Learn how to build a Million-Dollar Beauty Brand with Alicia Scott!

Start your dream ecommerce business in 2025 with insights from 14+ experts.

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, the complete guide to market research: what it is, why you need it, and how to do it.

Written by Mary Kate Miller | June 1, 2021

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Market research is a cornerstone of all successful, strategic businesses. It can also be daunting for entrepreneurs looking to launch a startup or start a side hustle . What is market research, anyway? And how do you…do it?

We’ll walk you through absolutely everything you need to know about the market research process so that by the end of this guide, you’ll be an expert in market research too. And what’s more important: you’ll have actionable steps you can take to start collecting your own market research.

What Is Market Research?

Market research is the organized process of gathering information about your target customers and market. Market research can help you better understand customer behavior and competitor strengths and weaknesses, as well as provide insight for the best strategies in launching new businesses and products. There are different ways to approach market research, including primary and secondary research and qualitative and quantitative research. The strongest approaches will include a combination of all four.

“Virtually every business can benefit from conducting some market research,” says Niles Koenigsberg of Real FiG Advertising + Marketing . “Market research can help you piece together your [business’s] strengths and weaknesses, along with your prospective opportunities, so that you can understand where your unique differentiators may lie.” Well-honed market research will help your brand stand out from the competition and help you see what you need to do to lead the market. It can also do so much more.

The Purposes of Market Research

Why do market research? It can help you…

- Pinpoint your target market, create buyer personas, and develop a more holistic understanding of your customer base and market.

- Understand current market conditions to evaluate risks and anticipate how your product or service will perform.

- Validate a concept prior to launch.

- Identify gaps in the market that your competitors have created or overlooked.

- Solve problems that have been left unresolved by the existing product/brand offerings.

- Identify opportunities and solutions for new products or services.

- Develop killer marketing strategies .

What Are the Benefits of Market Research?

Strong market research can help your business in many ways. It can…

- Strengthen your market position.

- Help you identify your strengths and weaknesses.

- Help you identify your competitors’ strengths and weaknesses.

- Minimize risk.

- Center your customers’ experience from the get-go.

- Help you create a dynamic strategy based on market conditions and customer needs/demands.

What Are the Basic Methods of Market Research?

The basic methods of market research include surveys, personal interviews, customer observation, and the review of secondary research. In addition to these basic methods, a forward-thinking market research approach incorporates data from the digital landscape like social media analysis, SEO research, gathering feedback via forums, and more. Throughout this guide, we will cover each of the methods commonly used in market research to give you a comprehensive overview.

Primary vs. Secondary Market Research

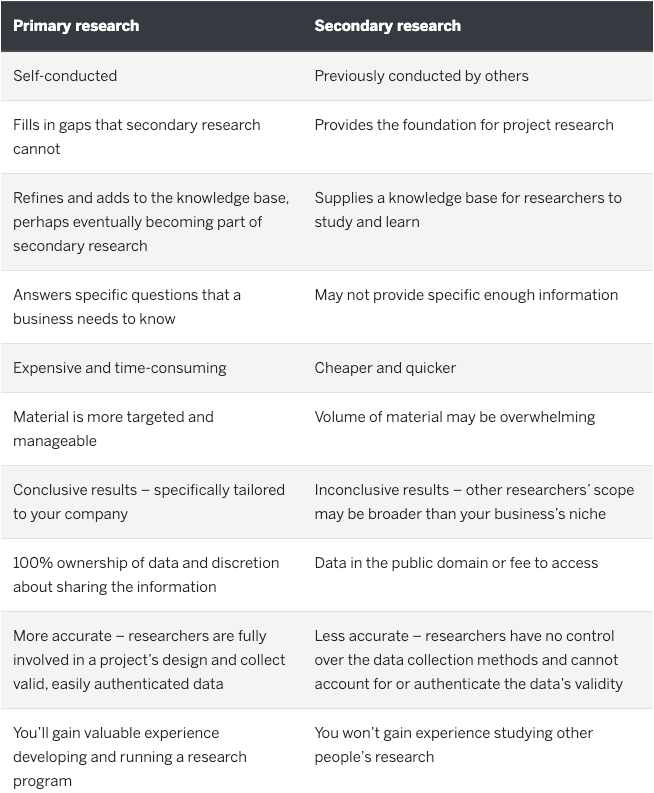

Primary and secondary are the two main types of market research you can do. The latter relies on research conducted by others. Primary research, on the other hand, refers to the fact-finding efforts you conduct on your own.

This approach is limited, however. It’s likely that the research objectives of these secondary data points differ from your own, and it can be difficult to confirm the veracity of their findings.

Primary Market Research

Primary research is more labor intensive, but it generally yields data that is exponentially more actionable. It can be conducted through interviews, surveys, online research, and your own data collection. Every new business should engage in primary market research prior to launch. It will help you validate that your idea has traction, and it will give you the information you need to help minimize financial risk.

You can hire an agency to conduct this research on your behalf. This brings the benefit of expertise, as you’ll likely work with a market research analyst. The downside is that hiring an agency can be expensive—too expensive for many burgeoning entrepreneurs. That brings us to the second approach. You can also do the market research yourself, which substantially reduces the financial burden of starting a new business .

Secondary Market Research

Secondary research includes resources like government databases and industry-specific data and publications. It can be beneficial to start your market research with secondary sources because it’s widely available and often free-to-access. This information will help you gain a broad overview of the market conditions for your new business.

Identify Your Goals and Your Audience

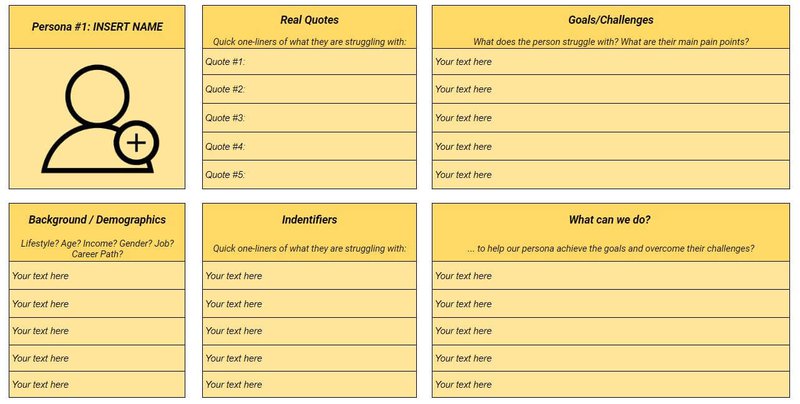

Before you begin conducting interviews or sending out surveys, you need to set your market research goals. At the end of your market research process, you want to have a clear idea of who your target market is—including demographic information like age, gender, and where they live—but you also want to start with a rough idea of who your audience might be and what you’re trying to achieve with market research.

You can pinpoint your objectives by asking yourself a series of guiding questions:

- What are you hoping to discover through your research?

- Who are you hoping to serve better because of your findings?

- What do you think your market is?

- Who are your competitors?

- Are you testing the reception of a new product category or do you want to see if your product or service solves the problem left by a current gap in the market?

- Are you just…testing the waters to get a sense of how people would react to a new brand?

Once you’ve narrowed down the “what” of your market research goals, you’re ready to move onto how you can best achieve them. Think of it like algebra. Many math problems start with “solve for x.” Once you know what you’re looking for, you can get to work trying to find it. It’s a heck of a lot easier to solve a problem when you know you’re looking for “x” than if you were to say “I’m gonna throw some numbers out there and see if I find a variable.”

How to Do Market Research

This guide outlines every component of a comprehensive market research effort. Take into consideration the goals you have established for your market research, as they will influence which of these elements you’ll want to include in your market research strategy.

Secondary Data

Secondary data allows you to utilize pre-existing data to garner a sense of market conditions and opportunities. You can rely on published market studies, white papers, and public competitive information to start your market research journey.

Secondary data, while useful, is limited and cannot substitute your own primary data. It’s best used for quantitative data that can provide background to your more specific inquiries.

