Home — Essay Samples — Economics — Political Economy — Inflation

Essays on Inflation

Inflation essay topics and outline examples, essay title 1: understanding inflation: causes, effects, and economic policy responses.

Thesis Statement: This essay provides a comprehensive analysis of inflation, exploring its root causes, the economic and societal effects it generates, and the various policy measures employed by governments and central banks to manage and mitigate inflationary pressures.

- Introduction

- Defining Inflation: Concept and Measurement

- Causes of Inflation: Demand-Pull, Cost-Push, and Monetary Factors

- Effects of Inflation on Individuals, Businesses, and the Economy

- Inflationary Policies: Central Bank Actions and Government Interventions

- Case Studies: Historical Inflationary Periods and Their Consequences

- Challenges in Inflation Management: Balancing Growth and Price Stability

Essay Title 2: Inflation and Its Impact on Consumer Purchasing Power: A Closer Look at the Cost of Living

Thesis Statement: This essay focuses on the effects of inflation on consumer purchasing power, analyzing how rising prices affect the cost of living, household budgets, and the strategies individuals employ to cope with inflation-induced challenges.

- Inflation's Impact on Prices: Understanding the Cost of Living Index

- Consumer Behavior and Inflation: Adjustments in Spending Patterns

- Income Inequality and Inflation: Examining Disparities in Financial Resilience

- Financial Planning Strategies: Savings, Investments, and Inflation Hedges

- Government Interventions: Indexation, Wage Controls, and Social Programs

- The Global Perspective: Inflation in Different Economies and Regions

Essay Title 3: Hyperinflation and Economic Crises: Case Studies and Lessons from History

Thesis Statement: This essay explores hyperinflation as an extreme form of inflation, examines historical case studies of hyperinflationary crises, and draws lessons on the devastating economic and social consequences that result from unchecked inflationary pressures.

- Defining Hyperinflation: Thresholds and Characteristics

- Case Study 1: Weimar Republic (Germany) and the Hyperinflation of 1923

- Case Study 2: Zimbabwe's Hyperinflationary Collapse in the Late 2000s

- Impact on Society: Currency Devaluation, Poverty, and Social Unrest

- Responses and Recovery: Stabilizing Currencies and Rebuilding Economies

- Preventative Measures: Policies to Avoid Hyperinflationary Crises

Report on Inflation and Its Causes

The rise of inflation rate in the us, made-to-order essay as fast as you need it.

Each essay is customized to cater to your unique preferences

+ experts online

Iflation and Its Causes

Methods to control inflation, the grade inflation, inflation: a deceitful solution to debt, let us write you an essay from scratch.

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

How to Control Inflation in Pakistan

Main factors of inflation in singapore, effects of inflation on commercial banks’ lending: a case of kenya commercial bank limited, food inflation in the republic of india, get a personalized essay in under 3 hours.

Expert-written essays crafted with your exact needs in mind

The Issue of Unemployment and Inflation in Colombia

The theory and policy of macroeconomics on inflation rate, non-accelerating inflation rate of unemployment (nairu), targeting zero inflation and increase of government spending as a way of curbing recession, howa spiraling inflation has impacted the venezuelan economy, how venezuela has been affected by inflation, effects of inflation on kenya commercial banks lending, exploring theories of inflation in economics, about fuel prices: factors, impacts, and solutions, analyzing the inflation reduction act, the oscillating tides of the american economy, exploring the implications of the inflation reduction act, inflation reduction act in the frame of macroeconomic challenges, the impact of inflation reduction act on the international economic stage, relevant topics.

- Unemployment

- Penny Debate

- American Dream

- Real Estate

- Supply and Demand

- Minimum Wage

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

- High School

- You don't have any recent items yet.

- You don't have any courses yet.

- You don't have any books yet.

- You don't have any Studylists yet.

- Information

Essay Outline on Inflation in the United States

Principles of microeconomics (econ 1020-01), vanderbilt university, students also viewed.

- Essay Outline on the principles and history of cross

- Chapter 17- Capital and Financial Markets

- Chapter 15- Taxes

- Chapter 14- Markets for Labor

- Chapter 13- The Economic Role of Government

- Chapter 12- Regulation of Firms with Market Power

Related documents

- Chapter 11- Between Perfect Competition and Monopoly

- Chapter 10- Monopoly

- Chapter 9 Way More Content

- Chapter 8 Extra Content

- Chapter 7 Extra Content

- Chapter 7- Behind Supply

Related Studylists

Preview text.

I. Introduction Definition of inflation Importance of understanding inflation for individuals and businesses II. History of inflation in the US Major economic events that have impacted inflation (e. wars, recessions, etc.) Trends in inflation over time III. Causes of inflation in the US Demand-pull inflation Cost-push inflation Monetary policy and inflation IV. Measures of inflation in the US Consumer Price Index (CPI) Personal Consumption Expenditures (PCE) Implications of different measures of inflation V. Effects of inflation on the economy Impact on consumers (e. purchasing power, savings) Impact on businesses (e. pricing decisions, profit margins) Impact on the government (e. fiscal policy, budget deficit) VI. Strategies for managing inflation Monetary policy tools (e. raising interest rates) Fiscal policy tools (e. government spending and taxation) Personal finance strategies (e. saving and investing) VII. Conclusion Recap of key points Future outlook on inflation in the US

I. Introduction Inflation is an economic phenomenon in which the general price level of goods and services in an economy increases over time. It is measured as the percentage change in the price level of a basket of goods and services over a certain period of time. Inflation can be caused by a variety of factors, including an increase in the supply of money, an increase in the cost of production, or an increase in the demand for goods and services. Inflation can have significant consequences for businesses, consumers, and the overall economy, as it can affect the purchasing power of money, the cost of borrowing, and the distribution of income. Understanding inflation is important for both individuals and businesses for a number of reasons. For individuals, understanding inflation is important because it can affect the purchasing power of their money. Inflation refers to the general increase in prices of goods and services over time, which means that the same amount of money will be able to buy fewer goods and services in the future. Therefore, understanding inflation can help individuals make informed financial decisions, such as how to save and invest their money, and how to budget for the long term.

For businesses, understanding inflation is important because it can affect the costs of production and the prices of goods and services. Inflation can increase the costs of raw materials, labor, and other inputs, which can lead to higher prices for goods and services. Therefore, businesses need to understand inflation in order to make informed decisions about pricing, production, and investment. Overall, understanding inflation is important for both individuals and businesses because it can affect the purchasing power of money and the costs and prices of goods and services. By understanding inflation, individuals and businesses can make informed financial decisions and plan for the future.

II. History of inflation in the US

There are many economic events that have impacted inflation over the years. Some examples include:

- Wars: Wars can have a significant impact on inflation, as they often lead to increased government spending on defense and other war-related activities. This increased spending can lead to an increase in the money supply, which can in turn lead to higher prices.

- Recessions: Recessions can also impact inflation, as they often lead to a decrease in demand for goods and services. This decrease in demand can lead to lower prices, and in some cases, deflation (a sustained decrease in the overall level of prices).

- Oil price shocks: Changes in the price of oil can also impact inflation. For example, a sudden increase in the price of oil can lead to higher prices for goods and services that rely on oil as an input, such as transportation and manufacturing.

- Natural disasters: Natural disasters can also impact inflation by disrupting the production and distribution of goods and services. For example, a hurricane or earthquake may damage infrastructure or disrupt transportation, leading to higher prices for affected goods.

- Political instability: Political instability can also impact inflation, as it can lead to uncertainty about the future and affect the confidence of consumers and businesses. This uncertainty can lead to changes in spending patterns, which can in turn impact the overall level of prices.

