next three to five years. This section should demonstrate your business’s financial viability and growth potential, with assumptions clearly stated.

- Appendix: Include any additional documents that support your business plan, such as resumes, permits, legal documentation, market research data, and any other relevant materials. The appendix should provide supporting evidence for the claims and projections made in your business plan.

Each of these components should be well-researched and thoroughly explained, offering a clear and detailed picture of your business and its potential. A comprehensive business plan not only helps in securing funding but also guides strategic decision-making and helps attract key partners and talent.

A pitch deck requires a concise yet engaging level of detail to capture the interest of potential investors and stakeholders effectively. Each component should be clear, visually appealing, and focus on the key highlights of your business. Here’s an outline of the necessary components and the level of detail required:

- Title Slide: Include your business name, logo, and a brief tagline or mission statement. This slide should set the tone and provide a quick grasp of your business identity.

- Problem Statement: Clearly and succinctly describe the problem your business aims to solve. Use visuals or anecdotes to illustrate the problem’s significance and relevance to your target market.

- Solution: Provide an overview of your product or service and explain how it addresses the problem. Highlight the unique aspects of your solution and how it stands out from existing alternatives.

- Market Opportunity: Present key information about your target market, including market size, growth potential, and trends. Use charts or graphs to make the data visually compelling and easy to understand.

- Business Model: Explain how your business will make money. Include details on your revenue streams, pricing strategy, and any monetization plans. Keep it straightforward but comprehensive enough to show viability.

- Traction: Highlight your business’s progress and milestones. This could include sales figures, user growth, partnerships, or any significant achievements. Use visuals like charts or graphs to showcase your momentum.

- Competition: Provide a brief analysis of your competitors and articulate your competitive advantages. Use a comparison chart to highlight how your business outperforms or differentiates from others in the market.

- Go-to-Market Strategy: Outline your plan for attracting and retaining customers. Include marketing and sales strategies, distribution channels, and any partnerships that will help you reach your target market effectively.

- Financials: Summarize your key financial projections and metrics. Include revenue forecasts, profit margins, and break-even analysis. Use simple charts or graphs to make the data accessible and impactful.

- Team: Introduce your founding team and key advisors. Highlight their relevant experience and roles within the company. Use photos and brief bios to humanize your team and build credibility.

- Use of Funds: Explain how you plan to use the investment you’re seeking. Provide a clear and specific breakdown of how the funds will be allocated to drive growth and achieve your business goals.

- Closing Slide: Summarize your pitch and include a call to action. Provide your contact information and invite investors to follow up for more detailed discussions.

Each component should be crafted to deliver maximum impact with minimal text, using visuals to convey key points effectively. The goal is to engage your audience, provide a compelling snapshot of your business, and secure further interest or meetings.

What Does It Take to Create Each One?

Creating a business plan and a pitch deck requires different approaches due to their distinct design, data, and storytelling requirements. Understanding the process for building each will help you allocate the necessary resources and time effectively.

Building a business plan is a detailed and collaborative effort that involves:

- Extensive Research: In-depth market analysis, competitive landscape assessment, and financial forecasting.

- Cross-Department Collaboration: Input from finance, marketing, operations, and management teams to ensure accuracy and comprehensiveness.

- Detailed Documentation: Crafting a thorough narrative with strategic projections and detailed analyses.

The process is time-intensive, typically taking several weeks to a few months, depending on the business complexity and data availability.

Creating a pitch deck is a more streamlined process that emphasizes:

- High-Level Research: Gathering essential data on market size, competition, and key financial metrics.

- Visual Design: Collaborating with designers to create engaging and visually appealing slides or using templates that make designing easier such as canva or pitch .

- Concise Storytelling: Developing a compelling, succinct narrative highlighting the business’s value proposition and growth potential.

This process is quicker, usually taking a few days to a couple of weeks, depending on the need for iterations and design work. Understanding these differences ensures you allocate the right resources and time for each document, aligning with their specific purposes and audiences.

Use Cases for Business Plans and Pitch Decks

Understanding when to use a business plan versus a pitch deck is crucial for effectively communicating your business vision and securing stakeholder support. Here are specific situations where each document would be most effective.

- Securing Bank Loans: A detailed business plan is essential when applying for a bank loan . It provides lenders with comprehensive information about your business model, financial projections, and market analysis, demonstrating your ability to repay the loan and manage financial responsibilities effectively.

- Internal Strategic Planning: A business plan guides internal decision-making and strategic planning . It helps align the management team on long-term goals, operational strategies, and resource allocation, ensuring everyone is working towards the same objectives.