Find Your Customers Online

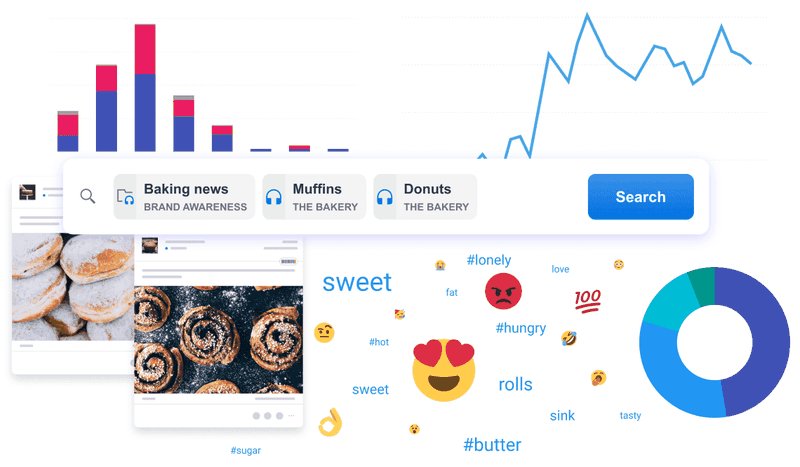

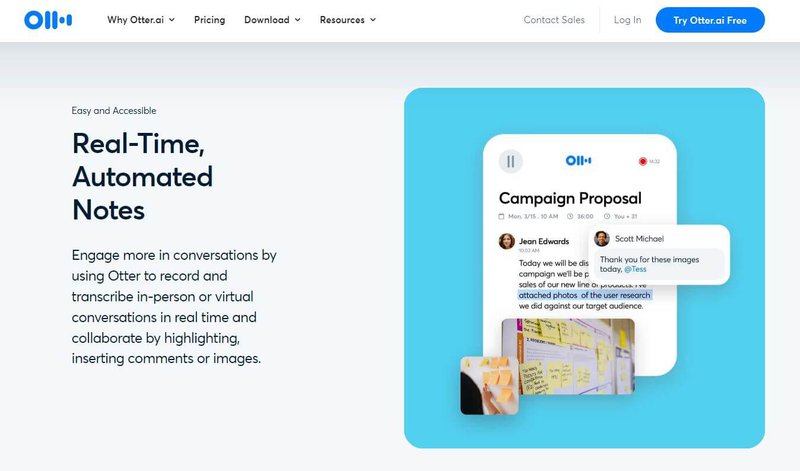

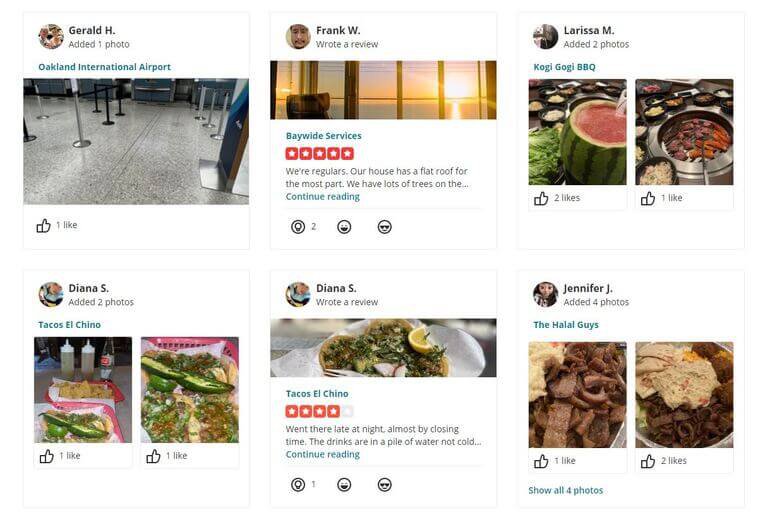

Once you’ve identified your target market, you can use online gathering spaces and forums to gain insights and give yourself a competitive advantage. Rebecca McCusker of The Creative Content Shop recommends internet recon as a vital tool for gaining a sense of customer needs and sentiment. “Read their posts and comments on forums, YouTube video comments, Facebook group [comments], and even Amazon/Goodreads book comments to get in their heads and see what people are saying.”

If you’re interested in engaging with your target demographic online, there are some general rules you should follow. First, secure the consent of any group moderators to ensure that you are acting within the group guidelines. Failure to do so could result in your eviction from the group.

Not all comments have the same research value. “Focus on the comments and posts with the most comments and highest engagement,” says McCusker. These high-engagement posts can give you a sense of what is already connecting and gaining traction within the group.

Social media can also be a great avenue for finding interview subjects. “LinkedIn is very useful if your [target customer] has a very specific job or works in a very specific industry or sector. It’s amazing the amount of people that will be willing to help,” explains Miguel González, a marketing executive at Dealers League . “My advice here is BE BRAVE, go to LinkedIn, or even to people you know and ask them, do quick interviews and ask real people that belong to that market and segment and get your buyer persona information first hand.”

Market research interviews can provide direct feedback on your brand, product, or service and give you a better understanding of consumer pain points and interests.

When organizing your market research interviews, you want to pay special attention to the sample group you’re selecting, as it will directly impact the information you receive. According to Tanya Zhang, the co-founder of Nimble Made , you want to first determine whether you want to choose a representative sample—for example, interviewing people who match each of the buyer persona/customer profiles you’ve developed—or a random sample.

“A sampling of your usual persona styles, for example, can validate details that you’ve already established about your product, while a random sampling may [help you] discover a new way people may use your product,” Zhang says.

Market Surveys

Market surveys solicit customer inclinations regarding your potential product or service through a series of open-ended questions. This direct outreach to your target audience can provide information on your customers’ preferences, attitudes, buying potential, and more.

Every expert we asked voiced unanimous support for market surveys as a powerful tool for market research. With the advent of various survey tools with accessible pricing—or free use—it’s never been easier to assemble, disseminate, and gather market surveys. While it should also be noted that surveys shouldn’t replace customer interviews , they can be used to supplement customer interviews to give you feedback from a broader audience.

Who to Include in Market Surveys

- Current customers

- Past customers

- Your existing audience (such as social media/newsletter audiences)

Example Questions to Include in Market Surveys

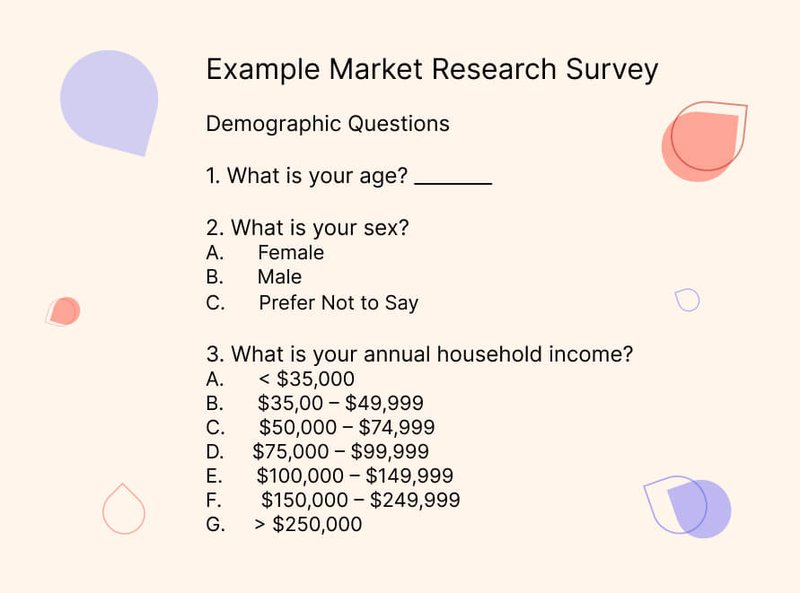

While the exact questions will vary for each business, here are some common, helpful questions that you may want to consider for your market survey. Demographic Questions: the questions that help you understand, demographically, who your target customers are:

- “What is your age?”

- “Where do you live?”

- “What is your gender identity?”

- “What is your household income?”

- “What is your household size?”

- “What do you do for a living?”

- “What is your highest level of education?”

Product-Based Questions: Whether you’re seeking feedback for an existing brand or an entirely new one, these questions will help you get a sense of how people feel about your business, product, or service:

- “How well does/would our product/service meet your needs?”

- “How does our product/service compare to similar products/services that you use?”

- “How long have you been a customer?” or “What is the likelihood that you would be a customer of our brand?

Personal/Informative Questions: the deeper questions that help you understand how your audience thinks and what they care about.

- “What are your biggest challenges?”

- “What’s most important to you?”

- “What do you do for fun (hobbies, interests, activities)?”

- “Where do you seek new information when researching a new product?”

- “How do you like to make purchases?”

- “What is your preferred method for interacting with a brand?”

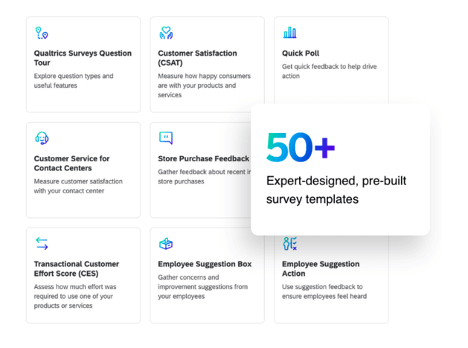

Survey Tools

Online survey tools make it easy to distribute surveys and collect responses. The best part is that there are many free tools available. If you’re making your own online survey, you may want to consider SurveyMonkey, Typeform, Google Forms, or Zoho Survey.

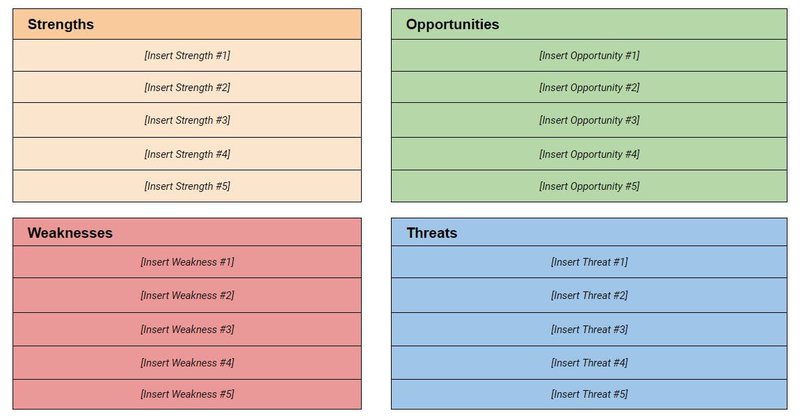

Competitive Analysis

A competitive analysis is a breakdown of how your business stacks up against the competition. There are many different ways to conduct this analysis. One of the most popular methods is a SWOT analysis, which stands for “strengths, weaknesses, opportunities, and threats.” This type of analysis is helpful because it gives you a more robust understanding of why a customer might choose a competitor over your business. Seeing how you stack up against the competition can give you the direction you need to carve out your place as a market leader.