III. Causes of inflation in the US

Inflation trends can vary over time, depending on a variety of factors, such as economic growth, changes in the supply and demand for goods and services, and the actions of central banks. In general, however, inflation tends to be higher during times of economic growth and lower during times of economic recession. Inflation rates can also vary significantly between countries and regions. For example, countries with high levels of economic growth and development tend to have higher inflation rates than countries with slower economic growth. Inflation rates can also be affected by the

IV. Measures of inflation in the US

The Consumer Price Index (CPI) is a measure of the average change in the prices of a basket of goods and services consumed by households. It is used to measure inflation and to adjust the purchasing power of money over time. The CPI is calculated by the Bureau of Labor Statistics (BLS) in the United States and is based on the prices of a representative sample of goods and services consumed by households. The CPI is calculated using a base year, which is a reference year that is used to compare the prices of goods and services over time. The base year is typically set to 100, and the prices of goods and services in subsequent years are measured as a percentage of the base year. For example, if the CPI for a particular year is 120, this means that the prices of goods and services in that year are 20% higher than the prices in the base year. The CPI is an important measure of inflation because it reflects the average change in the prices of goods and services consumed by households. It is used to adjust the purchasing power of money over time and to make comparisons of the cost of living between different periods or regions. The CPI is also used to adjust various economic indicators, such as wage rates, pensions, and government benefits, to reflect changes in the cost of living.

Personal Consumption Expenditures (PCE) is a measure of consumer spending on goods and services in the United States. It is one of the main components of gross domestic product (GDP) and is used by economists and policymakers to gauge the health of the economy. PCE includes spending on a wide range of goods and services, including durable goods (such as automobiles and appliances), nondurable goods (such as food and clothing), and services (such as healthcare and education). It excludes spending on exports and government purchases, as well as investment spending. PCE is measured in nominal terms, which means that it includes the effects of inflation. Therefore, it is important to adjust PCE for inflation in order to get a more accurate measure of the volume of goods and services being consumed. PCE is an important indicator of consumer demand and economic activity, and it is closely watched by economists and policymakers. Increases in PCE can indicate strong consumer demand and economic growth, while decreases in PCE can indicate a slowdown in the economy.

Different measures of inflation can have different implications for businesses, policymakers, and consumers. Some of the key considerations include:

- The impact on businesses: Different measures of inflation can have different implications for businesses. For example, if the measure of inflation being used understates the actual increase in the cost of production, businesses may find it difficult to pass on these increased costs to consumers through higher prices. This could lead to declining profits and, in some cases, bankruptcies.

- The impact on policymakers: Different measures of inflation can also have different implications for policymakers. For example, if the measure of inflation being used overstates the actual increase in the cost of living, policymakers may be more likely to adopt contractionary monetary or fiscal policies (such as raising interest rates or

reducing government spending) in an attempt to bring down the overall price level. These policies could have negative impacts on economic growth and employment. 3. The impact on consumers: Different measures of inflation can also have different implications for consumers. For example, if the measure of inflation being used understates the actual increase in the cost of living, consumers may find it difficult to maintain their standard of living despite experiencing higher prices for goods and services. On the other hand, if the measure of inflation being used overstates the actual increase in the cost of living, consumers may feel that they are worse off than they actually are and reduce their spending, which could have negative impacts on the economy. Overall, it is important to use an accurate measure of inflation in order to make informed decisions about economic policy and to ensure that businesses, policymakers, and consumers have a clear understanding of the state of the economy.

V. Effects of inflation on the economy

Inflation can have a significant impact on consumers, as it can affect the purchasing power of money and the value of savings. The purchasing power of money refers to the ability of a unit of currency to purchase goods and services. Inflation reduces the purchasing power of money because it increases the general price level of goods and services. For example, if the rate of inflation is 10% per year, this means that the prices of goods and services are expected to increase by 10% over the course of the year. As a result, a unit of currency will be able to purchase fewer goods and services than it could in the previous year. Inflation can also affect the value of savings, as it reduces the purchasing power of money over time. For example, if an individual has saved $100 and the rate of inflation is 10% per year, the purchasing power of those savings will be reduced by 10% over the course of the year. This means that the individual will be able to purchase fewer goods and services with those savings than they could in the previous year. Overall, inflation can have a significant impact on consumers by reducing the purchasing power of money and the value of savings. It is important for consumers to be aware of inflation trends and to take steps to protect the purchasing power of their money, such as by investing in assets that are expected to increase in value over time.

Inflation can have a significant impact on businesses, particularly with regard to pricing decisions and profit margins. One of the main impacts of inflation on businesses is that it can affect the costs of production. Inflation can increase the costs of raw materials, labor, and other inputs, which can lead to higher prices for goods and services. Businesses may need to increase the prices of their goods and services in order to cover these increased costs and maintain profit margins. Inflation can also affect businesses' pricing decisions in other ways. For example, if businesses expect inflation to increase in the future, they may decide to increase prices in

increase in value over time, such as stocks or real estate, can help to preserve purchasing power over the long term. 2. Diversification: Diversifying investments can also be an effective strategy for managing the impact of inflation. By investing in a variety of assets, individuals can reduce the risk of their portfolio being negatively impacted by inflation. For example, investing in both stocks and bonds can help to balance out the potential negative impact of rising prices on stocks. 3. Debt management: Another important strategy for managing the impact of inflation on personal finances is to carefully manage debt. By paying off high-interest debt, such as credit card balances, individuals can reduce the amount of money they need to set aside each month to meet their debt obligations. This can help to free up money for saving and investing and protect against the negative effects of inflation. 4. Regular budgeting and planning: Finally, regular budgeting and planning can be an effective way to manage the impact of inflation on personal finances.

Monetary policy tools are used by central banks, such as the Federal Reserve in the United States, to influence the level of economic activity in the economy. One of the main objectives of monetary policy is to maintain price stability, which refers to the goal of keeping the rate of inflation within a certain range. Central banks can use a variety of tools to achieve this objective, including setting interest rates, controlling the money supply, and using unconventional monetary policy measures, such as asset purchases. Raising interest rates is one of the primary tools that central banks can use to influence inflation. Interest rates are the cost of borrowing money, and they can affect the demand for goods and services by making borrowing more or less expensive. If the central bank wants to reduce the level of inflation in the economy, it can raise interest rates, which makes borrowing more expensive and can reduce the demand for goods and services. This can help to reduce the overall level of inflation in the economy. On the other hand, if the central bank wants to stimulate economic growth, it can lower interest rates, which makes borrowing cheaper and can increase the demand for goods and services. This can help to increase economic activity and potentially boost inflation. Overall, raising interest rates is one of the primary tools that central banks can use to influence inflation and achieve their monetary policy objectives. It is an important tool for managing the overall health of the economy and ensuring price stability.

Fiscal policy refers to the use of government spending and taxation to influence economic activity and manage economic challenges, such as inflation. There are several fiscal policy tools that can be used to address inflation, including:

Government spending: Increasing government spending can stimulate demand and boost economic activity, which can help to reduce unemployment and increase growth. However, it can also lead to higher inflation if demand outstrips the available supply of goods and services.

Taxation: Increasing taxes can reduce demand and slow down economic activity, which can help to reduce inflation. However, it can also lead to slower economic growth and higher unemployment.

Transfer payments: Transfer payments, such as welfare payments or unemployment benefits, can increase the purchasing power of households and stimulate demand, which can lead to higher inflation if not accompanied by other measures to increase the supply of goods and services.

Debt financing: The government can finance spending through borrowing, which can stimulate demand and boost economic activity. However, it can also lead to higher inflation if not accompanied by measures to increase the supply of goods and services. Overall, fiscal policy tools can be used to address inflation, but it is important to consider the trade-offs and potential impacts on economic growth, unemployment, and other economic variables.