- Attracting Key Hires and Partners: A well-structured business plan can attract top talent and potential business partners by clearly outlining the business’s vision, growth potential, and strategic direction. It provides a detailed understanding of the company’s mission and future prospects, making it an attractive opportunity for skilled professionals and collaborators.

- Investor Meetings: A pitch deck is perfect for pitching to venture capitalists and angel investors. Its concise, visually engaging format quickly captures the interest of potential investors, providing an overview of your business, the problem you’re solving, and your market opportunity, leading to follow-up meetings and deeper discussions.

- Startup Competitions: During startup competitions and demo days, a pitch deck is essential. It succinctly presents your business idea, traction, and competitive edge, helping you stand out in a crowded field and attract potential investors or partners who attend these events.

- Initial Partnership Discussions: When initiating discussions with potential partners, a pitch deck effectively communicates your business’s value proposition and strategic fit. It offers a compelling snapshot of your business, encouraging partners to explore collaboration opportunities further.

By understanding these use cases, you can strategically utilize business plans and pitch decks to engage different audiences and achieve your business objectives effectively.

Tailor Your Business Plan and Pitch Decks to Your Needs with Visible

Both business plans and pitch decks are essential tools for startup founders, each serving distinct purposes and requiring different levels of detail. A business plan provides a comprehensive roadmap for strategic planning and securing funding, while a pitch deck is a concise, visually engaging presentation designed to capture investor interest quickly.

Share your pitch deck confidently with Visible, a purpose-built platform for fundraising. Our pitch deck sharing tool is completely integrated with our fundraising CRM and investor updates platform. Founders can also leverage their brand by hosting decks from their own domain and highlighting brand colors.

Try Visible free for 14 days and start strengthening your investor connections.

AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

AI Research Assist Your go-to AI-powered research assistant

TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

INTEGRATIONS

QuickBooks Sync and compare with your QuickBooks data

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

Xero Sync and compare with your Xero data

See how easy it is to plan your business with Upmetrics: Take a Tour →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

BY USE CASE

Secure Funding, Loans, Grants Create plans that get you funded

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

E2 Visa Business Plan Create a business plan to support your E2 - Visa

Business Consultant & Advisors Plan with your team members and clients

Incubators & Accelerators Empowering startups for growth

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

Plan Writing & Consulting We create a business plan for you

Business Plan Review Get constructive feedback on your plan

Financial Forecasting We create financial projections for you

SBA Lending Assistance We help secure SBA loans for your business

WHY UPMETRICS?

Reviews See why customers love Upmetrics

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Customer Success Stories Read our customer success stories

Help Center Help & guides to plan your business

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

Pitch Deck VS. Business Plan: What is the Difference

Business Plan Template

- May 8, 2024

Pitch deck or a business plan—confused about which of these business documents you should create for your business?

Well, the short answer is both.

But, in a thriving startup world, where time’s a chase, knowing what will help you to make the most significant impact will make the choice easier.

Through this blog post, let’s help you understand the key differences between these two documents, i.e. pitch deck vs business plan , and instances when you will need them.

Ready to get started? Let’s dive right in.

What is a pitch deck?

A pitch deck is a concise visual presentation, often used by startups and emerging entrepreneurs, to introduce their business potential in front of investors and potential stakeholders.

These presentations explain the key details of your plan such as the problem, solution, revenue model, traction, financials, and organizational team through engaging visuals and simple text blocks.

Pitch decks hook the audience to your excellent business idea and persuade them to engage further or take action.

Pitch decks are important for a quick business introduction. But let’s now gather a basic overview of what a business plan is.

What is a business plan?

A business plan is a professional document outlining the goals, strategies, and operational aspects of your business. It serves as a guide for decision-making and offers a roadmap to achieve your business objectives.

In General business plan include key components like executive summary, company overview, market analysis, products and services, marketing and sales strategy, operation plan, management team, and financial plan.

It’s one detailed document that will help you to secure funds from potential investors.

Now, that you have gathered a fair understanding of pitch decks and business plans, let’s understand what makes them different.

Difference between a pitch deck and a business plan

Pitch decks are crisp offering a macro overview of your business idea through sharp and remarkable visuals. Business plans, on the other hand, are immaculately detailed, offering a micro overview of what your business does and where it aims to reach.

Well, the differences between a business plan and a pitch deck are fundamental and we will now explore those differences in detail.

Pitch decks serve the purpose of familiarizing the audience with your business idea in a short time. They capture the audience’s attention, spark excitement about a business idea, and help you secure further discussions and meetings with potential investors.

Business plans, on the other hand, offer an in-depth detailing of your business framework, financial projections, and strategic objectives. They are required by banks to grant loans, investors to evaluate the business’s viability, and internally to guide the management and operations.