Social Media Analysis

Social media has fundamentally changed the market research landscape, making it easier than ever to engage with a wide swath of consumers. Follow your current or potential competitors on social media to see what they’re posting and how their audience is engaging with it. Social media can also give you a lower cost opportunity for testing different messaging and brand positioning.

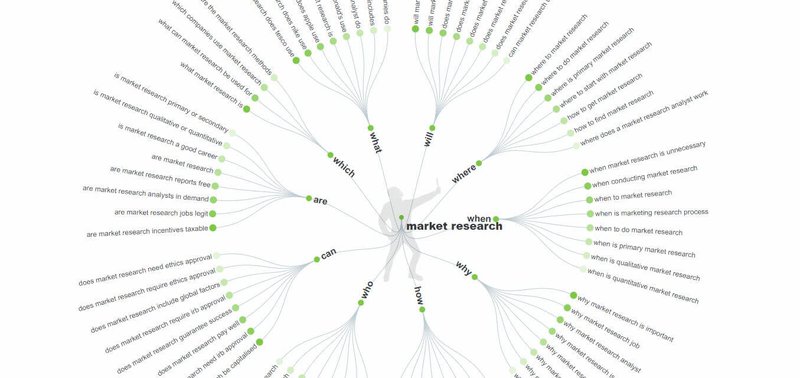

SEO Analysis and Opportunities

SEO analysis can help you identify the digital competition for getting the word out about your brand, product, or service. You won’t want to overlook this valuable information. Search listening tools offer a novel approach to understanding the market and generating the content strategy that will drive business. Tools like Google Trends and Awario can streamline this process.

Ready to Kick Your Business Into High Gear?

Now that you’ve completed the guide to market research you know you’re ready to put on your researcher hat to give your business the best start. Still not sure how actually… launch the thing? Our free mini-course can run you through the essentials for starting your side hustle .

About Mary Kate Miller

Mary Kate Miller writes about small business, real estate, and finance. In addition to writing for Foundr, her work has been published by The Washington Post, Teen Vogue, Bustle, and more. She lives in Chicago.

Related Posts

7 Steps to Finding Your Brand Tone of Voice

5 Ways to Leverage Customer Reviews to Increase Sales

Brand Authenticity: How User-Generated Content Can Give You a Much-Needed Boost

5 Ways Personalization in eCommerce Can Enhance Customer Experience

Engaging Your Audience with Social Media Quizzes and Polls

Email Marketing Automation: Tools and Strategies for 2024

How to Find Influencers: 6 Ways to Discover Your Perfect Brand Advocate

How to Create a Marketing Plan In 2024 (Template + Examples)

What Is UGC and Why It’s a Must-Have for Your Brand

Ad Expert Phoenix Ha on How to Make Creative Ads without Breaking Your Budget

14 Punchy TikTok Marketing Strategies to Amplify Your Growth

How to Grow Your YouTube Channel and Gain Subscribers Quickly

How to Get More Views on Snapchat with These 12 Tactics

12 Instagram Growth Hacks For More Engaged Followers (Without Running Ads)

Create Viral Infographics That Boost Your Organic Traffic

Accelerate Your Ecommerce Journey for Just $1

Step-by-Step Guidance from World-Class Entrepreneurs to Build, Grow, and Scale Your Ecommerce Brand

TIME IS RUNNING OUT TO BUILD YOUR DREAM ECOMMERCE BUSINESS I N 2025! Join 14+ ecommerce trailblazers

Starting Dec 15th at 4PM New York (US Eastern) / 8AM Melbourne (AEDT)

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- Product Demos

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

Market research definition

Market research – in-house or outsourced, market research in the age of data, when to use market research.

- Types of market research

Different types of primary research

How to do market research (primary data), how to do secondary market research, communicating your market research findings, choose the right platform for your market research, try qualtrics for free, the ultimate guide to market research: how to conduct it like a pro.

27 min read Wondering how to do market research? Or even where to start learning about it? Use our ultimate guide to understand the basics and discover how you can use market research to help your business.

Market research is the practice of gathering information about the needs and preferences of your target audience – potential consumers of your product.

When you understand how your target consumer feels and behaves, you can then take steps to meet their needs and mitigate the risk of an experience gap – where there is a shortfall between what a consumer expects you to deliver and what you actually deliver. Market research can also help you keep abreast of what your competitors are offering, which in turn will affect what your customers expect from you.

Market research connects with every aspect of a business – including brand , product , customer service , marketing and sales.

Market research generally focuses on understanding:

- The consumer (current customers, past customers, non-customers, influencers))

- The company (product or service design, promotion, pricing, placement, service, sales)

- The competitors (and how their market offerings interact in the market environment)

- The industry overall (whether it’s growing or moving in a certain direction)

Free eBook: This Year’s Global Market Research Trends Report

Why is market research important?

A successful business relies on understanding what like, what they dislike, what they need and what messaging they will respond to. Businesses also need to understand their competition to identify opportunities to differentiate their products and services from other companies.

Today’s business leaders face an endless stream of decisions around target markets, pricing, promotion, distribution channels, and product features and benefits . They must account for all the factors involved, and there are market research studies and methodologies strategically designed to capture meaningful data to inform every choice. It can be a daunting task.

Market research allows companies to make data-driven decisions to drive growth and innovation.

What happens when you don’t do market research?

Without market research, business decisions are based at best on past consumer behavior, economic indicators, or at worst, on gut feel. Decisions are made in a bubble without thought to what the competition is doing. An important aim of market research is to remove subjective opinions when making business decisions. As a brand you are there to serve your customers, not personal preferences within the company. You are far more likely to be successful if you know the difference, and market research will help make sure your decisions are insight-driven.

Traditionally there have been specialist market researchers who are very good at what they do, and businesses have been reliant on their ability to do it. Market research specialists will always be an important part of the industry, as most brands are limited by their internal capacity, expertise and budgets and need to outsource at least some aspects of the work.

However, the market research external agency model has meant that brands struggled to keep up with the pace of change. Their customers would suffer because their needs were not being wholly met with point-in-time market research.

Businesses looking to conduct market research have to tackle many questions –

- Who are my consumers, and how should I segment and prioritize them?

- What are they looking for within my category?

- How much are they buying, and what are their purchase triggers, barriers, and buying habits?

- Will my marketing and communications efforts resonate?

- Is my brand healthy ?

- What product features matter most?

- Is my product or service ready for launch?

- Are my pricing and packaging plans optimized?

They all need to be answered, but many businesses have found the process of data collection daunting, time-consuming and expensive. The hardest battle is often knowing where to begin and short-term demands have often taken priority over longer-term projects that require patience to offer return on investment.

Today however, the industry is making huge strides, driven by quickening product cycles, tighter competition and business imperatives around more data-driven decision making. With the emergence of simple, easy to use tools , some degree of in-house market research is now seen as essential, with fewer excuses not to use data to inform your decisions. With greater accessibility to such software, everyone can be an expert regardless of level or experience.

How is this possible?

The art of research hasn’t gone away. It is still a complex job and the volume of data that needs to be analyzed is huge. However with the right tools and support, sophisticated research can look very simple – allowing you to focus on taking action on what matters.

If you’re not yet using technology to augment your in-house market research, now is the time to start.

The most successful brands rely on multiple sources of data to inform their strategy and decision making, from their marketing segmentation to the product features they develop to comments on social media. In fact, there’s tools out there that use machine learning and AI to automate the tracking of what’s people are saying about your brand across all sites.

The emergence of newer and more sophisticated tools and platforms gives brands access to more data sources than ever and how the data is analyzed and used to make decisions. This also increases the speed at which they operate, with minimal lead time allowing brands to be responsive to business conditions and take an agile approach to improvements and opportunities.

Expert partners have an important role in getting the best data, particularly giving access to additional market research know-how, helping you find respondents , fielding surveys and reporting on results.

How do you measure success?

Business activities are usually measured on how well they deliver return on investment (ROI). Since market research doesn’t generate any revenue directly, its success has to be measured by looking at the positive outcomes it drives – happier customers, a healthier brand, and so on.

When changes to your products or your marketing strategy are made as a result of your market research findings, you can compare on a before-and-after basis to see if the knowledge you acted on has delivered value.

Regardless of the function you work within, understanding the consumer is the goal of any market research. To do this, we have to understand what their needs are in order to effectively meet them. If we do that, we are more likely to drive customer satisfaction , and in turn, increase customer retention .

Several metrics and KPIs are used to gauge the success of decisions made from market research results, including

- Brand awareness within the target market

- Share of wallet

- CSAT (customer satisfaction)

- NPS (Net Promoter Score)

You can use market research for almost anything related to your current customers, potential customer base or target market. If you want to find something out from your target audience, it’s likely market research is the answer.