VII. Conclusion

It is difficult to predict the future outlook for inflation in the United States with certainty, as it can be affected by a variety of factors, such as economic growth, changes in the supply and demand for goods and services, and the actions of central banks. In the short term, inflation in the United States is expected to remain relatively low, as the economy recovers from the impact of the COVID-19 pandemic. The Federal Reserve has stated that it expects inflation to remain below its target of 2% over the next few years. However, some economists have expressed concerns that the combination of large fiscal stimulus measures, such as government spending and tax cuts, and a potentially faster-than- expected economic recovery could lead to higher inflation in the medium term. In the long term, it is difficult to predict the outlook for inflation in the United States. Factors that could affect inflation in the long term include changes in economic growth, changes in the supply and demand for goods and services, and the actions of central banks. It is important for businesses, consumers, and policymakers to be aware of these factors and to be prepared for potential changes in the level of inflation in the future.

Sample Essays

(1) Inflation is a measure of the rate at which the general price level of goods and services is rising, and subsequently, purchasing power is falling. Central banks attempt to limit inflation and avoid deflation in order to keep the economy running smoothly. Inflation in the United States has fluctuated greatly over the country's history, with periods of high inflation followed by periods of low inflation or deflation. One of the main causes of inflation is an increase in demand for goods and services. When demand for goods and services outstrips supply, prices will rise. This is known as demand-pull inflation. Another cause of inflation is an increase in the cost of production, such as an increase in the cost of raw materials or wages. This is known as cost-push inflation. Both of these types of inflation can be influenced by monetary policy, which is the management of money supply and interest rates by a central bank.

policymakers to understand the factors that can affect inflation and to use tools, such as monetary policy, to maintain price stability and ensure the overall health of the economy.

Inflation, or the general increase in prices of goods and services over time, has a long history in the United States. Inflation has had both positive and negative impacts on the economy and has been influenced by various factors such as monetary policy, government spending, and economic growth. In the early history of the United States, inflation was not a significant problem, as the economy was largely based on agriculture and there were few manufactured goods. However, as the economy industrialized and the population grew, inflation became more of a concern. In the late 19th and early 20th centuries, the United States experienced periods of high inflation, particularly during and after World War I. Inflation was fueled by factors such as an increase in government spending, an increase in the money supply, and an increase in the cost of raw materials. In the post-World War II period, the United States experienced relatively low and stable inflation, thanks in part to the adoption of a flexible exchange rate system and the use of monetary policy to manage inflation. However, there were still occasional periods of higher inflation, such as during the 1970s when inflation reached double digits due to factors such as rising oil prices and increased government spending. In more recent years, the United States has generally experienced low and stable inflation, thanks in part to the adoption of an inflation targeting framework by the Federal Reserve, the central bank of the United States. The Federal Reserve uses monetary policy tools such as interest rates to manage inflation and maintain price stability. Overall, the history of inflation in the United States has been marked by both periods of stability and periods of higher inflation. Inflation has been influenced by various factors such as monetary policy, government spending, and economic growth, and has had both positive and negative impacts on the economy. Understanding the history of inflation in the United States can provide valuable insights into how to manage and address inflation in the future.

(4) Inflation is a measure of the percentage increase in the overall level of prices for goods and services in an economy. It is an important economic concept that can have a significant impact on the United States and its citizens. There are several factors that can influence the rate of inflation in the United States, including the level of economic activity, the level of employment, the availability of credit, and the level of government spending. One of the key impacts of inflation is on the purchasing power of money. When the rate of inflation is high, the purchasing power of money declines, as individuals need more money to buy the same goods and services. This can have negative impacts on the standard of living for many Americans, as they may struggle to afford the goods and services they need to maintain their desired level of consumption.

Inflation can also impact the economy as a whole, as it can affect the level of economic activity and employment. When the rate of inflation is high, businesses may be less likely to invest in new projects and hire new employees, as they may be uncertain about the future value of their investments. This can lead to a slowdown in economic growth and a decline in employment. Inflation can also affect the government and its fiscal policy. If the rate of inflation is high, the government may find it more difficult to borrow money at reasonable interest rates, as investors may be concerned about the value of their investments declining over time. This could limit the government's ability to fund its spending and may lead to a need to adopt contractionary fiscal policies (such as reducing spending or increasing taxes) in order to bring down the overall price level. To manage the impact of inflation, the Federal Reserve (the central bank of the United States) uses a variety of tools, including setting the target range for the federal funds rate (the interest rate at which banks lend and borrow money from each other overnight). By raising or lowering the federal funds rate, the Federal Reserve can influence the level of economic activity and the rate of inflation in the United States. In summary, inflation is a complex economic concept that can have significant impacts on the United States and its citizens. It can affect the purchasing power of money, the level of economic activity and employment, and the government's fiscal policy. By using tools such as setting the federal funds rate, the Federal Reserve works to maintain price stability and promote economic growth in the United States.

- Multiple Choice

Course : Principles of Microeconomics (ECON 1020-01)

University : vanderbilt university, this is a preview.

Access to all documents

Get Unlimited Downloads

Improve your grades

Share your documents to unlock

Get 30 days of free Premium

Why is this page out of focus?

Essay on Inflation

Essay generator.

Inflation is a term that resonates through the corridors of our daily lives, affecting decisions made by individuals, businesses, and governments alike. It refers to the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. Central banks attempt to limit inflation, and avoid deflation, to keep the economy running smoothly. This essay delves into the causes of inflation, its various effects on the economy and individuals, and the strategies employed to manage it, aiming to provide a comprehensive understanding suitable for a student participating in an essay writing competition.

The Causes of Inflation

Inflation is primarily caused by two factors: demand-pull and cost-push inflation. Demand-pull inflation occurs when demand for goods and services exceeds supply, causing prices to rise. This can happen due to increased consumer spending, government expenditure, or investment. Cost-push inflation, on the other hand, happens when the cost of production increases, leading producers to raise prices to maintain their profit margins. This increase in production costs can be due to rising wages, increased taxes, or higher prices for raw materials.

- Demand-pull inflation occurs when the overall demand for goods and services in an economy exceeds its supply. This excess demand leads to rising prices as businesses raise prices to capitalize on increased consumer demand.

- Factors contributing to demand-pull inflation include robust consumer spending, increased government spending, low-interest rates, and high levels of investment.

- Cost-push inflation is driven by rising production costs, which are then passed on to consumers in the form of higher prices. These rising costs can result from various factors, such as increased wages, higher energy prices, or supply chain disruptions.

- For example, if oil prices spike, it can lead to increased transportation costs, which may cause businesses to raise prices on their products.

- Built-in inflation, also known as the wage-price spiral, occurs when workers demand higher wages to keep up with rising prices. When businesses pay higher wages, they often pass those costs on to consumers, causing prices to rise further. This cycle can continue, perpetuating inflation.

- Expectations of future inflation can also contribute to built-in inflation, as people adjust their behavior and spending patterns in anticipation of rising prices.

- The policies of central banks, such as the Federal Reserve in the United States, can influence inflation. When central banks implement loose monetary policies, such as low-interest rates and quantitative easing, it can increase the money supply and potentially lead to demand-pull inflation.

- Central banks can also use tight monetary policies, such as raising interest rates, to combat inflation and reduce spending.

- Government fiscal policies, including changes in taxation and government spending, can affect inflation. An increase in government spending without corresponding revenue sources can stimulate demand and contribute to inflation.

- Tax cuts can also increase disposable income, leading to higher consumer spending and potential demand-pull inflation.