2. Length and Format

A slide deck is precise and concise. It summarizes your entire business idea within 10-15 slides, and sometimes even less.

These business documents are heavier on visual components. Instead of paragraphs, the important information is usually conveyed through crisp statements and bullet points.

Business plans, however, are extremely detailed and lengthy. While the length of a typical traditional plan varies between 20-100 pages, a startup business plan in a lean format can be as small as 1-2 pages.

These professional documents are heavier on text and include tables and charts to support the textual content. The design is kept minimal and professional and the information is organized neatly into digestible sections.

A pitch deck includes high-value information summarizing only the key aspects of your business plan. They focus more on the problem and the solution, revenue model, traction, competitive advantage, and key financial metrics of your business.

Such presentations also include your funding demand and are pretty straightforward in terms of content.

Business plans, however, provide extensive information detailing your business idea, strategies, resources, financials, and even the assumptions and justifications.

Generally, a comprehensive business plan includes an executive summary followed by a detailed description of the business, market analysis, products and services, marketing and sales strategies, operations, management, and financials.

However, one can adjust the contents and details of a business plan depending on their objective to write a business plan.

4. Audience

Pitch decks are essentially prepared to pitch to investors and venture capital firms for equity funding. However, that’s not it.

The very purpose of a business pitch deck is to educate the people about your business idea and stir their interest. So anyone who wants to acquaint themselves with the core fundamentals of your business in a short time is an ideal audience for a pitch deck.

Similarly, a business plan is also intended for a vast audience, including but not limited to, loan officers, investors, stakeholders, and the company’s internal team.

In fact, anyone who wants to have a deep, thorough insight into your business’s strategies, policies, operations, and finances can benefit from reading your business plan.

And those are the most fundamental differences between a pitch deck presentation and a business plan. However, let’s now understand different instances when you will require these business documents.

When to use a Pitch Deck?

A pitch deck offers a snapshot of your business and is most suitable for situations, events, and audiences that prefer to gather a level of information within a short span.

Here are a few instances where you would definitely require a business pitch deck:

- When you want to introduce your startup idea at investor meet-ups, networking events, and accelerator programs.

- When you want to get initial equity funding from investors and VC firms.

- When you want to secure an in-person meeting with an investor.

However, for all this to happen, you need a pitch deck that brilliantly captures the key essence of your business.

Well, it’s not that easy. From design to content—it takes a lot to create a 10-page, compelling pitch deck.

You must have figured out that creating a pitch deck is challenging given the crispness, conciseness, and briefness it requires.

Not anymore. You can now use AI to create your strategic pitch decks from scratch, requiring zero designing.

Ditch your old-school pitch deck creation methods

Make compelling pitch decks in minutes with AI

When to use a Business Plan?

A well-mapped business plan is an asset that will take your business to quite a few places helping you realize your business goals. If you are wondering where will you require a business plan, here you go:

- When you want significant funding from potential investors.

- When you want to validate your business idea.

- When you want to plan for subsequent business stages that require a strategic roadmap.

- When you want to explain your complex business model.

Now, a business plan can only help achieve all those things when it offers a true and realistic overview of your business and its strategies.

Absolutely, it’s a difficult task. But with the right tools and aid, you can create a realistic plan that offers a roadmap to success for your business.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

What to Write First—Business Plan or Pitch Deck

Ideally, a business plan should be drafted before creating a pitch deck.

The business plan demands thorough analysis and research. Writing it first will encourage you to explore the business nuances in detail.

You are more in sync with your business idea and its strategies by the time you are done writing your business plan. Such understanding is essential to creating a pitch deck that reflects your startup’s potential in a true light.

A Way Forward

It’s evident that you need both—a business plan and a pitch deck, to venture successfully into your market. Instead of contemplating, let’s make business planning easier for you.

Upmetrics offers a range of AI-powered solutions for all your business and strategic planning needs.

Whether you need an AI business plan generator to create a thorough business plan or AI pitch deck generator for a compelling pitch deck—Upmetrics has got you covered.

No need to spend any more time worrying about where and how to get started. Our perfectly designed solutions will guide you to create stellar business documents in no time.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

Is a pitch deck similar to a business plan.

Not really. Business plans are textual offering a detailed overview of your business idea. Pitch decks, however, are concise and visual. It can be said that pitch decks are a byproduct of business plans. However, they are not the same.

When should you use a business plan?

Business plans should be used when you want to obtain financing from traditional banks. However, even angel investors would ask for a business plan when the funding demand is substantial. Apart from this, you use a business plan for strategic planning and internal guidance.

When should you use a pitch deck?