Here are a few of the most common uses:

Buyer segmentation and profiling

Segmentation is a popular technique that separates your target market according to key characteristics, such as behavior, demographic information and social attitudes. Segmentation allows you to create relevant content for your different segments, ideally helping you to better connect with all of them.

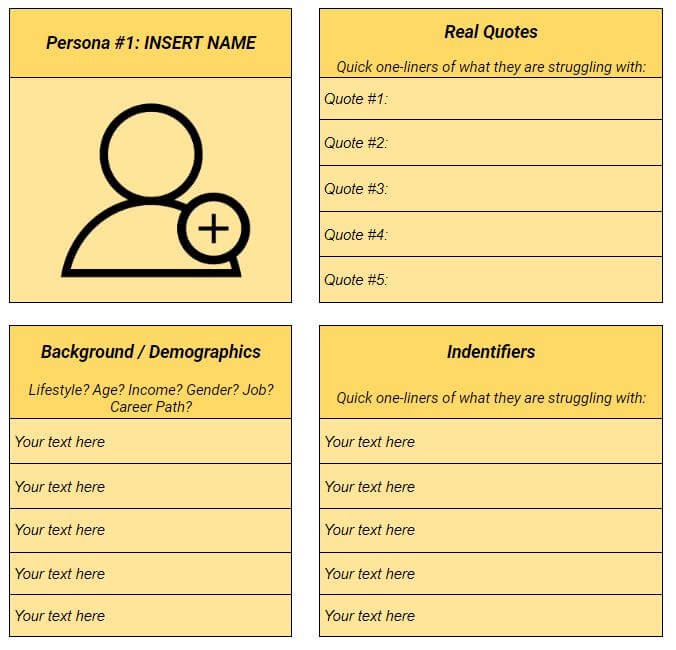

Buyer personas are profiles of fictional customers – with real attributes. Buyer personas help you develop products and communications that are right for your different audiences, and can also guide your decision-making process. Buyer personas capture the key characteristics of your customer segments, along with meaningful insights about what they want or need from you. They provide a powerful reminder of consumer attitudes when developing a product or service, a marketing campaign or a new brand direction.

By understanding your buyers and potential customers, including their motivations, needs, and pain points, you can optimize everything from your marketing communications to your products to make sure the right people get the relevant content, at the right time, and via the right channel .

Attitudes and Usage surveys

Attitude & Usage research helps you to grow your brand by providing a detailed understanding of consumers. It helps you understand how consumers use certain products and why, what their needs are, what their preferences are, and what their pain points are. It helps you to find gaps in the market, anticipate future category needs, identify barriers to entry and build accurate go-to-market strategies and business plans.

Marketing strategy

Effective market research is a crucial tool for developing an effective marketing strategy – a company’s plan for how they will promote their products.

It helps marketers look like rock stars by helping them understand the target market to avoid mistakes, stay on message, and predict customer needs . It’s marketing’s job to leverage relevant data to reach the best possible solution based on the research available. Then, they can implement the solution, modify the solution, and successfully deliver that solution to the market.

Product development

You can conduct market research into how a select group of consumers use and perceive your product – from how they use it through to what they like and dislike about it. Evaluating your strengths and weaknesses early on allows you to focus resources on ideas with the most potential and to gear your product or service design to a specific market.

Chobani’s yogurt pouches are a product optimized through great market research . Using product concept testing – a form of market research – Chobani identified that packaging could negatively impact consumer purchase decisions. The brand made a subtle change, ensuring the item satisfied the needs of consumers. This ability to constantly refine its products for customer needs and preferences has helped Chobani become Australia’s #1 yogurt brand and increase market share.

Pricing decisions

Market research provides businesses with insights to guide pricing decisions too. One of the most powerful tools available to market researchers is conjoint analysis, a form of market research study that uses choice modeling to help brands identify the perfect set of features and price for customers. Another useful tool is the Gabor-Granger method, which helps you identify the highest price consumers are willing to pay for a given product or service.

Brand tracking studies

A company’s brand is one of its most important assets. But unlike other metrics like product sales, it’s not a tangible measure you can simply pull from your system. Regular market research that tracks consumer perceptions of your brand allows you to monitor and optimize your brand strategy in real time, then respond to consumer feedback to help maintain or build your brand with your target customers.

Advertising and communications testing

Advertising campaigns can be expensive, and without pre-testing, they carry risk of falling flat with your target audience. By testing your campaigns, whether it’s the message or the creative, you can understand how consumers respond to your communications before you deploy them so you can make changes in response to consumer feedback before you go live.

Finder, which is one of the world’s fastest-growing online comparison websites, is an example of a brand using market research to inject some analytical rigor into the business. Fueled by great market research, the business lifted brand awareness by 23 percent, boosted NPS by 8 points, and scored record profits – all within 10 weeks.

Competitive analysis

Another key part of developing the right product and communications is understanding your main competitors and how consumers perceive them. You may have looked at their websites and tried out their product or service, but unless you know how consumers perceive them, you won’t have an accurate view of where you stack up in comparison. Understanding their position in the market allows you to identify the strengths you can exploit, as well as any weaknesses you can address to help you compete better.

Customer Story

See How Yamaha Does Product Research

Types of market research

Although there are many types market research, all methods can be sorted into one of two categories: primary and secondary.

Primary research

Primary research is market research data that you collect yourself. This is raw data collected through a range of different means – surveys , focus groups, , observation and interviews being among the most popular.

Primary information is fresh, unused data, giving you a perspective that is current or perhaps extra confidence when confirming hypotheses you already had. It can also be very targeted to your exact needs. Primary information can be extremely valuable. Tools for collecting primary information are increasingly sophisticated and the market is growing rapidly.

Historically, conducting market research in-house has been a daunting concept for brands because they don’t quite know where to begin, or how to handle vast volumes of data. Now, the emergence of technology has meant that brands have access to simple, easy to use tools to help with exactly that problem. As a result, brands are more confident about their own projects and data with the added benefit of seeing the insights emerge in real-time.

Secondary research

Secondary research is the use of data that has already been collected, analyzed and published – typically it’s data you don’t own and that hasn’t been conducted with your business specifically in mind, although there are forms of internal secondary data like old reports or figures from past financial years that come from within your business. Secondary research can be used to support the use of primary research.

Secondary research can be beneficial to small businesses because it is sometimes easier to obtain, often through research companies. Although the rise of primary research tools are challenging this trend by allowing businesses to conduct their own market research more cheaply, secondary research is often a cheaper alternative for businesses who need to spend money carefully. Some forms of secondary research have been described as ‘lean market research’ because they are fast and pragmatic, building on what’s already there.

Because it’s not specific to your business, secondary research may be less relevant, and you’ll need to be careful to make sure it applies to your exact research question. It may also not be owned, which means your competitors and other parties also have access to it.

Primary or secondary research – which to choose?

Both primary and secondary research have their advantages, but they are often best used when paired together, giving you the confidence to act knowing that the hypothesis you have is robust.

Secondary research is sometimes preferred because there is a misunderstanding of the feasibility of primary research. Thanks to advances in technology, brands have far greater accessibility to primary research, but this isn’t always known.

If you’ve decided to gather your own primary information, there are many different data collection methods that you may consider. For example:

- Customer surveys

- Focus groups

- Observation

Think carefully about what you’re trying to accomplish before picking the data collection method(s) you’re going to use. Each one has its pros and cons. Asking someone a simple, multiple-choice survey question will generate a different type of data than you might obtain with an in-depth interview. Determine if your primary research is exploratory or specific, and if you’ll need qualitative research, quantitative research, or both.

Qualitative vs quantitative

Another way of categorizing different types of market research is according to whether they are qualitative or quantitative.

Qualitative research

Qualitative research is the collection of data that is non-numerical in nature. It summarizes and infers, rather than pin-points an exact truth. It is exploratory and can lead to the generation of a hypothesis.

Market research techniques that would gather qualitative data include:

- Interviews (face to face / telephone)

- Open-ended survey questions

Researchers use these types of market research technique because they can add more depth to the data. So for example, in focus groups or interviews, rather than being limited to ‘yes’ or ‘no’ for a certain question, you can start to understand why someone might feel a certain way.

Quantitative research

Quantitative research is the collection of data that is numerical in nature. It is much more black and white in comparison to qualitative data, although you need to make sure there is a representative sample if you want the results to be reflective of reality.

Quantitative researchers often start with a hypothesis and then collect data which can be used to determine whether empirical evidence to support that hypothesis exists.

Quantitative research methods include:

- Questionnaires

- Review scores

Exploratory and specific research

Exploratory research is the approach to take if you don’t know what you don’t know. It can give you broad insights about your customers, product, brand, and market. If you want to answer a specific question, then you’ll be conducting specific research.

- Exploratory . This research is general and open-ended, and typically involves lengthy interviews with an individual or small focus group.

- Specific . This research is often used to solve a problem identified in exploratory research. It involves more structured, formal interviews.

Exploratory primary research is generally conducted by collecting qualitative data. Specific research usually finds its insights through quantitative data.

Primary research can be qualitative or quantitative, large-scale or focused and specific. You’ll carry it out using methods like surveys – which can be used for both qualitative and quantitative studies – focus groups, observation of consumer behavior, interviews, or online tools.