- Exchange rate fluctuations can impact inflation by influencing the prices of imported goods. A depreciating domestic currency can make imports more expensive, contributing to cost-push inflation.

- Conversely, a strengthening currency can lower import prices and help reduce inflation.

- Unforeseen events, such as natural disasters, geopolitical tensions, or disruptions in the supply chain, can cause sudden supply shortages or surpluses. These shocks can result in sharp price movements and contribute to inflation.

- For instance, a severe drought can reduce agricultural output, leading to higher food prices.

- Global economic conditions and trends, such as changes in international commodity prices or global economic growth, can influence inflation in individual countries.

- Economic policies in major trading partners can also have spill-over effects on domestic inflation.

The Effects of Inflation

Inflation impacts various facets of the economy and society. Moderate inflation is a sign of a growing economy, but high inflation can have detrimental effects.

Economic Effects

1. Reduced Purchasing Power: Inflation erodes the purchasing power of money, meaning consumers can buy less with the same amount of money. This reduction can impact living standards and consumer spending.

2. Income Redistribution: Inflation can act as a regressive tax, hitting harder on low-income families. Fixed-income recipients, such as pensioners, find their incomes do not stretch as far, while borrowers may benefit from repaying loans with money that is worth less.

3. Investment Uncertainty: High inflation can lead to uncertainty in the investment market. Investors become wary of long-term investments due to the unpredictability of future costs and returns.

Social Effects

1. Cost of Living: As the cost of goods and services increases, individuals may struggle to afford basic necessities, leading to a lower quality of life.

2. Wage-Price Spiral: Continuous inflation can lead to a wage-price spiral, where workers demand higher wages to keep up with rising prices, which in turn causes prices to rise further.

3. Access to Education and Healthcare: Rising costs can make education and healthcare less accessible to the general population, affecting long-term social and economic development.

Managing Inflation

Governments and central banks use various tools to manage inflation, aiming to maintain it at a level that promotes economic stability and growth.

Monetary Policy

The most common tool for managing inflation is monetary policy, which involves regulating the money supply and interest rates. Central banks can increase interest rates to reduce spending and borrowing, thereby slowing down the economy and reducing inflation. Conversely, lowering interest rates can stimulate spending and investment, increasing demand and potentially causing inflation.

Fiscal Policy

Governments can also use fiscal policy to control inflation by adjusting spending and taxation. Reducing government spending or increasing taxes can decrease the overall demand in the economy, lowering inflation. However, these measures can be unpopular politically as they may lead to reduced public services and higher taxes.

Supply-Side Policies

Improving efficiency and increasing supply can also combat inflation. This can be achieved through investment in technology, deregulation, and policies aimed at increasing productivity. By increasing the supply of goods and services, prices can stabilize or even decrease.

In conclusion, Inflation is a complex phenomenon with wide-ranging effects on the economy and society. Understanding its causes and impacts is crucial for effective management and policy-making. While moderate inflation is a sign of a healthy economy, unchecked inflation can lead to significant economic and social challenges. Through a combination of monetary, fiscal, and supply-side policies, governments and central banks strive to balance inflation to ensure economic stability and growth. As students delve into the intricacies of inflation, they gain insight into the delicate balance required to manage an economy, preparing them for informed citizenship and, possibly, roles in shaping economic policy in the future.

Text prompt

- Instructive

- Professional

Generate an essay on the importance of extracurricular activities for student development

Write an essay discussing the role of technology in modern education.

Improve your Grades

Essay on Inflation | Inflation Essay for Students and Children in English

February 14, 2024 by Sastry

Essay on Inflation: A sustained rise in the prices of commodities that leads to a fall in the purchasing power of a nation is called Inflation. Although inflation is a part of the normal economic phenomena of any country, any increase in inflation above a pre-determined level is a cause of concern. The causes of inflation are many. While it is -often cited that a drop in India’s agricultural output lead to the decline in supply, figures tell a different story.

You can read more Essay Writing about articles, events, people, sports, technology many more.

Long and Short Essays on Inflation for Kids and Students in English

Given below are two essays in English for students and children about the topic of ‘Inflation’ in both long and short form. The first essay is a long essay on Inflation of 400-500 words. This long essay about Inflation is suitable for students of class 7, 8, 9 and 10, and also for competitive exam aspirants. The second essay is a short essay on Inflation of 150-200 words. These are suitable for students and children in class 6 and below.

Long Essay on Inflation 400 Words in English

Below we have given a long essay on Inflation of 500 words is helpful for classes 7, 8, 9 and 10 and Competitive Exam Aspirants. This long essay on the topic is suitable for students of class 7 to class 10, and also for competitive exam aspirants.

India’s food production crossed 235 million tonnes during years 2010-11 as per the latest estimates and this is the highest since Independence. The previous highest production, at nearly 233 million tonnes, was achieved in years 2008-09. Agriculture recorded a 5.4% growth in years 2010-11 compared to the 4% growth achieved all these years, according to S Ayyappan, Director-General of the Indian Council of Agricultural Research.

However, inflation reflects overheating: the supply capacity of the economy is simply unable to match the demands on that capacity. Moreover, purchasing power of consumers is increasing and hence demand is accelerating. Minimum Support Prices (MSPs) for agriculture have also been increasing. The MSPs for various varieties of paddy during the years 2009-10 was between ₹ 950-980 per quintal and during the years 2010-11, it increased to ₹ 1000 to 1030 per quintal.

Moreover, for pulses such as Arhar and Moong the MSPs in years 2009-10 was ₹ 2300 and ₹ 2760 respectively, while in years 2010-11, it increased to ₹ 3000 and 3170 respectively. Another major cause of inflation is the increase in the prices of fuel internationally, which is contributing to the overall price inflation. There has been a steady increase in the international prices, with the Indian crude basket priced at $11 3.09 per barrel, as on May 2011. Any change in price of diesel immediately impacts price of food items, since most of them are dependent on transport through several 100 km. Inflation, in short, is “too much money chasing too few goods”. According to analysts, corruption, mafia operations, greed for money by politicians and industrialists, counterfeiting of currency notes etc., also contribute to corruption as they add to the availability of liquidity in different forms, which in turn adds to inflation.

High level of inflation distorts economic performance. It has added pressure on the Central Bank to raise rates despite signs of slow growth in the Indian economy. Thus, high inflation and rising interest rates are crimping domestic demand and slowing down the economy. Inflation also affects investment as higher long-term inflation adversely affects growth and investment. High inflation is pushing up the cost of credit for firms as well as escalating their input costs by inflating their spending on raw materials and wages. Corporate investment is affected by cost escalation of inputs, and inflation is waning the confidence in the economic growth.

Short Essay on Inflation 150 Words in English

Below we have given a short essay on Inflation is for Classes 1, 2, 3, 4, 5, and 6. This short essay on the topic is suitable for students of class 6 and below.

Food inflation adversely affected the country in 2013 and 2014 consecutively. Curbing the prices of goods is essential in order to attain revival from the slowdown in economic growth. Food bills already consume 35% of household incomes.

Inflation, as pointed, out by economists, occurred due to weak monsoon needed for the cultivation of summer crops. Despite being the second largest producer of fruits and vegetables after China, India suffers from shortages, owing to the lack of efficient cold storage and transport facilities. RBI Governor though, has promised to cut down inflation to 8% by 2015. All measures to curb inflation would be successful only if the middle men in the supply chain are barred from carrying out their nefarious activities. Only can then we not lose out on onions and tomatoes on our dinner plates.