Pitch decks should be used to introduce your business idea to different audiences. It is extensively used to pitch potential investors and persuade them for financing.

Do I need a pitch deck or a business plan?

A business requires both a pitch deck and a business plan. It is preferable to write a business plan first before creating a pitch deck to capture the essence of your business effectively.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Get started with Upmetrics Al

- 400+ sample business plans

- Al-powered financial planning

- Collaborative workspace

Reach Your Goals with Accurate Planning

- Pitch Deck Consulting Services

Business Plan

- Investment Teaser & One pager

- Startup Financial Model

- Investor Targeting and Outreach

- Due Diligence Consulting

- Post-Investment Reporting and Communication

- Pre-seed funding services

- Seed funding for startups

- Series A funding advisory

- Industry Analysis Services

- Executive Summary Consulting

- Company Overview

- Financial Performance Analysis

- Growth Opportunities and Projections

- Management and Organizational Structure

- Business Valuation Services

- Market Research Services

- Market Entry Strategy Analysis

- Pitch Deck Design Services

- Product Demo Presentation

- Event Deck Design Services

- Digital Health

- Mental Health and Psychology

- Personalized Medicine

- Biotechnology

- Neuroscience

- Medical Technology

- Medical Devices

- Life Sciences

- Personal Care & Beauty

- Alternative Medicine

- Wellness tourism

- Mental Health

- Fitness & Sports

- Spa Economy

- Workplace Wellness

- Healthy Eating & Weight Loss

- Dietary Supplements

- Organic Food

- Confectionery

- Ingredients

- Meat, poultry & seafood

- Sports Beverages

- Soft Drinks

- Alcoholic Beverages

- Food delivery

- Fast Food & Restaurants

- Dark Kitchens

- Plant-Based Food

- Food manufacturing

- Food processing

- Food packaging

- Cannabis Wellness

- Cannabis Biotech

- Cannabis Products

- Cannabis Cultivation

- Psychedelics

- Sustainable Fashion

- Luxury Fashion

- Sustainable products

- Social Commerce

- Omnichannel Commerce

- Mobile Commerce

- Voice Commerce

- Retail Analytics

- Digital shopper engagement

- Experiential Retail

- E-Commerce Platforms

- E-commerce Marketplaces

- Marketplaces

- P2P Marketplaces

- E-concessions

- Mobile Devices

- Smart Watches

- Handmade & DYI

- Sporting Goods

- Digital Banking

- Financial Exchanges

- Personal Finance

- Consumer Lending

- Commercial Lending

- Micro Lending

- P2P Lending

- Mortgage Tech

- Cryptocurrencies

- Crowdfunding

- Impact Investing

- Angel Investment

- Hedge Funds

- Venture Capital

- Private Equity

- Robo-advice

- Industrial Real Estate

- Retail Real Estate

- Flexible Workspace

- Residential & Multifamily

- Vacation Rentals

- Student Accommodation

- Self-storage

- Retirement Living

- Real Estate Marketplaces

- Real Estate Funds

- Real Estate Developers

- Green Building

- Non-renewable energy

- Clean Energy

- Solar Energy

- Wind Energy

- Energy Efficiency

- Energy Management

- Energy Storage

- Energy Analytics and Monitoring

- Biomass Energy

- Precious Metals

- Hydroponics

- Livestock Production

- Animal Health

- Precision Livestock Farming

- Livestock Monitoring

- Horticulture

- Vertical Farming

- Sustainable Farming

- Luxury Jets

- Electric Vehicles

- Autonomous Vehicles

- Bus and Coaches

- Taxi and Private Hire

- Mobility Tech

- Last Mile Transportation

- Delivery Service

- Freight Service

- Food Delivery

- Enterprise Supply Chain Management

- Fleet Management

- Freight Technology

- Port Operations

- Warehousing

- Adventure Travel

- Luxury Travel

- Travel Logistics and Operations

- Travel Agencies

- Travel Experience Management

- VR / AR Travel

- Space Travel

- Waste Management

- Water Conservation

- Renewable Energy Tech

- Energy Efficiency Tech

- ClimateTech

- Sustainable Materials

- Green Consumer Goods

- Circular Economy

- Car Sharing

- Ride Sharing

- P2P Finance

- P2P Accommodation

- Gig Economy

- Smart Government & GovTech

- Smart Building

- Public Safety

- Smart Infrastructure

- Smart Mobility

- Smart Utilities

- Edutainment

- Video Games

- Console Games

- Online Gaming

- Mobile Gaming

- Game Marketplaces

- Fantasy Sports

- Online Gambling

- Sports Betting

- Commercial Gambling