Step 1: Identify your research topic

Research topics could include:

- Product features

- Product or service launch

- Understanding a new target audience (or updating an existing audience)

- Brand identity

- Marketing campaign concepts

- Customer experience

Step 2: Draft a research hypothesis

A hypothesis is the assumption you’re starting out with. Since you can disprove a negative much more easily than prove a positive, a hypothesis is a negative statement such as ‘price has no effect on brand perception’.

Step 3: Determine which research methods are most effective

Your choice of methods depends on budget, time constraints, and the type of question you’re trying to answer. You could combine surveys, interviews and focus groups to get a mix of qualitative and quantitative data.

Step 4: Determine how you will collect and analyze your data.

Primary research can generate a huge amount of data, and when the goal is to uncover actionable insight, it can be difficult to know where to begin or what to pay attention to.

The rise in brands taking their market research and data analysis in-house has coincided with the rise of technology simplifying the process. These tools pull through large volumes of data and outline significant information that will help you make the most important decisions.

Step 5: Conduct your research!

This is how you can run your research using Qualtrics CoreXM

- Pre-launch – Here you want to ensure that the survey/ other research methods conform to the project specifications (what you want to achieve/research)

- Soft launch – Collect a small fraction of the total data before you fully launch. This means you can check that everything is working as it should and you can correct any data quality issues.

- Full launch – You’ve done the hard work to get to this point. If you’re using a tool, you can sit back and relax, or if you get curious you can check on the data in your account.

- Review – review your data for any issues or low-quality responses. You may need to remove this in order not to impact the analysis of the data.

A helping hand

If you are missing the skills, capacity or inclination to manage your research internally, Qualtrics Research Services can help. From design, to writing the survey based on your needs, to help with survey programming, to handling the reporting, Research Services acts as an extension of the team and can help wherever necessary.

Secondary market research can be taken from a variety of places. Some data is completely free to access – other information could end up costing hundreds of thousands of dollars. There are three broad categories of secondary research sources:

- Public sources – these sources are accessible to anyone who asks for them. They include census data, market statistics, library catalogs, university libraries and more. Other organizations may also put out free data from time to time with the goal of advancing a cause, or catching people’s attention.

- Internal sources – sometimes the most valuable sources of data already exist somewhere within your organization. Internal sources can be preferable for secondary research on account of their price (free) and unique findings. Since internal sources are not accessible by competitors, using them can provide a distinct competitive advantage.

- Commercial sources – if you have money for it, the easiest way to acquire secondary market research is to simply buy it from private companies. Many organizations exist for the sole purpose of doing market research and can provide reliable, in-depth, industry-specific reports.

No matter where your research is coming from, it is important to ensure that the source is reputable and reliable so you can be confident in the conclusions you draw from it.

How do you know if a source is reliable?

Use established and well-known research publishers, such as the XM Institute , Forrester and McKinsey . Government websites also publish research and this is free of charge. By taking the information directly from the source (rather than a third party) you are minimizing the risk of the data being misinterpreted and the message or insights being acted on out of context.

How to apply secondary research

The purpose and application of secondary research will vary depending on your circumstances. Often, secondary research is used to support primary research and therefore give you greater confidence in your conclusions. However, there may be circumstances that prevent this – such as the timeframe and budget of the project.

Keep an open mind when collecting all the relevant research so that there isn’t any collection bias. Then begin analyzing the conclusions formed to see if any trends start to appear. This will help you to draw a consensus from the secondary research overall.

Market research success is defined by the impact it has on your business’s success. Make sure it’s not discarded or ignored by communicating your findings effectively. Here are some tips on how to do it.

- Less is more – Preface your market research report with executive summaries that highlight your key discoveries and their implications

- Lead with the basic information – Share the top 4-5 recommendations in bullet-point form, rather than requiring your readers to go through pages of analysis and data

- Model the impact – Provide examples and model the impact of any changes you put in place based on your findings

- Show, don’t tell – Add illustrative examples that relate directly to the research findings and emphasize specific points

- Speed is of the essence – Make data available in real-time so it can be rapidly incorporated into strategies and acted upon to maximize value

- Work with experts – Make sure you’ve access to a dedicated team of experts ready to help you design and launch successful projects

Trusted by 8,500 brands for everything from product testing to competitor analysis, Our Strategic Research software is the world’s most powerful and flexible research platform . With over 100 question types and advanced logic, you can build out your surveys and see real-time data you can share across the organization. Plus, you’ll be able to turn data into insights with iQ, our predictive intelligence engine that runs complicated analysis at the click of a button.

Free eBook: This Year's Global Market Research Trends Report

Related resources

Mixed methods research 17 min read, market intelligence 10 min read, marketing insights 11 min read, ethnographic research 11 min read, qualitative vs quantitative research 13 min read, primary vs secondary research 14 min read, business research methods 12 min read, request demo.

Ready to learn more about Qualtrics?

How to do market research: The complete guide for your brand

Written by by Jacqueline Zote

Published on April 13, 2023

Reading time 10 minutes

Blindly putting out content or products and hoping for the best is a thing of the past. Not only is it a waste of time and energy, but you’re wasting valuable marketing dollars in the process. Now you have a wealth of tools and data at your disposal, allowing you to develop data-driven marketing strategies . That’s where market research comes in, allowing you to uncover valuable insights to inform your business decisions.

Conducting market research not only helps you better understand how to sell to customers but also stand out from your competition. In this guide, we break down everything you need to know about market research and how doing your homework can help you grow your business.

Table of contents:

What is market research?

Why is market research important, types of market research, where to conduct market research.

- Steps for conducting market research

- Tools to use for market research

Market research is the process of gathering information surrounding your business opportunities. It identifies key information to better understand your audience. This includes insights related to customer personas and even trends shaping your industry.

Taking time out of your schedule to conduct research is crucial for your brand health. Here are some of the key benefits of market research:

Understand your customers’ motivations and pain points

Most marketers are out of touch with what their customers want. Moreover, these marketers are missing key information on what products their audience wants to buy.

Simply put, you can’t run a business if you don’t know what motivates your customers.

And spoiler alert: Your customers’ wants and needs change. Your customers’ behaviors today might be night and day from what they were a few years ago.

Market research holds the key to understanding your customers better. It helps you uncover their key pain points and motivations and understand how they shape their interests and behavior.

Figure out how to position your brand

Positioning is becoming increasingly important as more and more brands enter the marketplace. Market research enables you to spot opportunities to define yourself against your competitors.

Maybe you’re able to emphasize a lower price point. Perhaps your product has a feature that’s one of a kind. Finding those opportunities goes hand in hand with researching your market.

Maintain a strong pulse on your industry at large

Today’s marketing world evolves at a rate that’s difficult to keep up with.

Fresh products. Up-and-coming brands. New marketing tools. Consumers get bombarded with sales messages from all angles. This can be confusing and overwhelming.

By monitoring market trends, you can figure out the best tactics for reaching your target audience.

Not everyone conducts market research for the same reason. While some may want to understand their audience better, others may want to see how their competitors are doing. As such, there are different types of market research you can conduct depending on your goal.

Interview-based market research allows for one-on-one interactions. This helps the conversation to flow naturally, making it easier to add context. Whether this takes place in person or virtually, it enables you to gather more in-depth qualitative data.

Buyer persona research

Buyer persona research lets you take a closer look at the people who make up your target audience. You can discover the needs, challenges and pain points of each buyer persona to understand what they need from your business. This will then allow you to craft products or campaigns to resonate better with each persona.

Pricing research

In this type of research, brands compare similar products or services with a particular focus on pricing. They look at how much those products or services typically sell for so they can get more competitive with their pricing strategy.

Competitive analysis research

Competitor analysis gives you a realistic understanding of where you stand in the market and how your competitors are doing. You can use this analysis to find out what’s working in your industry and which competitors to watch out for. It even gives you an idea of how well those competitors are meeting consumer needs.