Inflation Essay Word Meanings for Simple Understanding

- Output – the material produce or yield, product

- Escalating – to increase something in extent

- Accelerating – to cause faster or greater activity, development, progress, advancement

- Crude – lacking finish, polish, or completeness

- Counterfeiting – made in imitation so as to be passed off fraudulently or deceptively as genuine

- Distort – to give a false, perverted, or disproportionate meaning to, misrepresent

- Crimping – to check, restrain, or inhibit; hinder

- Escalation – increase in intensity, magnitude, etc

- Waning – decreasing in strength, intensity, etc

- Revival – restoration to life, consciousness, vigour strength, etc

- Nefarious – extremely wicked or villainous

- Picture Dictionary

- English Speech

- English Slogans

- English Letter Writing

- English Essay Writing

- English Textbook Answers

- Types of Certificates

- ICSE Solutions

- Selina ICSE Solutions

- ML Aggarwal Solutions

- HSSLive Plus One

- HSSLive Plus Two

- Kerala SSLC

- Distance Education

Inflation: Types, Causes and Effects (With Diagram)

Inflation and unemployment are the two most talked-about words in the contemporary society.

These two are the big problems that plague all the economies.

Almost everyone is sure that he knows what inflation exactly is, but it remains a source of great deal of confusion because it is difficult to define it unambiguously.

1. Meaning of Inflation:

Inflation is often defined in terms of its supposed causes. Inflation exists when money supply exceeds available goods and services. Or inflation is attributed to budget deficit financing. A deficit budget may be financed by the additional money creation. But the situation of monetary expansion or budget deficit may not cause price level to rise. Hence the difficulty of defining ‘inflation’.

ADVERTISEMENTS:

Inflation may be defined as ‘a sustained upward trend in the general level of prices’ and not the price of only one or two goods. G. Ackley defined inflation as ‘a persistent and appreciable rise in the general level or average of prices’. In other words, inflation is a state of rising prices, but not high prices.

It is not high prices but rising price level that constitute inflation. It constitutes, thus, an overall increase in price level. It can, thus, be viewed as the devaluing of the worth of money. In other words, inflation reduces the purchasing power of money. A unit of money now buys less. Inflation can also be seen as a recurring phenomenon.

While measuring inflation, we take into account a large number of goods and services used by the people of a country and then calculate average increase in the prices of those goods and services over a period of time. A small rise in prices or a sudden rise in prices is not inflation since they may reflect the short term workings of the market.

It is to be pointed out here that inflation is a state of disequilibrium when there occurs a sustained rise in price level. It is inflation if the prices of most goods go up. Such rate of increases in prices may be both slow and rapid. However, it is difficult to detect whether there is an upward trend in prices and whether this trend is sustained. That is why inflation is difficult to define in an unambiguous sense.

Let’s measure inflation rate. Suppose, in December 2007, the consumer price index was 193.6 and, in December 2008, it was 223.8. Thus, the inflation rate during the last one year was

223.8- 193.6/ 193.6 x 100 = 15.6

As inflation is a state of rising prices, deflation may be defined as a state of falling prices but not fall in prices. Deflation is, thus, the opposite of inflation, i.e., a rise in the value of money or purchasing power of money. Disinflation is a slowing down of the rate of inflation.

2. Types of Inflation:

As the nature of inflation is not uniform in an economy for all the time, it is wise to distinguish between different types of inflation. Such analysis is useful to study the distributional and other effects of inflation as well as to recommend anti-inflationary policies. Inflation may be caused by a variety of factors. Its intensity or pace may be different at different times. It may also be classified in accordance with the reactions of the government toward inflation.

Thus, one may observe different types of inflation in the contemporary society:

A. On the Basis of Causes:

(i) Currency inflation:

This type of inflation is caused by the printing of currency notes.

(ii) Credit inflation:

Being profit-making institutions, commercial banks sanction more loans and advances to the public than what the economy needs. Such credit expansion leads to a rise in price level.

(iii) Deficit-induced inflation:

The budget of the government reflects a deficit when expenditure exceeds revenue. To meet this gap, the government may ask the central bank to print additional money. Since pumping of additional money is required to meet the budget deficit, any price rise may the be called the deficit-induced inflation.

(iv) Demand-pull inflation:

An increase in aggregate demand over the available output leads to a rise in the price level. Such inflation is called demand-pull inflation (henceforth DPI). But why does aggregate demand rise? Classical economists attribute this rise in aggregate demand to money supply. If the supply of money in an economy exceeds the available goods and services, DPI appears. It has been described by Coulborn as a situation of “too much money chasing too few goods.”

Keynesians hold a different argument. They argue that there can be an autonomous increase in aggregate demand or spending, such as a rise in consumption demand or investment or government spending or a tax cut or a net increase in exports (i.e., C + I + G + X – M) with no increase in money supply. This would prompt upward adjustment in price. Thus, DPI is caused by monetary factors (classical adjustment) and non-monetary factors (Keynesian argument).

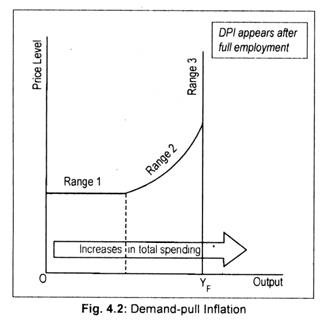

DPI can be explained in terms of Fig. 4.2, where we measure output on the horizontal axis and price level on the vertical axis. In Range 1, total spending is too short of full employment output, Y F . There is little or no rise in the price level. As demand now rises, output will rise. The economy enters Range 2, where output approaches towards full employment situation. Note that in this region price level begins to rise. Ultimately, the economy reaches full employment situation, i.e., Range 3, where output does not rise but price level is pulled upward. This is demand-pull inflation. The essence of this type of inflation is that “too much spending chasing too few goods.”

(v) Cost-push inflation:

Inflation in an economy may arise from the overall increase in the cost of production. This type of inflation is known as cost-push inflation (henceforth CPI). Cost of production may rise due to an increase in the prices of raw materials, wages, etc. Often trade unions are blamed for wage rise since wage rate is not completely market-determinded. Higher wage means high cost of production. Prices of commodities are thereby increased.

A wage-price spiral comes into operation. But, at the same time, firms are to be blamed also for the price rise since they simply raise prices to expand their profit margins. Thus, we have two important variants of CPI wage-push inflation and profit-push inflation.

Anyway, CPI stems from the leftward shift of the aggregate supply curve:

B. On the Basis of Speed or Intensity:

(i) Creeping or Mild Inflation:

If the speed of upward thrust in prices is slow but small then we have creeping inflation. What speed of annual price rise is a creeping one has not been stated by the economists. To some, a creeping or mild inflation is one when annual price rise varies between 2 p.c. and 3 p.c. If a rate of price rise is kept at this level, it is considered to be helpful for economic development. Others argue that if annual price rise goes slightly beyond 3 p.c. mark, still then it is considered to be of no danger.

(ii) Walking Inflation:

If the rate of annual price increase lies between 3 p.c. and 4 p.c., then we have a situation of walking inflation. When mild inflation is allowed to fan out, walking inflation appears. These two types of inflation may be described as ‘moderate inflation’.

Often, one-digit inflation rate is called ‘moderate inflation’ which is not only predictable, but also keep people’s faith on the monetary system of the country. Peoples’ confidence get lost once moderately maintained rate of inflation goes out of control and the economy is then caught with the galloping inflation.

(iii) Galloping and Hyperinflation:

Walking inflation may be converted into running inflation. Running inflation is dangerous. If it is not controlled, it may ultimately be converted to galloping or hyperinflation. It is an extreme form of inflation when an economy gets shattered.”Inflation in the double or triple digit range of 20, 100 or 200 p.c. a year is labelled “galloping inflation”.