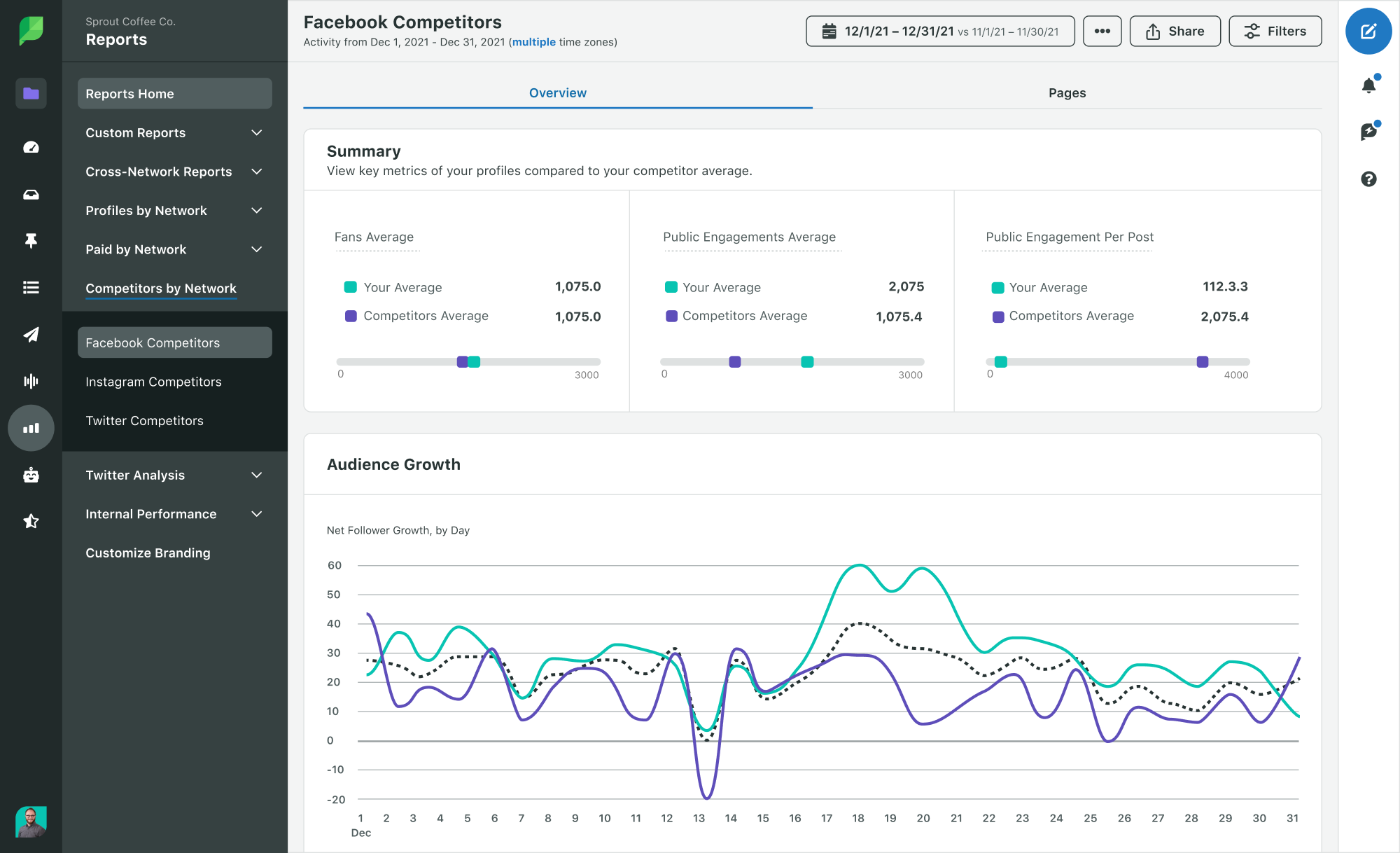

Depending on the competitor analysis tool you use, you can get as granular as you need with your research. For instance, Sprout Social lets you analyze your competitors’ social strategies. You can see what types of content they’re posting and even benchmark your growth against theirs.

Brand awareness research

Conducting brand awareness research allows you to assess your brand’s standing in the market. It tells you how well-known your brand is among your target audience and what they associate with it. This can help you gauge people’s sentiments toward your brand and whether you need to rebrand or reposition.

If you don’t know where to start with your research, you’re in the right place.

There’s no shortage of market research methods out there. In this section, we’ve highlighted research channels for small and big businesses alike.

Considering that Google sees a staggering 8.5 billion searches each day, there’s perhaps no better place to start.

A quick Google search is a potential goldmine for all sorts of questions to kick off your market research. Who’s ranking for keywords related to your industry? Which products and pieces of content are the hottest right now? Who’s running ads related to your business?

For example, Google Product Listing Ads can help highlight all of the above for B2C brands.

The same applies to B2B brands looking to keep tabs on who’s running industry-related ads and ranking for keyword terms too.

There’s no denying that email represents both an aggressive and effective marketing channel for marketers today. Case in point, 44% of online shoppers consider email as the most influential channel in their buying decisions.

Looking through industry and competitor emails is a brilliant way to learn more about your market. For example, what types of offers and deals are your competitors running? How often are they sending emails?

Email is also invaluable for gathering information directly from your customers. This survey message from Asana is a great example of how to pick your customers’ brains to figure out how you can improve your quality of service.

Industry journals, reports and blogs

Don’t neglect the importance of big-picture market research when it comes to tactics and marketing channels to explore. Look to marketing resources such as reports and blogs as well as industry journals

Keeping your ear to the ground on new trends and technologies is a smart move for any business. Sites such as Statista, Marketing Charts, AdWeek and Emarketer are treasure troves of up-to-date data and news for marketers.

And of course, there’s the Sprout Insights blog . And invaluable resources like The Sprout Social Index™ can keep you updated on the latest social trends.

Social media

If you want to learn more about your target market, look no further than social media. Social offers a place to discover what your customers want to see in future products or which brands are killin’ it. In fact, social media is become more important for businesses than ever with the level of data available.

It represents a massive repository of real-time data and insights that are instantly accessible. Brand monitoring and social listening are effective ways to conduct social media research . You can even be more direct with your approach. Ask questions directly or even poll your audience to understand their needs and preferences.

The 5 steps for how to do market research

Now that we’ve covered the why and where, it’s time to get into the practical aspects of market research. Here are five essential steps on how to do market research effectively.

Step 1: Identify your research topic

First off, what are you researching about? What do you want to find out? Narrow down on a specific research topic so you can start with a clear idea of what to look for.

For example, you may want to learn more about how well your product features are satisfying the needs of existing users. This might potentially lead to feature updates and improvements. Or it might even result in new feature introductions.

Similarly, your research topic may be related to your product or service launch or customer experience. Or you may want to conduct research for an upcoming marketing campaign.

Step 2: Choose a buyer persona to engage

If you’re planning to focus your research on a specific type of audience, decide which buyer persona you want to engage. This persona group will serve as a representative sample of your target audience.

Engaging a specific group of audience lets you streamline your research efforts. As such, it can be a much more effective and organized approach than researching thousands (if not millions) of individuals.

You may be directing your research toward existing users of your product. To get even more granular, you may want to focus on users who have been familiar with the product for at least a year, for example.

Step 3: Start collecting data

The next step is one of the most critical as it involves collecting the data you need for your research. Before you begin, make sure you’ve chosen the right research methods that will uncover the type of data you need. This largely depends on your research topic and goals.

Remember that you don’t necessarily have to stick to one research method. You may use a combination of qualitative and quantitative approaches. So for example, you could use interviews to supplement the data from your surveys. Or you may stick to insights from your social listening efforts.

To keep things consistent, let’s look at this in the context of the example from earlier. Perhaps you can send out a survey to your existing users asking them a bunch of questions. This might include questions like which features they use the most and how often they use them. You can get them to choose an answer from one to five and collect quantitative data.

Plus, for qualitative insights, you could even include a few open-ended questions with the option to write their answers. For instance, you might ask them if there’s any improvement they wish to see in your product.

Step 4: Analyze results

Once you have all the data you need, it’s time to analyze it keeping your research topic in mind. This involves trying to interpret the data to look for a wider meaning, particularly in relation to your research goal.

So let’s say a large percentage of responses were four or five in the satisfaction rating. This means your existing users are mostly satisfied with your current product features. On the other hand, if the responses were mostly ones and twos, you may look for opportunities to improve. The responses to your open-ended questions can give you further context as to why people are disappointed.

Step 5: Make decisions for your business

Now it’s time to take your findings and turn them into actionable insights for your business. In this final step, you need to decide how you want to move forward with your new market insight.

What did you find in your research that would require action? How can you put those findings to good use?

The market research tools you should be using

To wrap things up, let’s talk about the various tools available to conduct speedy, in-depth market research. These tools are essential for conducting market research faster and more efficiently.

Social listening and analytics

Social analytics tools like Sprout can help you keep track of engagement across social media. This goes beyond your own engagement data but also includes that of your competitors. Considering how quickly social media moves, using a third-party analytics tool is ideal. It allows you to make sense of your social data at a glance and ensure that you’re never missing out on important trends.

Email marketing research tools

Keeping track of brand emails is a good idea for any brand looking to stand out in its audience’s inbox.

Tools such as MailCharts , Really Good Emails and Milled can show you how different brands run their email campaigns.

Meanwhile, tools like Owletter allow you to monitor metrics such as frequency and send-timing. These metrics can help you understand email marketing strategies among competing brands.

Content marketing research

If you’re looking to conduct research on content marketing, tools such as BuzzSumo can be of great help. This tool shows you the top-performing industry content based on keywords. Here you can see relevant industry sites and influencers as well as which brands in your industry are scoring the most buzz. It shows you exactly which pieces of content are ranking well in terms of engagements and shares and on which social networks.

SEO and keyword tracking

Monitoring industry keywords is a great way to uncover competitors. It can also help you discover opportunities to advertise your products via organic search. Tools such as Ahrefs provide a comprehensive keyword report to help you see how your search efforts stack up against the competition.

Competitor comparison template

For the sake of organizing your market research, consider creating a competitive matrix. The idea is to highlight how you stack up side-by-side against others in your market. Use a social media competitive analysis template to track your competitors’ social presence. That way, you can easily compare tactics, messaging and performance. Once you understand your strengths and weaknesses next to your competitors, you’ll find opportunities as well.

Customer persona creator

Finally, customer personas represent a place where all of your market research comes together. You’d need to create a profile of your ideal customer that you can easily refer to. Tools like Xtensio can help in outlining your customer motivations and demographics as you zero in on your target market.

Build a solid market research strategy

Having a deeper understanding of the market gives you leverage in a sea of competitors. Use the steps and market research tools we shared above to build an effective market research strategy.

But keep in mind that the accuracy of your research findings depends on the quality of data collected. Turn to Sprout’s social media analytics tools to uncover heaps of high-quality data across social networks.

- Leveling Up

[Toolkit] Mastering Integrated Marketing Strategy for 2025 and Beyond

- Marketing Disciplines

- Social Media Strategy

Social media RFPs: The best questions to include (plus a template)

Template: Essential Questions to Ask in Your Social Media Management Software RFP

- Team Collaboration

How to build a marketing tech stack that scales your business

- Now on slide

Build and grow stronger relationships on social

Sprout Social helps you understand and reach your audience, engage your community and measure performance with the only all-in-one social media management platform built for connection.

The Ultimate Guide to Market Research [+Free Templates]

A comprehensive guide on Market Research with tools, examples of brands winning with research, and templates for surveys, focus groups + presentation template.

Rakefet is the CMO at Mayple. She manages all things marketing and leads our community of experts through live events, workshops, and expert interviews. MBA, 1 dog + 2 cats, and has an extensive collection of Chinese teas.

Learn about our

Natalie is a content writer and manager who is passionate about using her craft to empower others. She thrives on team dynamic, great coffee, and excellent content. One of these days, she might even get to her own content ideas.

Updated November 7, 2024.

![market research guide The Ultimate Guide to Market Research [+Free Templates] main image](https://entail.mayple.com/en-assets/mayple/62b4087370d3b5eab8bfb6b6_marketingresearch1_e2786f4e8b966e44f1401562fa23c07b_2000-1699776197229.jpg)

Before you do anything in business you have to have a good grasp of the market. What’s the market like? Who are your competitors? And what are the pain points and challenges of your ideal customer? And how can you solve them? Once you have the answers to those questions then you are ready to move forward with a marketing plan and/or hire a digital marketing agency to execute it.

In this guide we break down what market research is, the different types of market research, and provide you with some of the best templates, tools, and examples, to help you execute it on your own.

Excited to learn?

Let’s dive in.

Hire the best advertising agencies

Find a reliable partner to help you enhance your marketing efforts and promote your business the right way.

What is market research?

Market research is the process of gathering information about your target market and customers to determine the success of your product or service, make changes to your existing product, or understand the perception of your brand in the market.

“Research is formalized curiosity, it is poking and prying with a purpose.” - Zora Neale Hurston

We hear the phrase "product-market fit" all the time and that just means that a product solves a customer's need in the market. And it's very hard to get there without proper market research. Now, I know what you're going to say. Why not get actionable insights from your existing customers? Why not do some customer research?

The problem with customer research is two-fold:

- You have a very limited amount of data as your current customers don't represent the entire market.

- Customer research can introduce a lot of bias into the process.

So the real way to solve these issues is by going broader and conducting some market research.

Why do market research?

There are many benefits of doing market research for your company. Here are a few of them:

- Understand how much demand exists in the market, the market size

- Discover who your competitors are and where they are falling short.

- Better understand the needs of your target customers and the problems and pain points your product solves.

- Learn what your potential customers feel about your brand.

- Identify potential partners and new markets and opportunities.

- Determine which product features you should develop next.

- Find out what your ideal customer is thinking and feeling.

- Use these findings to improve your brand strategy and marketing campaigns.

“The goal is to transform data into information, and information into insight.” - Carly Fiorina

Market research allows you to make better business decisions at every stage of your business and helps you launch better products and services for your customers.

Primary vs secondary research

There are two main types of market research - primary and secondary research.

Primary research

Primary market research is when researchers collect information directly, instead of relying on outside sources of information. It could be done through interviews, online surveys, or focus groups and the advantage here is that the company owns that information. The disadvantage of using primary sources of information is that it's usually more expensive and time-consuming than secondary market research.

Secondary research

Secondary market research involves using existing data that is summarized and collected by third parties. Secondary sources could be commercial sources or public sources like libraries, other websites, blogs , government agencies, and existing surveys. It's data that's more readily available and it's usually much cheaper than conducting primary research.

Qualitative vs quantitative research

Qualitative research is about gathering qualitative data like the market sentiment about the products currently available on the market (read: words and meanings). Quantitative research deals with numbers and statistics. It's data that is numbers-based, countable, and measurable.

Types of market research

1. competitive analysis.

Every business needs to know its own strengths and weaknesses and how they compare with its largest competitors in the market. It helps brands identify gaps in the market, develop new products and services, uncover market trends, improve brand positioning , and increase their market share. A SWOT analysis is a good framework to use for this type of research.

2. Consumer insights

It's also equally important to know what consumers are thinking, what the most common problems are and what products they are purchasing. Consumer research can be done through social listening which involves tracking consumer conversations on social media. It could also include analyzing audiences of brands , online communities, and influencers, and analyzing trends in the market.

3. Brand awareness research

Brand awareness is a super important metric for understanding how well your target audience knows your brand. It's used to assess brand performance and the marketing effectiveness of a brand. It tells you about the associations consumers make when they think of your brand and what they believe you're all about.

4. Customer satisfaction research

Customer satisfaction and loyalty are two really important levers for any business and you don't have to conduct in-depth interviews to get that information. There is a wide range of automated methods to get that kind of data including customer surveys such as NPS surveys, customer effort score (CES) surveys, and regularly asking your customers about their experience with your brand.

5. Customer segmentation research

Customer segmentation research involves figuring out what buckets consumers fall into based on common characteristics such as - demographics, interests, purchasing behavior, and more. Market segmentation is super helpful for advertising campaigns, product launches, and customer journey mapping.

6. Interviews

Customer interviews are one of the most effective market research methods out there. It's a great way for business owners to get first-party data from their customers and get insights into how they are doing in real time.

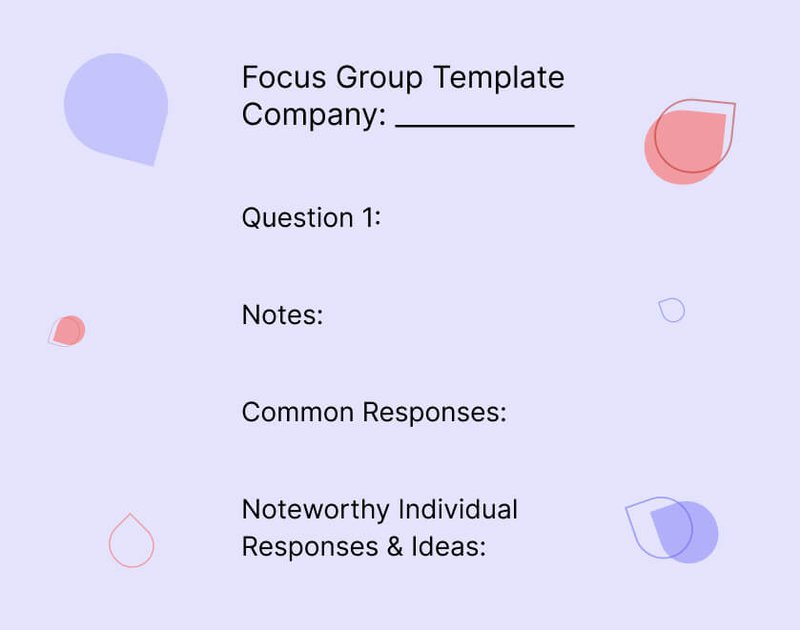

7. Focus groups

Focus groups are a great way to get data on a specific demographic. It's one of the most well-known data collection methods and it involves taking a sample size of people and asking them some open-ended questions. It's a great way to get actionable insights from your target market.

8. Pricing research

Pricing strategy has a huge influence on business growth and it's critical for any business to know how they compare with the leading brands in their niche. It can help you understand what your target customer is willing to pay for your product and at what price you should be selling it.

To start, get automated software to track your competitors' pricing . Then, summarize your research into a report and group the results based on product attributes and other factors. You can use quadrants to make it easier to read visually.

9. Campaign research

It's also important for a brand to research its past marketing campaigns to determine the results and analyze their success. It takes a lot of experimentation to nail the various aspects of a campaign and it's crucial for business leaders to continuously analyze and iterate.

10. Product/service use research

Product or user research gives you an idea of why and how an audience uses a product and gives you data about specific features. Studies show that usability testing is ranked among the most useful ways to discover user insights (8.7 out of 10), above digital analytics and user surveys. So it's a very effective way to measure the usability of a product.

Now that you know the different types of market research let's go through a step-by-step process of setting up your study.

How to conduct a market research study

Looking for your next business idea? Want to check which niche markets are going to be best for it? if it's going to Here's a pretty simple process for conducting

1. Define your buyer persona

The first step in market research is to understand who your buyers are. For that, you need a buyer persona (sometimes called a marketing persona) which is a fictional generalized description of your target customer. You could (and should) have several buyer personas to work with.

Key characteristics to include in your buyer personas are:

- Job title(s)

- Family size

- Major challenges

Now that you've got your customer personas it's time to decide who to work with for your research.

2. Identify the right people to engage with

It's critical that you pick the right group of people to research. This could make or break your market research study. It's important to pick a representative sample that most closely resembles your target customer. That way you'll be able to identify their actual characteristics, challenges, pain points, and buying behavior.