(iv) Government’s Reaction to Inflation:

Inflationary situation may be open or suppressed. Because of anti-inflationary policies pursued by the government, inflation may not be an embarrassing one. For instance, increase in income leads to an increase in consumption spending which pulls the price level up.

If the consumption spending is countered by the government via price control and rationing device, the inflationary situation may be called a suppressed one. Once the government curbs are lifted, the suppressed inflation becomes open inflation. Open inflation may then result in hyperinflation.

3. Causes of Inflation:

Inflation is mainly caused by excess demand/ or decline in aggregate supply or output. Former leads to a rightward shift of the aggregate demand curve while the latter causes aggregate supply curve to shift leftward. Former is called demand-pull inflation (DPI), and the latter is called cost-push inflation (CPI). Before describing the factors, that lead to a rise in aggregate demand and a decline in aggregate supply, we like to explain “demand-pull” and “cost-push” theories of inflation.

(i) Demand-Pull Inflation Theory:

There are two theoretical approaches to the DPI—one is classical and other is the Keynesian.

According to classical economists or monetarists, inflation is caused by an increase in money supply which leads to a rightward shift in negative sloping aggregate demand curve. Given a situation of full employment, classicists maintained that a change in money supply brings about an equiproportionate change in price level.

That is why monetarists argue that inflation is always and everywhere a monetary phenomenon. Keynesians do not find any link between money supply and price level causing an upward shift in aggregate demand.

According to Keynesians, aggregate demand may rise due to a rise in consumer demand or investment demand or government expenditure or net exports or the combination of these four components of aggreate demand. Given full employment, such increase in aggregate demand leads to an upward pressure in prices. Such a situation is called DPI. This can be explained graphically.

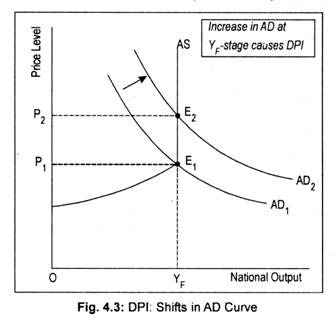

Just like the price of a commodity, the level of prices is determined by the interaction of aggregate demand and aggregate supply. In Fig. 4.3, aggregate demand curve is negative sloping while aggregate supply curve before the full employment stage is positive sloping and becomes vertical after the full employment stage is reached. AD 1 is the initial aggregate demand curve that intersects the aggregate supply curve AS at point E 1 .

The price level, thus, determined is OP 1 . As aggregate demand curve shifts to AD 2 , price level rises to OP 2 . Thus, an increase in aggregate demand at the full employment stage leads to an increase in price level only, rather than the level of output. However, how much price level will rise following an increase in aggregate demand depends on the slope of the AS curve.

(ii) Causes of Demand-Pull Inflation:

DPI originates in the monetary sector. Monetarists’ argument that “only money matters” is based on the assumption that at or near full employment excessive money supply will increase aggregate demand and will, thus, cause inflation.

An increase in nominal money supply shifts aggregate demand curve rightward. This enables people to hold excess cash balances. Spending of excess cash balances by them causes price level to rise. Price level will continue to rise until aggregate demand equals aggregate supply.

Keynesians argue that inflation originates in the non-monetary sector or the real sector. Aggregate demand may rise if there is an increase in consumption expenditure following a tax cut. There may be an autonomous increase in business investment or government expenditure. Government expenditure is inflationary if the needed money is procured by the government by printing additional money.

In brief, increase in aggregate demand i.e., increase in (C + I + G + X – M) causes price level to rise. However, aggregate demand may rise following an increase in money supply generated by the printing of additional money (classical argument) which drives prices upward. Thus, money plays a vital role. That is why Milton Friedman argues that inflation is always and everywhere a monetary phenomenon.

There are other reasons that may push aggregate demand and, hence, price level upwards. For instance, growth of population stimulates aggregate demand. Higher export earnings increase the purchasing power of the exporting countries. Additional purchasing power means additional aggregate demand. Purchasing power and, hence, aggregate demand may also go up if government repays public debt.

Again, there is a tendency on the part of the holders of black money to spend more on conspicuous consumption goods. Such tendency fuels inflationary fire. Thus, DPI is caused by a variety of factors.

(iii) Cost-Push Inflation Theory:

In addition to aggregate demand, aggregate supply also generates inflationary process. As inflation is caused by a leftward shift of the aggregate supply, we call it CPI. CPI is usually associated with non-monetary factors. CPI arises due to the increase in cost of production. Cost of production may rise due to a rise in cost of raw materials or increase in wages.

However, wage increase may lead to an increase in productivity of workers. If this happens, then the AS curve will shift to the right- ward not leftward—direction. We assume here that productivity does not change in spite of an increase in wages.

Such increases in costs are passed on to consumers by firms by raising the prices of the products. Rising wages lead to rising costs. Rising costs lead to rising prices. And, rising prices again prompt trade unions to demand higher wages. Thus, an inflationary wage-price spiral starts. This causes aggregate supply curve to shift leftward.

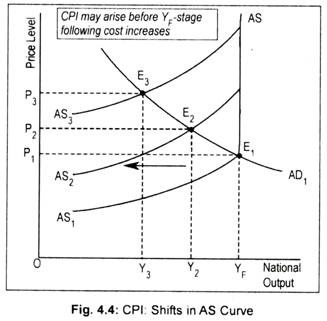

This can be demonstrated graphically where AS 1 is the initial aggregate supply curve. Below the full employment stage this AS curve is positive sloping and at full employment stage it becomes perfectly inelastic.

Intersection point (E 1 ) of AD 1 and AS 1 curves determine the price level (OP 1 ). Now there is a leftward shift of aggregate supply curve to AS 2 . With no change in aggregate demand, this causes price level to rise to OP 2 and output to fall to OY 2 . With the reduction in output, employment in the economy declines or unemployment rises. Further shift in AS curve to AS 3 results in a higher price level (OP 3 ) and a lower volume of aggregate output (OY 3 ). Thus, CPI may arise even below the full employment (Y F ) stage.

(iv) Causes of Cost-Push Inflation:

It is the cost factors that pull the prices upward. One of the important causes of price rise is the rise in price of raw materials. For instance, by an administrative order the government may hike the price of petrol or diesel or freight rate. Firms buy these inputs now at a higher price. This leads to an upward pressure on cost of production.

Not only this, CPI is often imported from outside the economy. Increase in the price of petrol by OPEC compels the government to increase the price of petrol and diesel. These two important raw materials are needed by every sector, especially the transport sector. As a result, transport costs go up resulting in higher general price level.

Again, CPI may be induced by wage-push inflation or profit-push inflation. Trade unions demand higher money wages as a compensation against inflationary price rise. If increase in money wages exceed labour productivity, aggregate supply will shift upward and leftward. Firms often exercise power by pushing prices up independently of consumer demand to expand their profit margins.

Fiscal policy changes, such as increase in tax rates also leads to an upward pressure in cost of production. For instance, an overall increase in excise tax of mass consumption goods is definitely inflationary. That is why government is then accused of causing inflation.

Finally, production setbacks may result in decreases in output. Natural disaster, gradual exhaustion of natural resources, work stoppages, electric power cuts, etc., may cause aggregate output to decline. In the midst of this output reduction, artificial scarcity of any goods created by traders and hoarders just simply ignite the situation.

Inefficiency, corruption, mismanagement of the economy may also be the other reasons. Thus, inflation is caused by the interplay of various factors. A particular factor cannot be held responsible for any inflationary price rise.

4. Effects of Inflation:

People’s desires are inconsistent. When they act as buyers they want prices of goods and services to remain stable but as sellers they expect the prices of goods and services should go up. Such a happy outcome may arise for some individuals; “but, when this happens, others will be getting the worst of both worlds.”