Here are a few strategies that will help you pick the right people:

- Select people who have recently interacted with you

- Pull a list of participants who made a recent purchase

- Call for participants on social media

- Leverage your own network

- Gather a mix of participants

- Offer an incentive (gift card, product access, content upgrades)

3. Pick your data collection method(s)

Here's a quick breakdown of all the different ways you could collect data for your market research study.

Surveys are by far the fastest method of gathering data. You could launch them on your site or send them in an email and automate the whole process. Regular surveys can also help brands improve their customer service so they help kill two birds with one stone.

Interviews take a little longer and require a detailed set of interview questions. Never go into an interview without a clear idea of what you're going to be asking. It's also a little more difficult to schedule time and to get your potential or current customers on the phone or on Zoom.

Focus group

Focus groups are controlled interviews with groups of people led by facilitators. Participants in focus groups are selected based on a set of predetermined criteria such as location, age, social status, income, and more.

Online tracking

Online tracking is done through digital analytics tools like HotJar or Google Analytics. Tracking user behavior on your site gets you an accurate analysis of who your demographic is and what are the types of products or content that they engage with.

The problem here is that you never get to find out the 'why' - the reason behind their behavior - and that's why you need to combine digital analytics with other data collection methods like surveys and usability/product testing.

Marketing analysis

Another great way to collect data is to analyze your marketing campaigns which gives you a great idea of who clicked on your ads, how often, and which device they used. It's a more focused way of using tracking to zero in on a specific marketing campaign.

Social media monitoring

We've talked about this one before. Social monitoring or listening is when you track online conversations on social media platforms. You can use a simple social listening tool to get all the data you need by searching for specific keywords, hashtags, or topics.

Subscription and registration data

Another great way to collect data is to look at your existing audience. That might include your email list, rewards program, or existing customers. Depending on the size of your list, it could give you some broad insights into the type of customers/users you have and what they are most interested in.

Monitoring in-store traffic

Conduct a customer observation session to monitor your actual customers and how they behave in your store (physically or online). Observation is a market research technique where highly-trained market researchers observe how people or consumers interact with products/services in a natural setting.

4. Prepare your research questions

Write down your research questions before you conduct the research. Make sure you cover all the topics that you are trying to gain clarity on and include open-ended questions. The type of questions you use will vary depending on your data collection approach from the last step.

If you're doing a survey or an in-person interview then here are some of the best questions to ask.

The awareness stage

- How did you know that something in this product category could help you?

- Think back to the time you first realized you needed [product category]. What was your challenge?

- How familiar were you with different options on the market?

The consideration stage

- Where did you go to find out the information?

- What was the first thing you did to research potential solutions?

- Did you search on Google? What specifically did you search for? Which keywords did you use?

- Which vendor sites did you visit?

- What did you find helpful? What turned you off?

The decision stage

- Which criteria did you use to compare different vendors?

- What vendors made it to the shortlist and what were the pros/cons of each?

- Who else was involved in the final decision?

- Allow time for further questions on their end.

- Don't forget to thank them for their time and confirm their email/address to receive the incentive you offered

If you noticed, the progression of these questions follows the stages of the buyer's journey which helps you to gain actionable insights into the entire customer experience.

5. List your primary competitors

There are two kinds of competitors - industry competitors and content competitors. Industry competitors compete with you on the actual product or service they sell. Content competitors compete with you in terms of the content they publish - whether that's on specific keywords or they rank higher on topics that you want to be ranked for.

It's important to write a list of all of your competitors and compare their strengths, weaknesses, competitive advantages, and the type of content they publish.

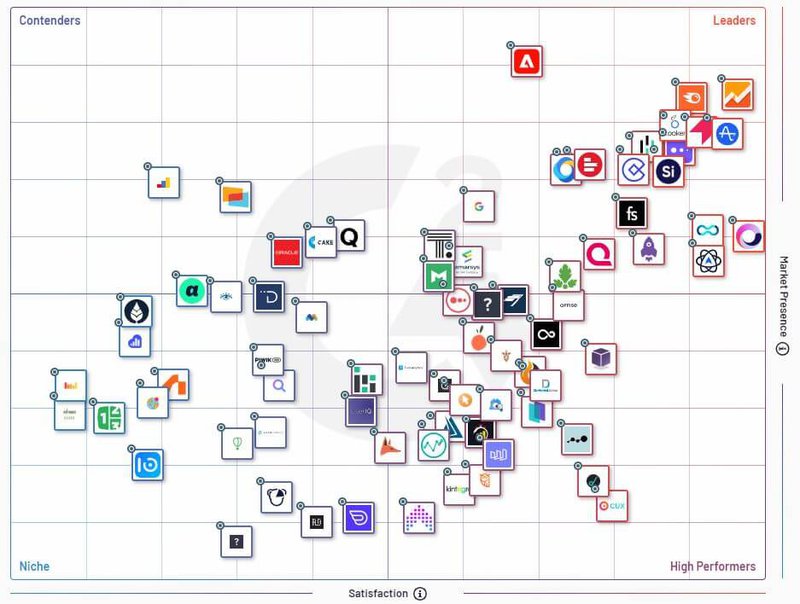

There are different ways to find your competitors. You can look on sites like G2 Crowd and check their industry quadrants.

You could also download a market report from Forrester or Gartner . And you could also search on social media or market research tools like SimilarWeb .

6. Summarize your findings

Now that you've done your research it's time to summarize your findings. Look for common themes in your research and try to present them in the simplest way possible. Use your favorite presentation software to document it and add it to your company database.

Here's a quick research outline you could use:

Background - your goals and why you conducted this study

Participants - who you've talked to. Break down the type of personas and/or customers you've spoken with.

Executive summary - what was the most interesting stuff you've learned? What do you plan to do about it?

Customer journey map - map out the specific motivations and behavioral insights you've gained from each stage of the customer journey (awareness, consideration, and decision).

Action plan - describe what action steps you're going to take to address the issues you've uncovered in your research and how you are going to promote your product/service to your target audience more effectively.

Market research template

Not sure where to begin? Need some templates to help you get started? We got them for you.

1. Market survey template

First and foremost, you need a template to run your market survey. In this template, you will find all the types of questions you should be asking - demographic, product, pricing, and brand questions. They can be used for market surveys, individual interviews, and focus groups.

We also present a variety of question formats for you to use:

- true/false questions

- multiple choice questions

- open response questions

2. SWOT analysis template

A strength, weakness, opportunities, and threats (SWOT) analysis is one of the best ways to do competitor research. It's a really simple analysis. There are four squares and you write down all four of these attributes for each of your competitors.

3. Focus group template

Not sure how to conduct focus groups? Here is a comprehensive template that will help you to take better notes and record your findings during the focus group meeting.

4. Marketing strategy template

The plan of action from your market research should become a vital part of your marketing strategy. We've actually created a marketing strategy template that you could download and use to update your marketing personas, your SWOT analysis, and your marketing channel strategies.

Market research examples

Here are some examples of the good, the bad, and the ugly in market research. Some brands thrive on research and some ignore it completely. Take a look.

McDonald's

McDonald’s sells its food in 97 countries around the world. Their secret? They do a lot of market research before they launch anything. The company uses four key questions in their research process:

- Which products are performing well?

- What prices are most affordable to customers?

- What are consumers reading and watching?

- What content do they consume?

- Which restaurants are most attended, and why?

They also extensively use customer feedback to improve their products. They even put some products up for a vote to see which ones are most loved by their customers.

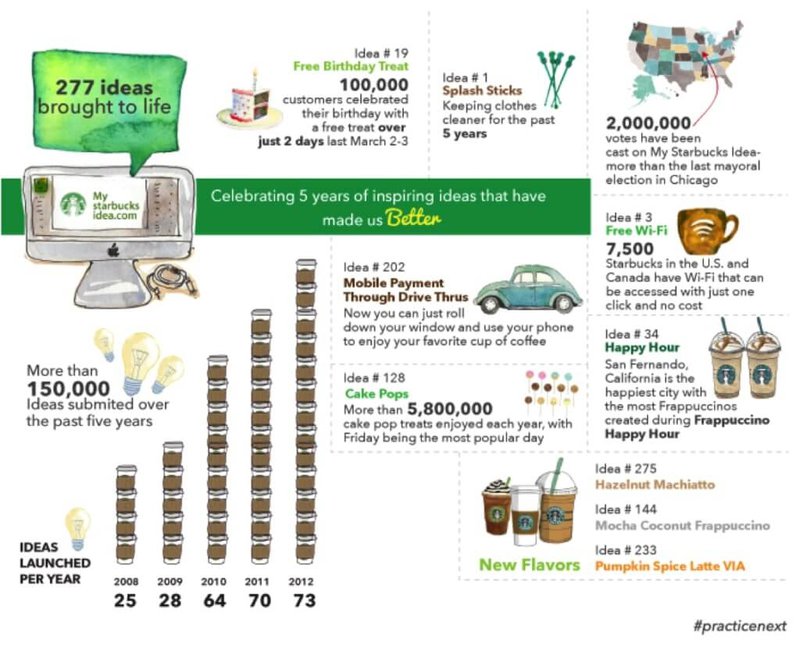

The iconic coffee brand is valued at almost $30 billion and has over 30,000 coffee shops around the world and part of that success comes from their obsession with customer service. They launched a brilliant idea called “My Starbucks Idea” to try and make the customer feel a part of the journey.