When price level goes up, there is both a gainer and a loser. To evaluate the consequence of inflation, one must identify the nature of inflation which may be anticipated and unanticipated. If inflation is anticipated, people can adjust with the new situation and costs of inflation to the society will be smaller.

In reality, people cannot predict accurately future events or people often make mistakes in predicting the course of inflation. In other words, inflation may be unanticipated when people fail to adjust completely. This creates various problems.

One can study the effects of unanticipated inflation under two broad headings:

(a) Effect on distribution of income and wealth; and

(b) Effect on economic growth.

(a) Effects of Inflation on Distribution of Income and Wealth:

During inflation, usually people experience rise in incomes. But some people gain during inflation at the expense of others. Some individuals gain because their money incomes rise more rapidly than the prices and some lose because prices rise more rapidly than their incomes during inflation. Thus, it redistributes income and wealth.

Though no conclusive evidence can be cited, it can be asserted that following categories of people are affected by inflation differently:

(i) Creditors and debtors:

Borrowers gain and lenders lose during inflation because debts are fixed in rupee terms. When debts are repaid their real value declines by the price level increase and, hence, creditors lose. An individual may be interested in buying a house by taking loan of Rs. 7 lakh from an institution for 7 years.

The borrower now welcomes inflation since he will have to pay less in real terms than when it was borrowed. Lender, in the process, loses since the rate of interest payable remains unaltered as per agreement. Because of inflation, the borrower is given ‘dear’ rupees, but pays back ‘cheap’ rupees. However, if in an inflation-ridden economy creditors chronically loose, it is wise not to advance loans or to shut down business.

Never does it happen. Rather, the loan-giving institution makes adequate safeguard against the erosion of real value. Above all, banks do not pay any interest on current account but charges interest on loans.

(ii) Bond and debenture-holders:

In an economy, there are some people who live on interest income—they suffer most. Bondholders earn fixed interest income: These people suffer a reduction in real income when prices rise. In other words, the value of one’s savings decline if the interest rate falls short of inflation rate. Similarly, beneficiaries from life insurance programmes are also hit badly by inflation since real value of savings deteriorate.

(iii) Investors:

People who put their money in shares during inflation are expected to gain since the possibility of earning of business profit brightens. Higher profit induces owners of firm to distribute profit among investors or shareholders.

(iv) Salaried people and wage-earners:

Anyone earning a fixed income is damaged by inflation. Sometimes, unionised worker succeeds in raising wage rates of white-collar workers as a compensation against price rise. But wage rate changes with a long time lag. In other words, wage rate increases always lag behind price increases. Naturally, inflation results in a reduction in real purchasing power of fixed income-earners.

On the other hand, people earning flexible incomes may gain during inflation. The nominal incomes of such people outstrip the general price rise. As a result, real incomes of this income group increase.

(v) Profit-earners, speculators and black marketers:

It is argued that profit-earners gain from inflation. Profit tends to rise during inflation. Seeing inflation, businessmen raise the prices of their products. This results in a bigger profit. Profit margin, however, may not be high when the rate of inflation climbs to a high level.

However, speculators dealing in business in essential commodities usually stand to gain by inflation. Black marketers are also benefited by inflation.

Thus, there occurs a redistribution of income and wealth. It is said that rich becomes richer and poor becomes poorer during inflation. However, no such hard and fast generalisation can be made. It is clear that someone wins and someone loses during inflation.

These effects of inflation may persist if inflation is unanticipated. However, the redistributive burdens of inflation on income and wealth are most likely to be minimal if inflation is anticipated by the people. With anticipated inflation, people can build up their strategies to cope with inflation.

If the annual rate of inflation in an economy is anticipated correctly people will try to protect them against losses resulting from inflation. Workers will demand 10 p.c. wage increase if inflation is expected to rise by 10 p.c.

Similarly, a percentage of inflation premium will be demanded by creditors from debtors. Business firms will also fix prices of their products in accordance with the anticipated price rise. Now if the entire society “learn to live with inflation”, the redistributive effect of inflation will be minimal.

However, it is difficult to anticipate properly every episode of inflation. Further, even if it is anticipated it cannot be perfect. In addition, adjustment with the new expected inflationary conditions may not be possible for all categories of people. Thus, adverse redistributive effects are likely to occur.

Finally, anticipated inflation may also be costly to the society. If people’s expectation regarding future price rise become stronger they will hold less liquid money. Mere holding of cash balances during inflation is unwise since its real value declines. That is why people use their money balances in buying real estate, gold, jewellery, etc. Such investment is referred to as unproductive investment. Thus, during inflation of anticipated variety, there occurs a diversion of resources from priority to non-priority or unproductive sectors.

(b) Effect on Production and Economic Growth:

Inflation may or may not result in higher output. Below the full employment stage, inflation has a favourable effect on production. In general, profit is a rising function of the price level. An inflationary situation gives an incentive to businessmen to raise prices of their products so as to earn higher volume of profit. Rising price and rising profit encourage firms to make larger investments.

As a result, the multiplier effect of investment will come into operation resulting in a higher national output. However, such a favourable effect of inflation will be temporary if wages and production costs rise very rapidly.

Further, inflationary situation may be associated with the fall in output, particularly if inflation is of the cost-push variety. Thus, there is no strict relationship between prices and output. An increase in aggregate demand will increase both prices and output, but a supply shock will raise prices and lower output.

Inflation may also lower down further production levels. It is commonly assumed that if inflationary tendencies nurtured by experienced inflation persist in future, people will now save less and consume more. Rising saving propensities will result in lower further outputs.

One may also argue that inflation creates an air of uncertainty in the minds of business community, particularly when the rate of inflation fluctuates. In the midst of rising inflationary trend, firms cannot accurately estimate their costs and revenues. That is, in a situation of unanticipated inflation, a great deal of risk element exists.

It is because of uncertainty of expected inflation, investors become reluctant to invest in their business and to make long-term commitments. Under the circumstance, business firms may be deterred in investing. This will adversely affect the growth performance of the economy.

However, slight dose of inflation is necessary for economic growth. Mild inflation has an encouraging effect on national output. But it is difficult to make the price rise of a creeping variety. High rate of inflation acts as a disincentive to long run economic growth. The way the hyperinflation affects economic growth is summed up here. We know that hyper-inflation discourages savings.

A fall in savings means a lower rate of capital formation. A low rate of capital formation hinders economic growth. Further, during excessive price rise, there occurs an increase in unproductive investment in real estate, gold, jewellery, etc. Above all, speculative businesses flourish during inflation resulting in artificial scarcities and, hence, further rise in prices.

Again, following hyperinflation, export earnings decline resulting in a wide imbalances in the balance of payment account. Often galloping inflation results in a ‘flight’ of capital to foreign countries since people lose confidence and faith over the monetary arrangements of the country, thereby resulting in a scarcity of resources. Finally, real value of tax revenue also declines under the impact of hyperinflation. Government then experiences a shortfall in investible resources.

Thus economists and policymakers are unanimous regarding the dangers of high price rise. But the consequence of hyperinflation are disastrous. In the past, some of the world economies (e.g., Germany after the First World War (1914-1918), Latin American countries in the 1980s) had been greatly ravaged by hyperinflation.

The German inflation of 1920s was also catastrophic:

During 1922, the German price level went up 5,470 per cent. In 1923, the situation worsened; the German price level rose 1,300,000,000 (1.3 billion) times. By October of 1923, the postage in the lightest letter sent from Germany to the United States was 200,000 marks. Butter cost 1.5 million marks per pound, meat 2 million marks, a loaf of bread 200,000 marks, and an egg 60,000 marks! Prices increased so rapidly that waiters changed the prices on the menu several times during the course of a lunch!! Sometimes, customers had to pay the double price listed on the menu when they observed it first!!! A photograph of the period shows a German housewife starting the fire in her kitchen stove with paper money and children playing with bundles of paper money tied together into building blocks!

Currently (September 2008), Indian economy experienced an inflation rate of almost 13 p.c.—an unprecedented one over the last 16 or 17 years. However, an all-time record in price rise in India was struck in 1974-75 when it rose more than 25 p.c. Anyway, people are ultimately harassed by the high dose of inflation. That is why, it is said that ‘inflation is our public enemy number one.’ Rising inflation rate is a sign of failure on the part of the government.

Related Articles:

- Demand Pull Inflation and Cost Push Inflation | Money

- Essay on the Causes of Inflation (473 Words)

- Cost-Push Inflation and Demand-Pull or Mixed Inflation

- Difference between Open Inflation and Suppressed Inflation

Inflation Essay Examples and Topics

Inflation and deflation and their outcomes, inflation in turkey: contemporary and past episodes.

- Words: 1609

The “Analyze This! Inflation” Video Reflection

The price deviations and inflation rates, the economic disparity and inflation, the inflation dynamics in the canadian context.

- Words: 1091

“Expected and Realized Inflation…” by Binder & Kamdar

Inflation at the international monetary fund, inflation: types and negative effects, “inflation hits the fastest pace since 1981, at 8.5% through march” by koeze.

- Words: 1112

Inflation Rates and the Value of the Dollar

Monetary union of latin american countries.

- Words: 1333

Inflation’s Impact on Fixed Income

Unemployment and inflation relation, unanticipated and participated inflation, securitization and the credit crisis of 2007, inflation and deflation effects on the us and saudi stock markets.

- Words: 1200

Significance of Inflation to Corporate Finance

History of the kenyan economy: stimulating the economic growth through various means, macroeconomics and hyperinflation in 1914-1923, dollar depreciation issue analysis.

- Words: 1931

Government Spending Stimulation in the Fight Against Inflation

Hyperinflation analysis in zimbabwe.

- Words: 1210

Hyperinlfation in Zimbabwe

- Words: 1755

Gasoline Prices, Rates of Unemployment, Inflation, and Economic Growth

- Words: 1721

Federal Reserve System: Inflation

Impact of zimbabwe’s monetary policy on its economy.

- Words: 3271

Reasons for a Decrease of a Superannuation Assets Value

- Words: 2338

Keynesian Theory of Unemployment

“the debt-deflation theory of great depressions” by irving fisher, hyperinflations factors and eliminating strategies, “inflation rise hits us consumers” bbc article, hyperinflation in a real-life example, consumer price indices for gasoline and electricity in canada, increasing inflation impact on individuals, maintenance of stable pricing, inflation expectations: households and forecasters, fall in oil prices in the mid 2014.

- Words: 1943

United Arab Emirates and Norway Economies

- Words: 3493

International Financial Markets and Institutions

- Words: 3365

Inflation Causes: Structuralism and Monetarism

- Words: 2920

The Effects of Inflation Targeting

The euro zone’s rising inflation and unemployment rate, inflation tax – printing more money to cover the war expenses.

- Words: 1683

Economic Condition of Singapore: Inflation Hits 5.2% in March

- Words: 1078

Unemployment Issue in Europe

Economic health of the economy: memo, the effect of global financial crisis on saudi arabian economy.

- Words: 2710

Keynesian Explanation of Recession

- Words: 1388

Inflation in the United Kingdom

- Words: 1649

Effect of a Permanent Increase in Oil Price on Inflation and Output

Consumer price index: measuring inflation.

- Words: 2178

International Finance. Main Causes of Recent Financial Crisis

The cause of china’s inflation, deficit spending, the current impact of inflation and unemployment on germany’s political/economic system.

- Words: 1686

Okun’s Law Associations

Pricing goods internationally.

- Words: 1151

Cause of the Financial Crisis

- Words: 1675

Problem of China’s Inflation

- Words: 2174

Inflation in Saudi Arabia

- Words: 5524

Benefits Run Out for Spain’s Jobless: Theories of Unemployment

Unemployment rates in the united states, the monetary and fiscal policy implemented during the great recession.

- Words: 1663

The Empirical Project: Turkey

- Words: 3283

Inflation Rates in Sweden

Monetary and fiscal policies during the great recession.

- Words: 1419

Role of the Federal Reserve in the US Economy

- Words: 1348

Fiscal Policy and Monetary Policy

Scarcity and choice as economic issues.

- Words: 1351

The Faults of the Consumer Price Index

- Words: 1836

Analysis of the Performance of Domestic & Multinational US Restaurants

Saudi arabia’s oil sector.

BEST ENGLISH NOTES

Essay On Inflation

Inflation is an important economic concept that affects everyone from consumers to businesses and governments. In simple terms, it refers to a general increase in prices and a decrease in the purchasing power of money. Understanding inflation and its effects is essential to making informed financial decisions and understanding how the economy works. This essay on inflation will explore its causes, effects and ways to manage it, providing a clear and comprehensive overview of this important economic phenomenon.

Introduction

Inflation means prices of things like groceries and services go up over time. This means your money doesn’t buy as much as it used to. For instance, if prices go up by 3%, something that costs $100 now would cost $103 next year. Inflation is normal in an economy, but too much can cause problems. We measure inflation using things like the Consumer Price Index (CPI) and Producer Price Index (PPI).

Causes of Inflation

Inflation can happen for several reasons:

- Demand-Pull Inflation : This happens when people want to buy more goods and services than are available. For example, during a strong economy, people have more money to spend, and prices rise.

- Cost-Push Inflation : This happens when the cost of making goods increases. For example, if the price of oil rises, it costs more to transport and produce goods, so prices rise.

- Built-In Inflation : This happens when workers demand higher wages because the cost of living is rising. Businesses then raise prices to compensate for higher wages, creating a cycle. This is common in places where labor unions are strong.

- Monetary Inflation : This happens when there is a lot of money in circulation. For example, if a country prints too much money, the value of money falls, and prices rise. Zimbabwe was a serious case in the late 2000s, where the money rapidly lost its value.

Effects of Inflation

Inflation affects the economy and people in many ways:

- Purchasing Power: As prices rise, the value of money falls. People can buy less for the same amount. For example, if inflation is 5% per year, a commodity that costs $100 today will be worth $105 next year.

- Savings and Investment: Inflation can reduce the value of savings. If the interest rate on savings is lower than inflation, money in the bank loses value. Borrowers benefit because they pay off the loan with a lower cost.

- Distribution of Income: Inflation affects people differently. Individuals on fixed incomes, such as retirees, may struggle because their incomes do not increase with prices. Those who have assets like property can see their wealth grow.

- Uncertainty and Planning: High inflation makes it difficult to plan for the future. Businesses may delay investment, and consumers may hesitate to spend as economic growth slows.

Solutions to Inflation

There are several ways to control inflation:

- Monetary Policy: Central banks can control inflation by adjusting interest rates and money supply. For example, rising interest rates make borrowing more expensive, reducing spending and cooling the economy. The US Federal Reserve uses this method.

- Fiscal Policy: Governments can reduce inflation by cutting spending or raising taxes. This reduces demand in the economy. During low inflation, they can spend more to boost demand.

- Supply-side policies: can help improve the economy’s ability to produce goods and services. Investments in infrastructure, technology and education make production more efficient and cheaper, which can lower costs.

- Income Policies: Sometimes, governments directly control wages and prices. This can be difficult and cause other problems, so it should be done carefully.